Small-cap funds have seen the highest correction among diversified equity funds over the past one month, highlighting significant risks that they could experience when the market fluctuates.

In general, this fund category is more vulnerable to market shocks compared to more stable large-cap, multi-cap or flexi-cap funds.

The small-cap fund category went down around 7 percent on average in the past one month, when mid-cap funds shed 6.50 percent and large-cap funds 6 percent. Although in the red, multi-cap and flexi-cap have fared better than the small-cap funds in this period.

Data available with the Association of Mutual Funds in India (AMFI) for October 2024 showed that when the Indian equity market recorded around 6 percent correction during the month, the small-cap funds suffered a dent in the quality of their assets.

Also read | Bribery charges: Mutual fund holdings in 10 Adani group firms at Rs 43,455 crore

The BSE Sensex and the NSE Nifty were down 5.77 percent and 6.22 percent last month.

Longer period for redemption

When markets fall badly, typically more investors withdraw their money. An illiquid mutual fund scheme can stop redemptions, which can spread panic in the market.

A scheme’s liquidity is important because it shows how quickly it can sell its stocks in the markets to generate cash to meet sudden redemptions if many investors end up at their doorstep to take back their money.

The purpose of the stress test is to ascertain how soon fund managers can liquidate their portfolios, if investors were to rush for redemptions under adverse market conditions.

The latest batch of mutual fund stress-test results for October 2024 showed that the top 15 small-cap funds would take an average of 25 days to liquidate half of their portfolios, against 22 days in the previous month.

As per the stress test results for October, the biggest small-cap fund, Nippon India Small Cap, would take 31 days to offload 50 percent of its portfolio against 26 days in the previous. The cash allocation of the fund also increased 5.31 percent against 4.06 percent on a month-on-month (MoM) basis.

Also read | Stocks where top mid-cap and small-cap MFs redeployed cash

The SBI Small Cap Fund would now take 10 more days at 56 days to redeem half of its portfolio as per October data.

Quant Small Cap Fund, which needs 55 days to sell off half of its portfolio as per October report, saw its cash allocation falling to 11.15 percent against 13.06 percent, sequentially.

Among the top 15 small-cap funds, Franklin India Smaller Companies Fund saw big jump in cash holding to 5.6 percent from 2.4 percent during the month.

How small-cap funds reduce risk

Fund managers employ various strategies to mitigate risk and protect investors' interests during market corrections.

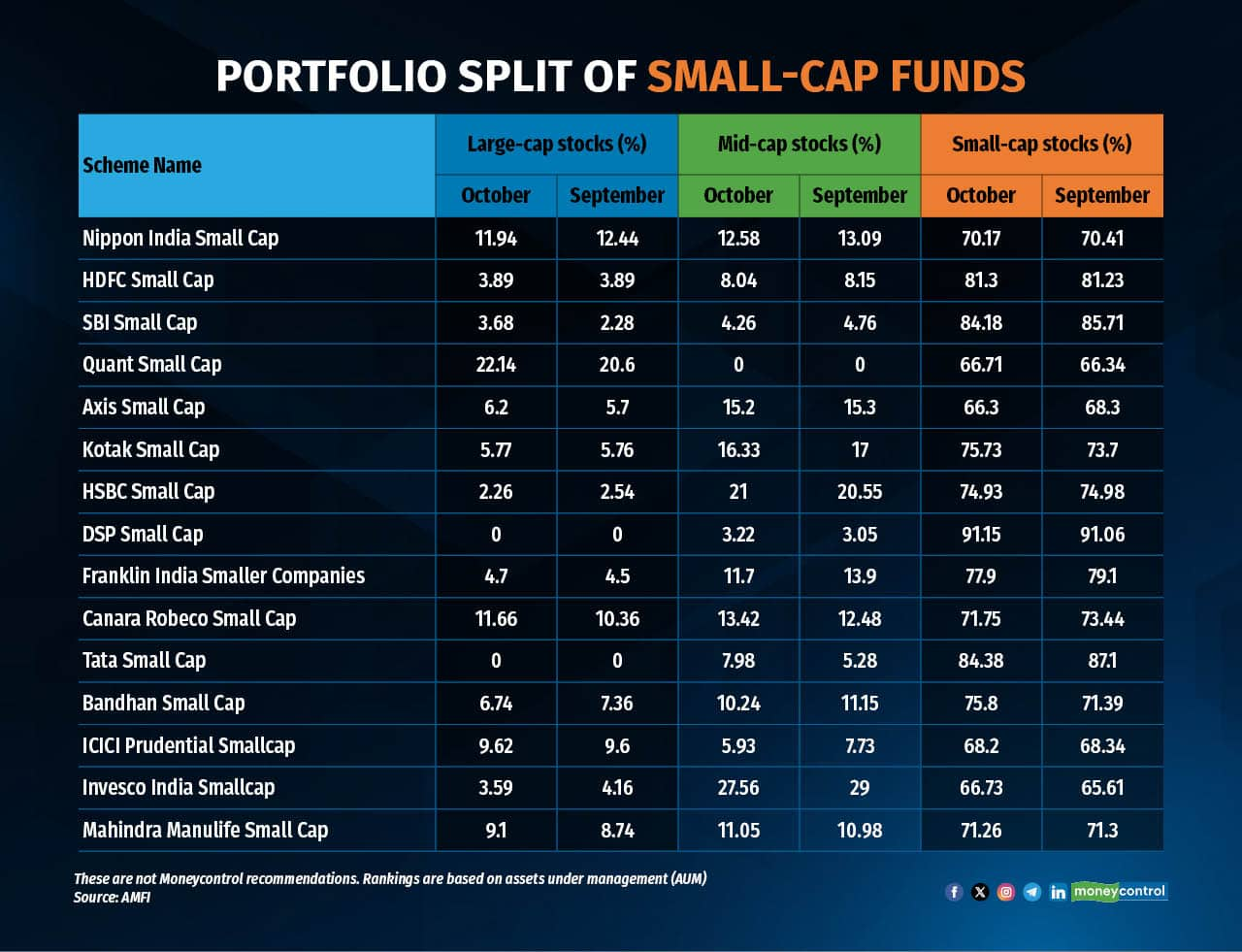

For diversification, the small-cap funds invest in a diverse basket of small-cap stocks across various sectors. Small-cap funds can also invest in more liquid mid-cap and large-cap stocks. This diversification helps spread risk and reduces the impact of any single stock's performance on the overall fund.

The funds also typically hold a certain portion of their assets in liquid securities like cash or short-term debt instruments. This provides flexibility to manage cash flows and meet redemption requests during market downturns.

“Fund managers may use various risk management tools, such as stop-loss orders, hedging strategies, and derivatives, to limit downside risk,” said Viral Bhatt, who founded Money Mantra.

How to select small-cap funds?

Investing in small-cap funds during market corrections can be a strategic move for long-term investors. Here are some ways to do it.

Systematic Investment Plan (SIP): Invest a fixed amount regularly through SIPs. This strategy buys more units when the market is low and fewer when it's high, reducing your average cost per unit over time.

Also read | China or the US: Which is a better market now to bet on global diversification?

Navigate the challenges of bottom fishing: If you can accurately identify the bottom of the market correction, investing a lump sum can be beneficial. However, timing the market is challenging, so proceed with caution.

Gradual investment: Consider investing in tranches over a period to reduce the impact of market volatility.

According to Bhatt, the strategy at this time should be to focus on quality and long-term potential. “Select strong funds and choose funds managed by experienced fund managers with a proven track record of selecting quality small-cap stocks,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.