Market volatility: Stocks where top mid-cap and small-cap MFs redeployed cash

Market corrections provide opportunities for fund managers to accumulate quality stocks that are available at cheaper valuations. Moneycontrol has identified mid-cap and small-cap schemes that redeployed their cash notably in October. Here are their stock picks

1/13

Falling equity markets provide fund managers with opportunities to take positions in beaten-down quality stocks. Data from ACEMF, a mutual fund research platform, shows that some fund managers used the correction in October to redeploy their cash pile that had grown in size over the last few months.

2/13

The cash holdings of all actively managed equity funds increased from 4.7 percent of total assets to 5.7 percent over the past six months. However, compared to the previous month-end cash position of Rs 1,24,684 crore, it decreased to Rs 1,19,398 crore as of October 31, 2024.

Here are the top schemes from mid-cap and small-cap categories that redeployed their cash in October and the stocks that they added to portfolios during the month.

Here are the top schemes from mid-cap and small-cap categories that redeployed their cash in October and the stocks that they added to portfolios during the month.

3/13

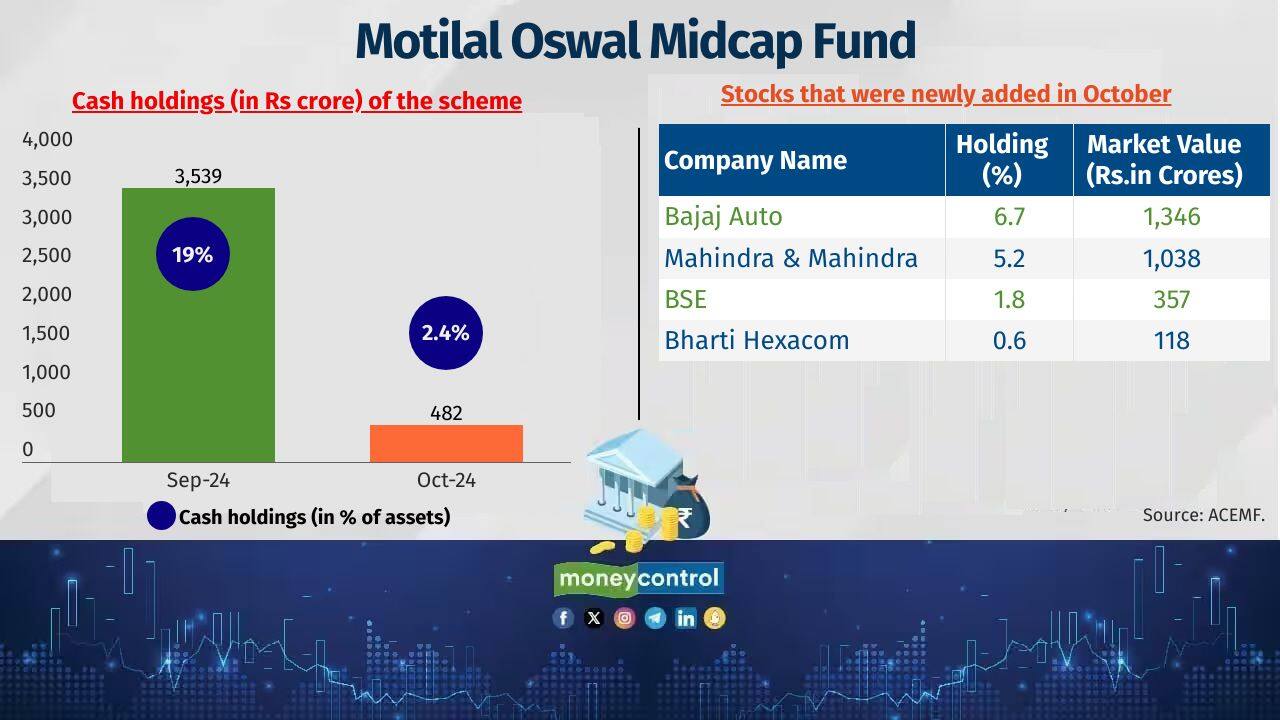

Motilal Oswal Midcap Fund

Category: Mid Cap Fund

Fund managers: Niket Shah, Ajay Khandelwal and Santosh Singh

Corpus as of October 31, 2024: Rs 20,056 crore

Also see: MF, PMS and AIFs are betting on these mid-cap stocks. Check if you own any

Category: Mid Cap Fund

Fund managers: Niket Shah, Ajay Khandelwal and Santosh Singh

Corpus as of October 31, 2024: Rs 20,056 crore

Also see: MF, PMS and AIFs are betting on these mid-cap stocks. Check if you own any

4/13

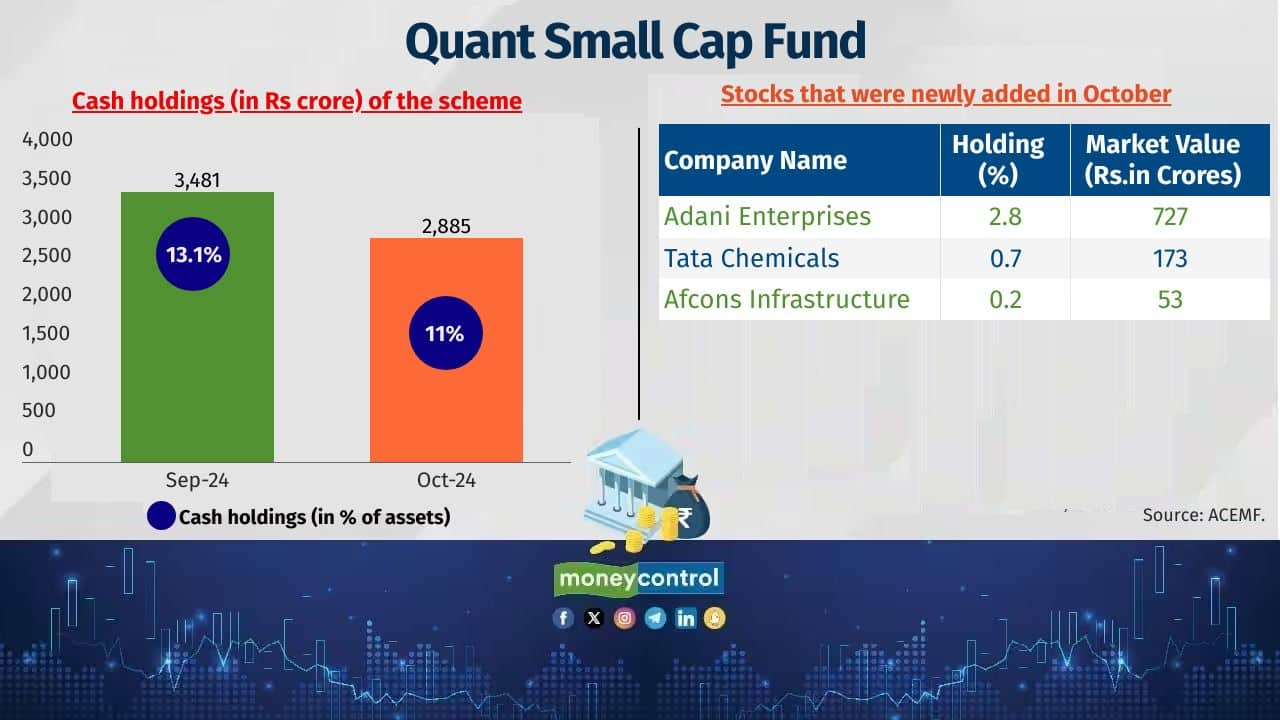

Quant Small Cap Fund

Category: Small Cap Fund

Fund managers: Ankit Pande, Vasav Sahgal and Sanjeev Sharma

Latest corpus: Rs 26,331 crore

Also see: New-age tech stocks turn favorite among mutual funds. Check out their top picks

Category: Small Cap Fund

Fund managers: Ankit Pande, Vasav Sahgal and Sanjeev Sharma

Latest corpus: Rs 26,331 crore

Also see: New-age tech stocks turn favorite among mutual funds. Check out their top picks

5/13

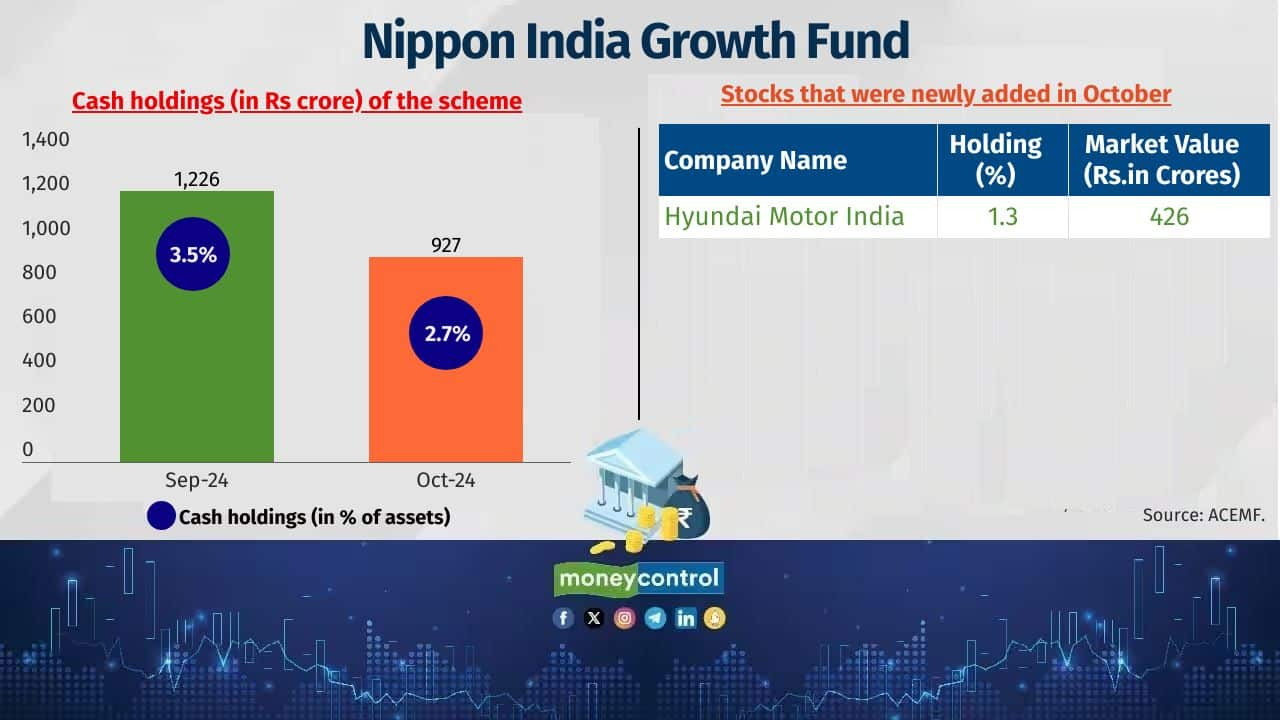

Nippon India Growth Fund

Category: Mid Cap Fund

Fund manager: Rupesh Patel

Latest corpus: Rs 33,922 crore

Category: Mid Cap Fund

Fund manager: Rupesh Patel

Latest corpus: Rs 33,922 crore

6/13

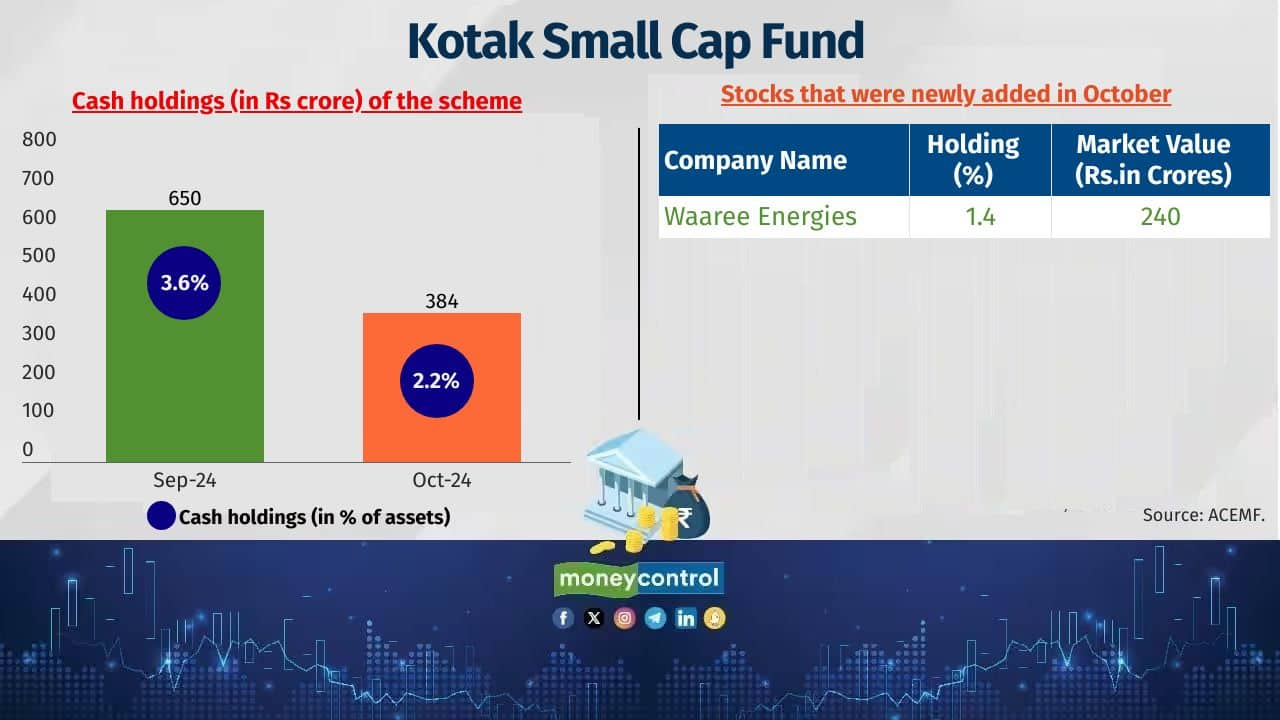

Kotak Small Cap Fund

Category: Small Cap Fund

Fund manager: Harish Bihani

Latest corpus: Rs 17,593 crore

Also see: Want to invest overseas? Here are the international mutual funds that are open for subscription

Category: Small Cap Fund

Fund manager: Harish Bihani

Latest corpus: Rs 17,593 crore

Also see: Want to invest overseas? Here are the international mutual funds that are open for subscription

7/13

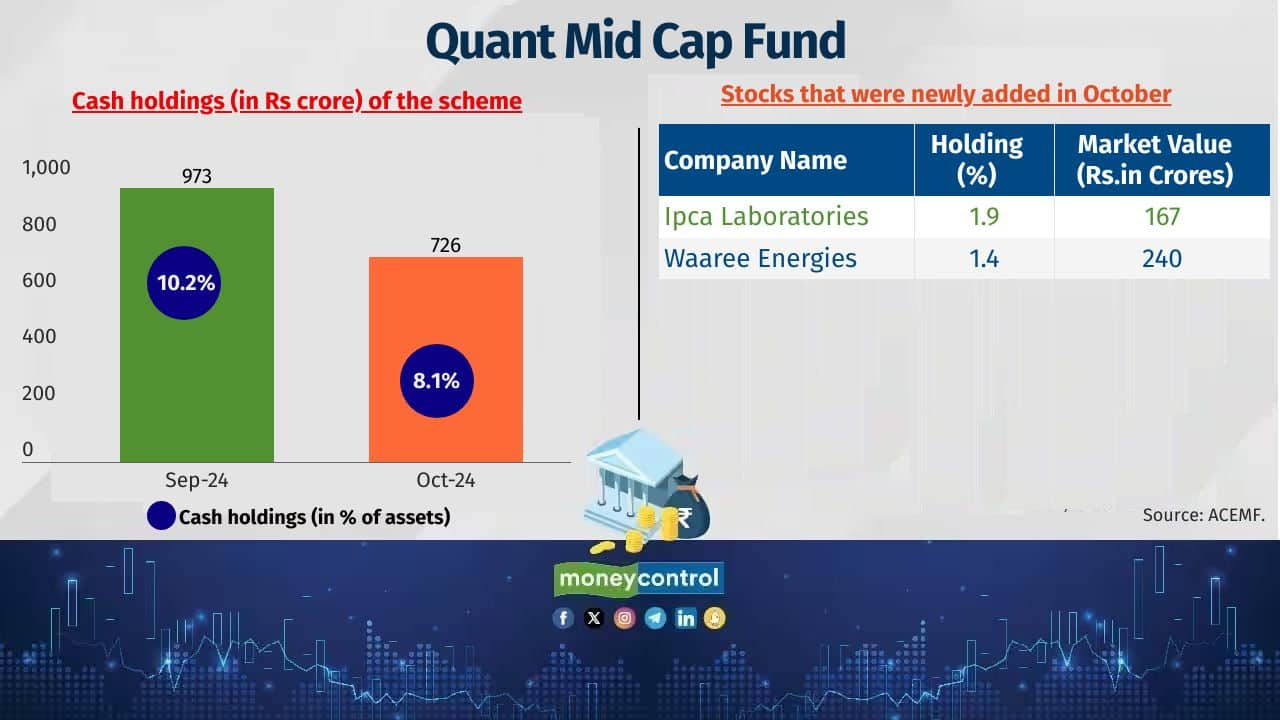

Quant Mid Cap Fund

Category: Mid Cap Fund

Fund managers: Ankit Pande, Vasav Sahgal and Sanjeev Sharma

Latest corpus: Rs 8,941 crore

Category: Mid Cap Fund

Fund managers: Ankit Pande, Vasav Sahgal and Sanjeev Sharma

Latest corpus: Rs 8,941 crore

8/13

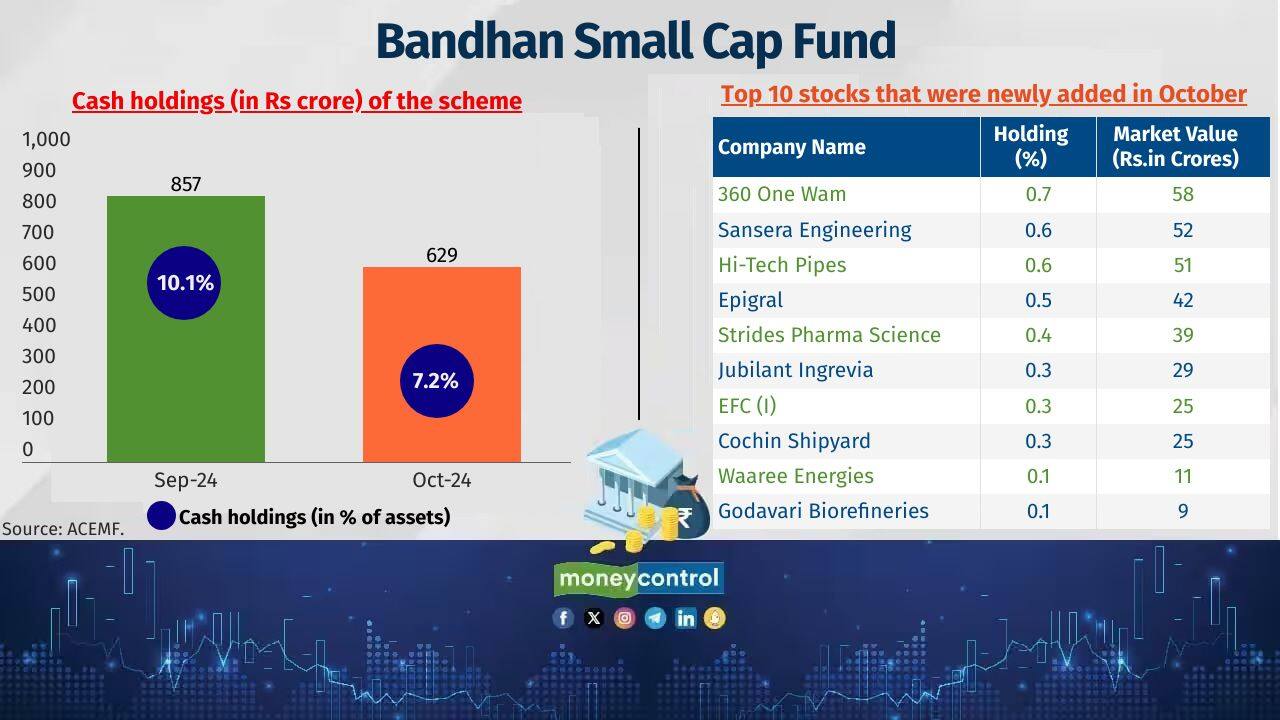

Bandhan Small Cap Fund

Category: Small Cap Fund

Fund managers: Manish Gunwani, Kirthi Jain and Harsh Bhatia

Latest corpus: Rs 8,716 crore

Also see: 10 US stocks that have found favour with domestic equity-oriented mutual funds

Category: Small Cap Fund

Fund managers: Manish Gunwani, Kirthi Jain and Harsh Bhatia

Latest corpus: Rs 8,716 crore

Also see: 10 US stocks that have found favour with domestic equity-oriented mutual funds

9/13

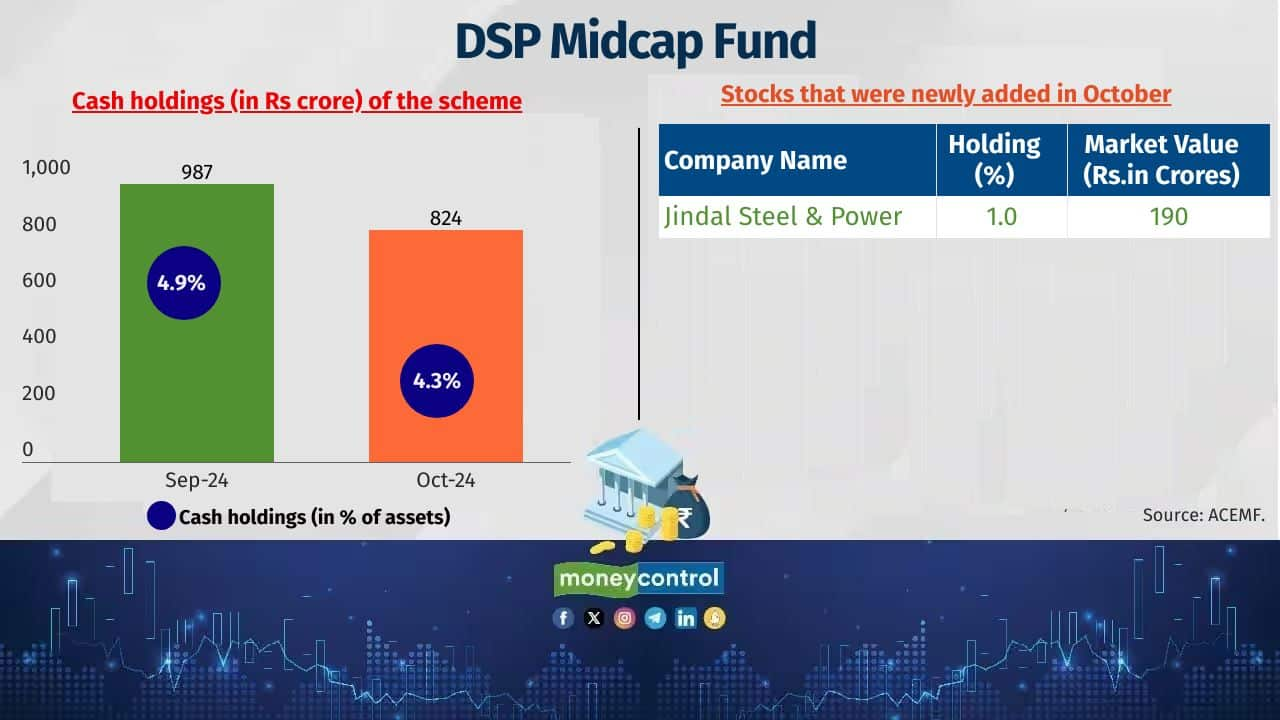

DSP Midcap Fund

Category: Mid Cap Fund

Fund managers: Vinit Sambre and Abhishek Ghosh

Latest corpus: Rs 19,015 crore

Category: Mid Cap Fund

Fund managers: Vinit Sambre and Abhishek Ghosh

Latest corpus: Rs 19,015 crore

10/13

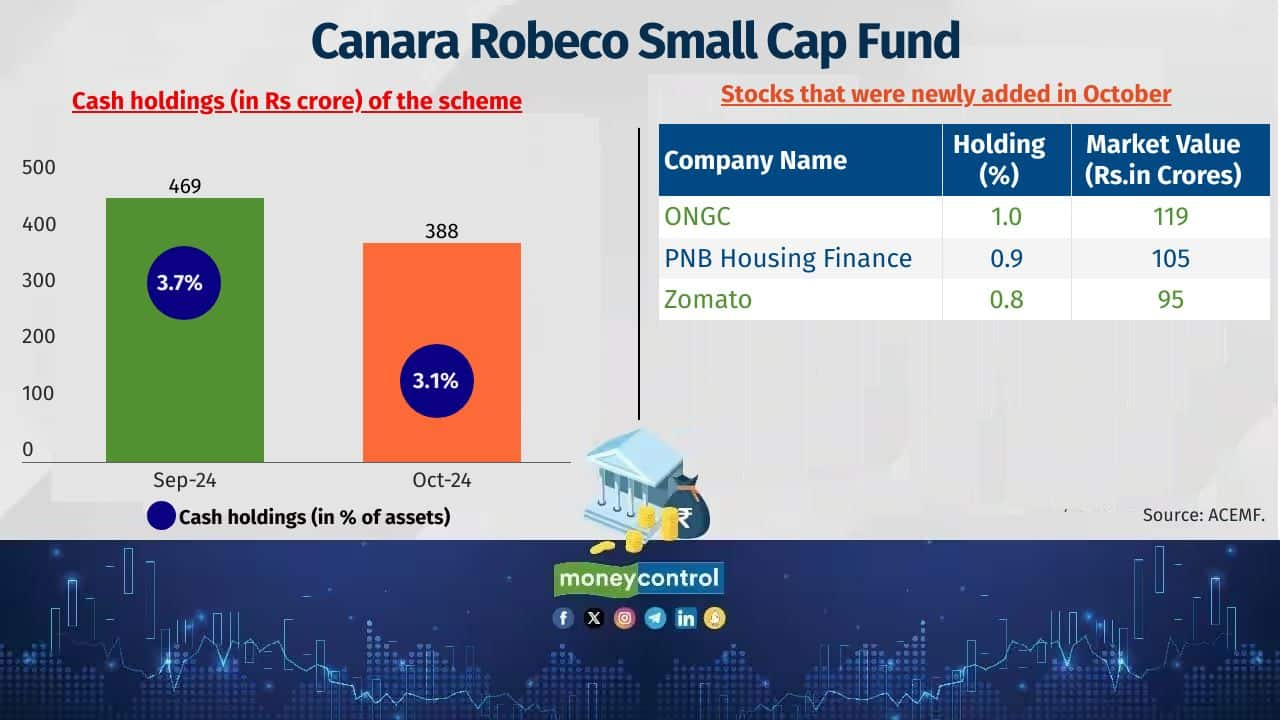

Canara Robeco Small Cap Fund

Category: Small Cap Fund

Fund managers: Pranav Gokhale and Shridatta Bhandwaldar

Latest corpus: Rs 12,324 crore

Category: Small Cap Fund

Fund managers: Pranav Gokhale and Shridatta Bhandwaldar

Latest corpus: Rs 12,324 crore

11/13

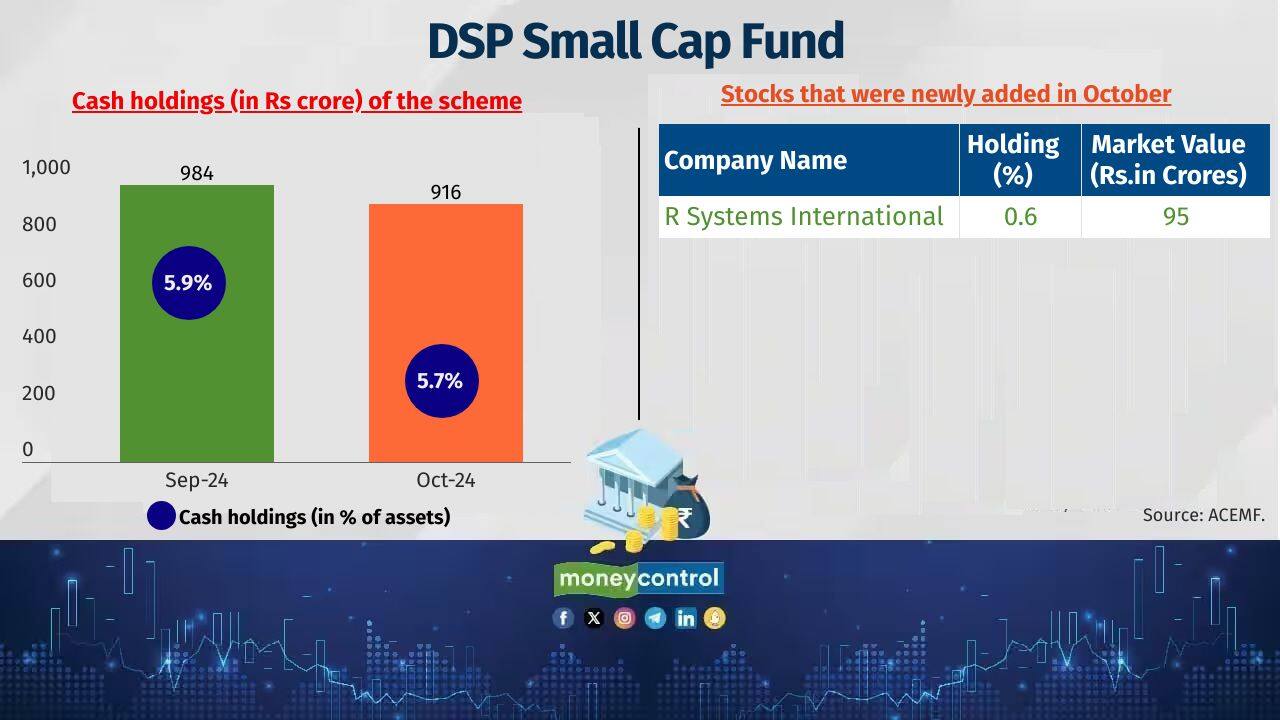

DSP Small Cap Fund

Category: Small Cap Fund

Fund managers: Vinit Sambre and Resham Jain

Latest corpus: Rs 16,147 crore

Also see: Worried about market turbulence? Here are top-performing aggressive hybrid funds to ride out the volatility

Category: Small Cap Fund

Fund managers: Vinit Sambre and Resham Jain

Latest corpus: Rs 16,147 crore

Also see: Worried about market turbulence? Here are top-performing aggressive hybrid funds to ride out the volatility

12/13

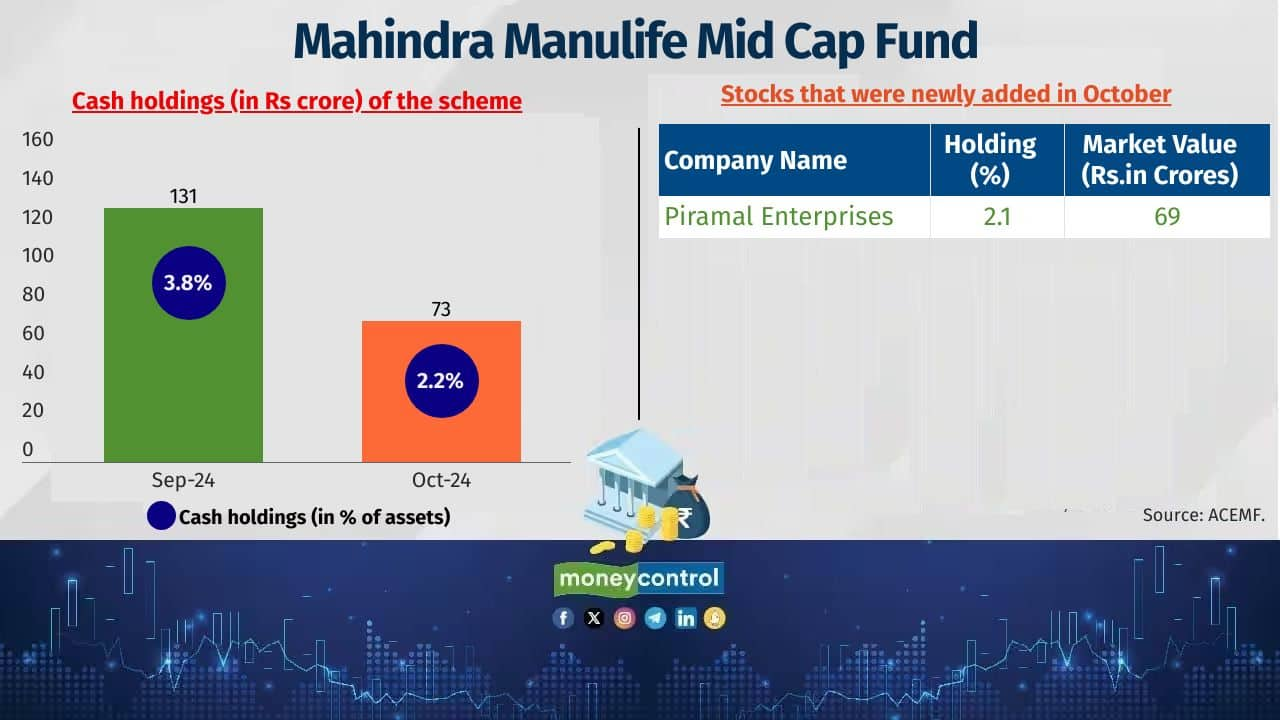

Mahindra Manulife Mid Cap Fund

Category: Mid Cap Fund

Fund managers: Krishna Sanghavi, Manish Lodha

Latest corpus: Rs 3,341 crore

Category: Mid Cap Fund

Fund managers: Krishna Sanghavi, Manish Lodha

Latest corpus: Rs 3,341 crore

13/13

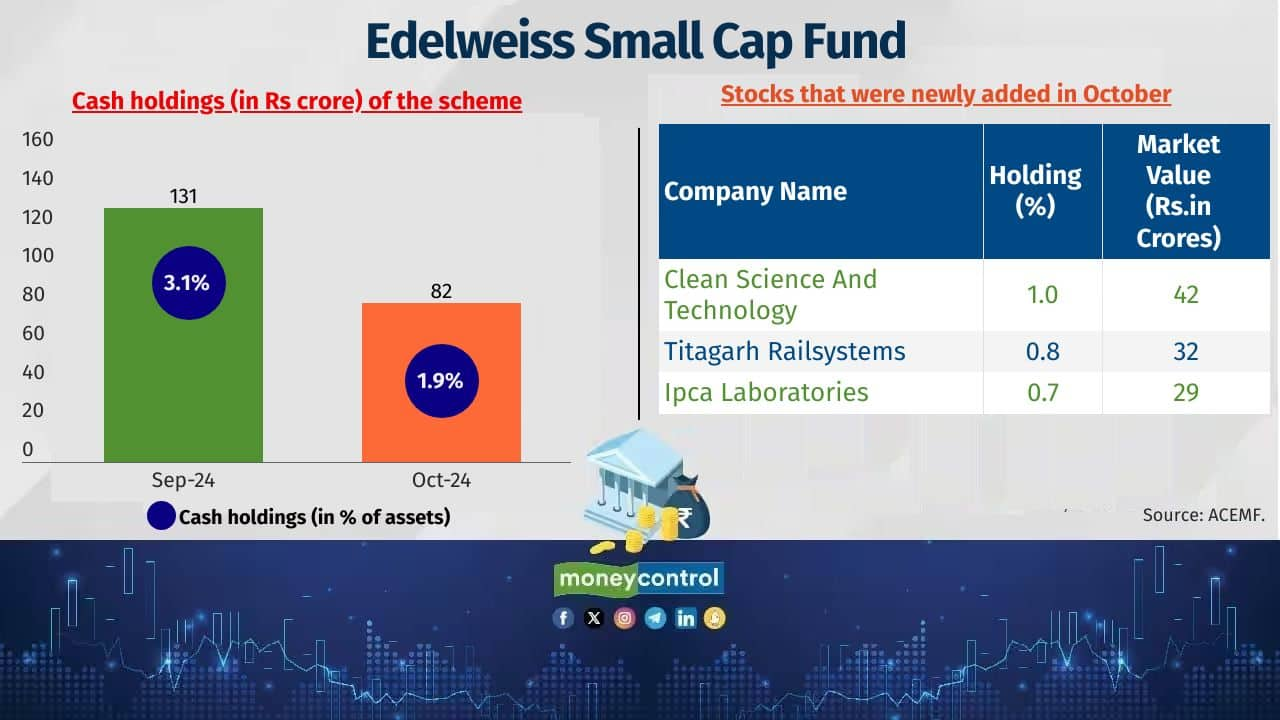

Edelweiss Small Cap Fund

Category: Small Cap Fund

Fund managers: Trideep Bhattacharya, Raj Koradia and Dhruv Bhatia

Latest corpus: Rs 4,256 crore

Also see: How Step-up SIP in mid-cap funds helps to achieve larger corpus and higher returns than a normal SIP

Category: Small Cap Fund

Fund managers: Trideep Bhattacharya, Raj Koradia and Dhruv Bhatia

Latest corpus: Rs 4,256 crore

Also see: How Step-up SIP in mid-cap funds helps to achieve larger corpus and higher returns than a normal SIP

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!