Even as the weakness on the economic front gets worrisome, the headline indices seem to be on a different path altogether as they scale new peaks. One key reason for this could be that the Indian retail investor has put her investment bets well and truly behind the markets through the fund route.

In every single month of 2019 thus far, investors have poured in more than Rs 8000 crores each through the systematic investment plan route into mutual fund schemes – debt and equity. The trend of the past 3-4 years has only strengthened in 2019.

Be that as it may, the year was marked by debt schemes of all hues offered by mutual fund houses – already hurt by the IL&FS crisis in 2018 – reeling under the impact of defaults/delays in payments. But the year also saw the market regulator SEBI step in and bring a whole host of regulations to streamline the operations of debt funds.

Here is a gaze back at the year that was, one that was a scary ride for debt funds, but was a somewhat cheerful period for equity schemes, at least during the last quarter.

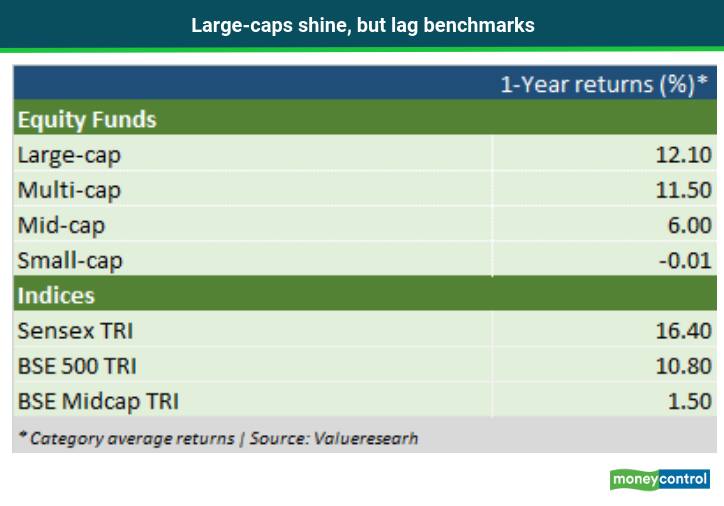

Equity funds rally, but large-caps lag benchmarks

After remaining in a bear grip for much of the year following a weak economic environment, the equity markets got a jump-start when the finance minister announced a cut in corporate income taxes.

Buoyed by the news and the possibility of earnings revival as a result of these cuts, the Sensex and Nifty rallied by over 10 per cent from September and in excess of 16 per cent for the year, touching new highs every passing day. The mid and small-cap indices though haven’t quite had such a spectacular run, and these are still a good 25-30 per cent down from their all-time highs.

Multi-cap funds did have a reasonable run, delivering 11.5 per cent for the year, a tad better than the BSE 500 TRI benchmark’s 10.8 per cent.

“In the current market scenario, we recommend a combination of multi-cap funds (which should be core allocation for the equity portfolio), along with allocation to mid & small cap funds where the managers have excellent pedigree and should have seen multiple market cycles,” says Ashish Shanker, Head – Investment Advisory, Motilal Oswal Private Wealth Management

In the mid and small-cap spaces, many fund managers and analysts have pointed out how there is value for the taking.

“It is a good time to invest in mid and small-cap funds through SIPs. In small-caps, unless the stocks are fundamentally robust and are down due to broader slowdown ills, fund managers exit them, even if at a distress. The risk of value traps is lower when done through funds,” suggests Vidya Bala, Co-founder, Primeinvestor.

Suresh Sadagopan, Founder of Ladder7 Financial Advisories, concurs, “SIPs can be continued or even started with a long horizon (five years or more) to reap the benefits.”

The large-cap funds category delivered 12.1 per cent on an average, which is a good four percentage points lower than the Sensex TRI index’s returns (16.4 per cent). Only 15 of the 50 Nifty stocks participated significantly in the rally.

This underperformance has brought back the debate on passive investing.

Vidya suggests a way out and says, “A broader index fund (other than the Nifty 50) such as Nifty 100 would be a good way to participate in large-caps, given the challenges faced by large-cap funds due to rally in a very limited number of stocks.”

“A case is building up for passive investments, especially in the large-cap space. One can consider a mix of actively managed funds along with passives as part of portfolio allocation,” suggests Suresh.

There is still hope though, as Ashish states, “While there is a case for investment in passive funds within the large cap category, we continue to believe that good managers should be able to deliver alpha in this category in the long term.”

Debt funds turmoil on DHFL saga

In January this year, a news portal came out with allegations of financial irregularities against Dewan Housing Finance Limited (DHFL), an NBFC in whose debt instruments (NCDs) many retail investors and fund houses had invested. DHFL’s NCDs were rated AAA and commercial papers A1+, the highest rating.

After the news-break, agencies reduced the credit rating of DHFL to AA+.

But when DHFL defaulted on payments in June, the rating agencies downgraded the debt instruments of the NBFC to D (default status) in one stroke.

Some debt funds had to mark down their NAVs by as much as 10-50 per cent on a single day.

(Reliance) Nippon AMC is fighting a court battle against DHFL to recover the money.

Recently, the RBI superseded the DHFL board and referred the company to insolvency proceedings in the NCLT.

In April, we had FMPs postponing their maturity dates as borrowers did not pay up in time.

One fund house gave investors the choice of either extending the maturity date to taking a reduced amount (lower than the FMP’s NAV).

Then, a couple of Essel Group companies defaulted on repayments. The debt instruments issued by the group companies were backed by the shares of Zee Entertainment, which were placed as collateral. Some fund houses sold the shares as a result of which Zee Entertainment and Dish TV (with the same promoter group as Zee’s) stocks crashed as the margin calls were triggered.

This forced Zee Entertainment’s promoters to enter into a ‘stand-still’ agreement with lenders to not sell the shares and that the amounts due would be repaid soon.

Reliance Home Finance too defaulted on its payments. Reports suggest the troubled telecom operator Vodafone-Idea too could pose risks. The Supreme Court has asked the company and other mobile firms to pay up their dues to the government and Vodafone Idea has stated that it requires a waiver of the dues for it to sustain operations.

SEBI moves to tighten norms

With far too many accidents in the debt fund space, the market regulator SEBI stepped in and brought in some decisive regulations.

First, all funds, including liquid and overnight schemes, are mandated to mark-to-market all their securities, even those maturing within 30 days (exempted earlier), from April 1, 2010. This move would give the fair value of schemes at all times.

Second, in the event of a default or a ‘credit event’ happening, the norms for valuing those securities have been standardised and made more stringent. Rating agencies (CRISIL and ICRA) would be relied upon to provide a fair value to the defaulted instrument, more so in the case of non-traded securities. They would poll a few select fund houses, based on criteria decided by industry body AMFI, and the selected AMCs must participate and help arrive at a reasonable value for defaulted non-traded securities.

Third, SEBI has barred fund houses from trading in unlisted securities such as commercial papers.

Fourth, liquid and overnight funds would not be allowed to invest in short-term deposits of banks and debt securities that come with structured obligations, credit enhancements (loans against shares) etc.

Also, the market regulator has stipulated that liquid funds must hold at least 20 per cent of their portfolios in cash and government securities, so as to increase the safety quotient of such schemes.

Next, inter-scheme security transfers have been regularised. Funds can now transfer a security to another scheme from the same house at a price determined by the valuing agencies and not randomly at the previous day’s closing price as was the case till now.

Finally, in cases where fund houses had entered into standstill agreements with borrowers (where repayment is not done on time), they would need to recognise the securities as having defaulted and the NAV marked down.

So how will these measures be viewed? Are they positive for investors?

“Absolutely, these are commendable steps taken by SEBI, which should help bring greater transparency & more importantly provide more confidence to investors,” says Ashish.

Suresh agrees, “These are welcome measures to bring more accountability, stricter rules of engagement, more transparent and verifiable norms and investor protection & provide them a safety net.”

While welcoming the moves from SEBI, Vidya gives an interesting suggestion: “Providing restriction on minimum investments in more complex and higher-risk categories would automatically curb retail investors from participating in categories that need enhanced risk appetite.”

Gilts and long duration funds shine

Credit risk funds underperformed – the category barely managed to deliver 0.5 per cent for the year.

Thanks to RBI’s rate cuts – 135 basis points on the repo – the 10-year G-Sec yields plummeted to less than 6.5 per cent from a high of nearly 8 per cent at the start of the year.

Bond yields and prices move in opposite directions. This ensured that gilt funds as well as long-duration schemes that rally during falling rates delivered a staggering 10.85 per cent and 12.5 per cent, respectively over the past one year.

Where does that leave investors in the current situation?

“Stay with the shorter duration funds – those with high-quality papers that have an accrual strategy to mitigate interest rate risks. Dynamic bond funds and credit risk schemes are for those investors who have a high-risk appetite,” says Suresh of Ladder7 Financial.

Apart from asking investors to stick to an accrual strategy and investing in schemes that carry only sovereign/AAA papers (with duration of 3-10 years), Ashish of MOPWM has an opinion on another category of funds: “Investors could invest in Banking & PSU Debt funds, which have predominantly AAA-oriented portfolios, with duration of 2-3 years.”

Vidya of Primeinvestor adds a note of caution, “Even categories like short duration or even low duration funds can sport risks as the regulator does not restrict their credit universe.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.