To enable geographical diversification and gain from the robust returns delivered by international funds in recent months, the mutual fund (MF) industry is giving more options to domestic investors. This would allow them to take exposure to foreign equity markets.

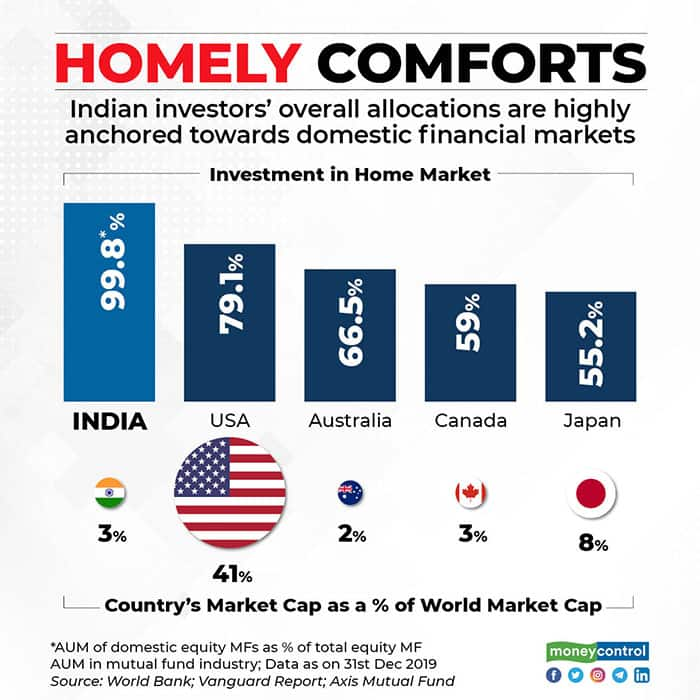

MF industry data shows that as much as 99.8 per cent of Indian investors’ investment in equity funds is oriented towards domestic markets. Meanwhile, in other economies, the bias towards home markets is not as high.

Diversifying across geographies

Data collated by Axis Mutual Fund shows that US investors have 79.1 per cent of their investment in their country, even though US indices have a 41 per cent share of the world market cap.

On Thursday, Axis MF announced the launch of a feeder fund -- Axis Global Equity Alpha Fund of Fund -- which will invest in Schroder International Selection Fund Global Equity Alpha. This fund invests significantly in the US.

Advisors say there has been an increase in international offerings, but investors should only opt for such products, if they add value to their existing allocations.

“Recent launches of multi-asset funds are also offering international equity exposure to investors. However, at different periods of time, certain asset classes can outperform for a specific period. So, investors need not get carried away,” said Amol Joshi, founder of Plan Rupee Investment Services.

However, advisors say that limited allocation to international funds is important as geographical diversifications helps in curbing volatility, and also gives cushion when there is pressure on the domestic currency.

“Global funds also give exposure to businesses with global scale, which wouldn’t be available for investing in Indian markets at present,” Joshi added.

Year-to-date, international funds are holding on with positive gains of 4.49 per cent. Large-cap funds, which are the largest in the equity category in terms of asset size, are down 4.21 per cent over the same period. But investors shouldn’t get into global funds just because recent returns have been good.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.