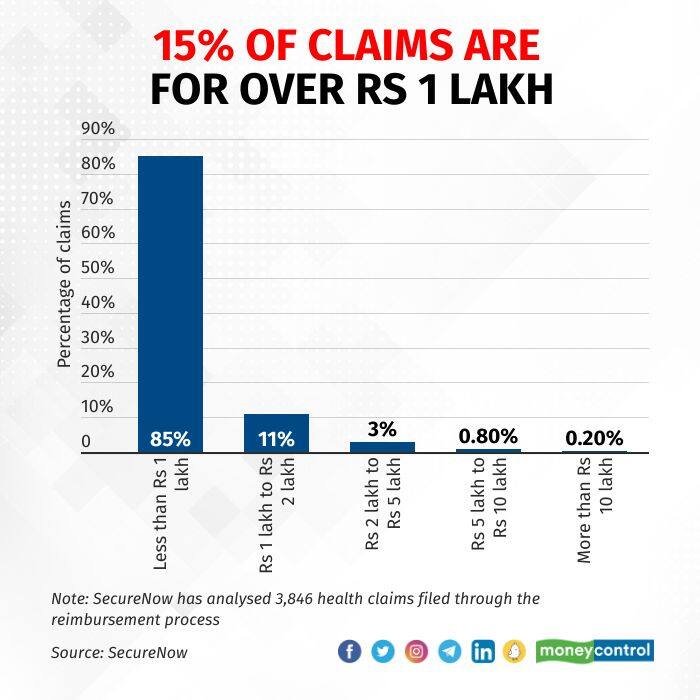

An analysis of 3,846 health insurance reimbursement claims by SecureNow, a Delhi-based insurance broker, revealed that nearly 85 percent of those claims were for an amount under Rs 1 lakh. And a mere 0.2 percent were for amounts greater than Rs 10 lakh, per SecureNow. These are among the crucial findings throwing light on the pattern of health insurance claims.

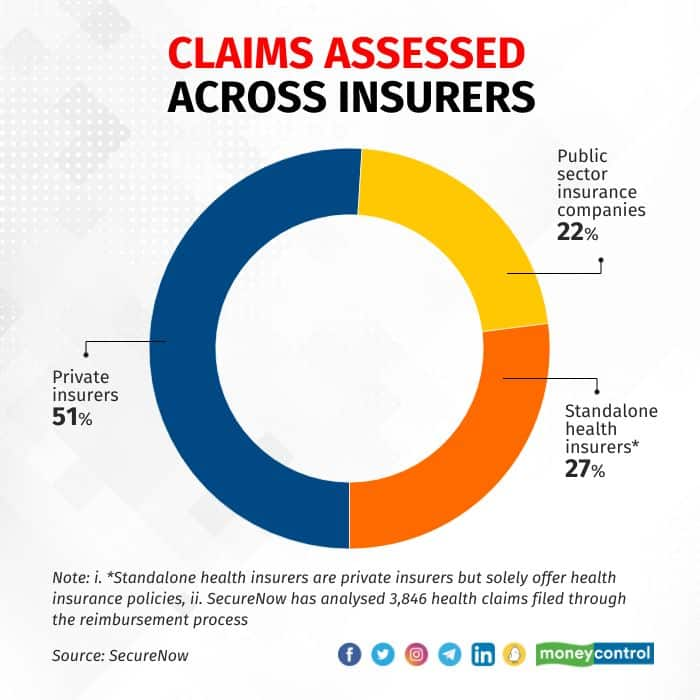

Private insurers are becoming popular

The report — an analysis of claims submitted in June — revealed that nearly 51 percent of insurance claims were assessed by private insurers.

You could file a claim settlement in reimbursement or cashless mode. The reimbursement mode requires you to pay first and get the amount reimbursed later by the insurer. “For hospitals that are not part of the (insurer’s cashless) network, reimbursement is the only mode for claim settlement,” says Abhishek Bondia, Principal Officer and Managing Director, securenow.in. You would have to submit all bills, receipts and medical papers to the insurer, which then verifies them and reimburses the amount to your bank account.

Cashless, however, is an easier and faster process. “Under this, you would need to approach the insurance helpdesk at the hospital and show your health e-card. The hospital and insurer coordinate directly to settle bills up to your policy limit,” says Bondia.

To avail of a cashless claim, the treating hospital should be registered as a network hospital with the insurer.

Also read | New commission rules will benefit policyholders & insurance firms: IRDAI chief

Maintain an emergency corpus

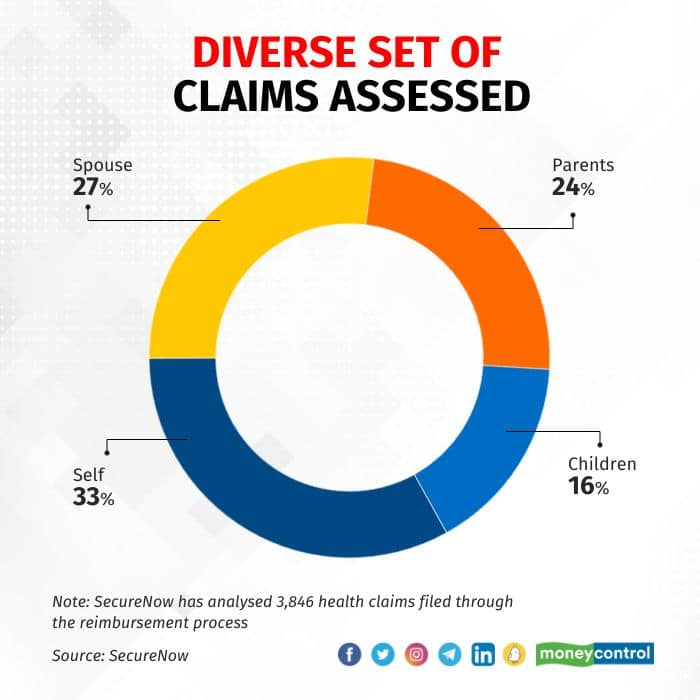

The survey revealed that insurance claims were made by policyholders not just for their own treatment, but also for the treatment of family members. Just 33 percent of the claims were made by policyholders for their own hospitalisation expenses. The remaining 67 percent was for family members.

This underlines the need to have an emergency corpus in place. Experts recommend an emergency fund for medical emergencies in the family.

“You may need to go to a non-network hospital in emergencies. If you have a financial cushion in place, at least you can afford to pay the bills first and then run around for reimbursements,” says Dev Ashish, Founder, StableInvestor. For older people, he adds, it is extremely important to have a medical contingency fund in place, in addition to health insurance.

You should also opt for a good parental cover. “It can cost about Rs 25,000 per life, per year. This may be similar in terms of price to individual insurance, but is far more effective and usable, says Bondia. To buy a health insurance cover for your parents, you must work with experienced brokers, he adds. There are just a handful of insurers that will issue parental insurance because claims are high.

How much health insurance should you have?

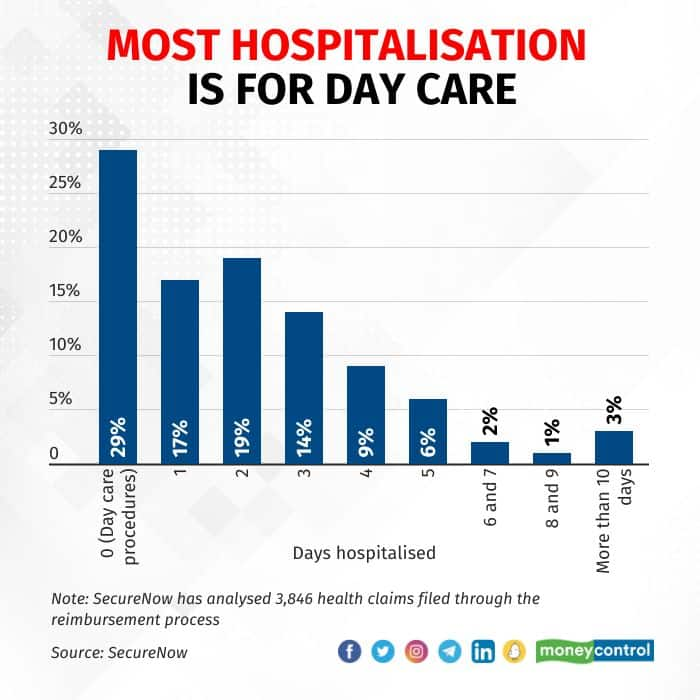

According to SecureNow’s study, typical hospitalisation is for two days, but over 21 percent is for three or more days. Day-care procedures account for 29 percent of the claims.

Further, the average reimbursement claim is for Rs 42,000, while 15 percent is for over Rs 1 lakh. Clearly, one must be well prepared for an extreme claim where hospitalisation is for over five days and costs upward of Rs 5 lakh (refer to graphic).

Make sure you have a family health insurance cover of at least Rs 15-20 lakh. This should be in addition to any corporate health insurance coverage that you already have.

“If buying a large cover is not feasible, then purchase a smaller base plan and enhance it with a super top-up policy,” says Ashish. For instance, you can buy a Rs 5 lakh base cover and then a top-up policy of, say, Rs 20 lakh.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.