Worried about market turbulence? Here are top-performing aggressive hybrid funds to ride out the volatility

Top Hybrid Mutual Funds: Aggressive hybrid funds invest between 65 and 80 per cent in equity and the rest in debt. Higher allocation to equity can boost returns during stock market rallies, while the debt component can cap losses during market turbulence.

1/10

Indian equity markets have been on a downtrend over the last one month. As of November 4, the BSE Sensex has plummeted more than eight per cent from its last peak of September 26, 2024 (85,836), while BSE Mid-cap and BSE Small-cap indices have declined by 7.4 per cent and 4.2 per cent, respectively.

Factors that have triggered this volatility and dampened investors’ sentiment include tepid second-quarter (Q2) earnings, relentless foreign institutional investors’ (FIIs) sell-offs, rising valuations of domestic mid-and small-cap stocks and escalating geopolitical tensions.

However, investors should focus on their long-term investment goals and not be influenced by short-term market turbulence, according to financial advisors.

Factors that have triggered this volatility and dampened investors’ sentiment include tepid second-quarter (Q2) earnings, relentless foreign institutional investors’ (FIIs) sell-offs, rising valuations of domestic mid-and small-cap stocks and escalating geopolitical tensions.

However, investors should focus on their long-term investment goals and not be influenced by short-term market turbulence, according to financial advisors.

2/10

Aggressive hybrid mutual funds are an option for investors with a medium-risk appetite who are worried about the current volatility in the markets.

Peeyush Pandey, a registered investment advisor, said, “Within the hybrid fund sub-categories, aggressive hybrid funds are investing between 65 and 80 per cent in equity and the rest are being parked in debt assets. The higher allocation to equity can help deliver good returns during equity market rallies, while the debt exposure helps cap losses amid market downturns.”

These funds will be treated like equity funds for taxation purposes, he said.

“In today’s market environment, investors might consider actively managed aggressive hybrid funds that have experienced various market cycles. Typically, these funds maintain a well-rounded equity component, with exposure to large, mid, and small caps, while the debt portion generates yields through a mix of credit, interest rate, and duration strategies,” said Ravi Kumar TV, Director, Gaining Ground Investment Services.

The funds navigate complex economic cycles, adjusting their composition of equities and bonds to match opportunities as and when they arise, Kumar added.

Here’s a lowdown on the top-performing aggressive hybrid funds, whose selection choice is based on their 10-year SIP (systematic investment plan) returns. Source: ACEMF

Peeyush Pandey, a registered investment advisor, said, “Within the hybrid fund sub-categories, aggressive hybrid funds are investing between 65 and 80 per cent in equity and the rest are being parked in debt assets. The higher allocation to equity can help deliver good returns during equity market rallies, while the debt exposure helps cap losses amid market downturns.”

These funds will be treated like equity funds for taxation purposes, he said.

“In today’s market environment, investors might consider actively managed aggressive hybrid funds that have experienced various market cycles. Typically, these funds maintain a well-rounded equity component, with exposure to large, mid, and small caps, while the debt portion generates yields through a mix of credit, interest rate, and duration strategies,” said Ravi Kumar TV, Director, Gaining Ground Investment Services.

The funds navigate complex economic cycles, adjusting their composition of equities and bonds to match opportunities as and when they arise, Kumar added.

Here’s a lowdown on the top-performing aggressive hybrid funds, whose selection choice is based on their 10-year SIP (systematic investment plan) returns. Source: ACEMF

3/10

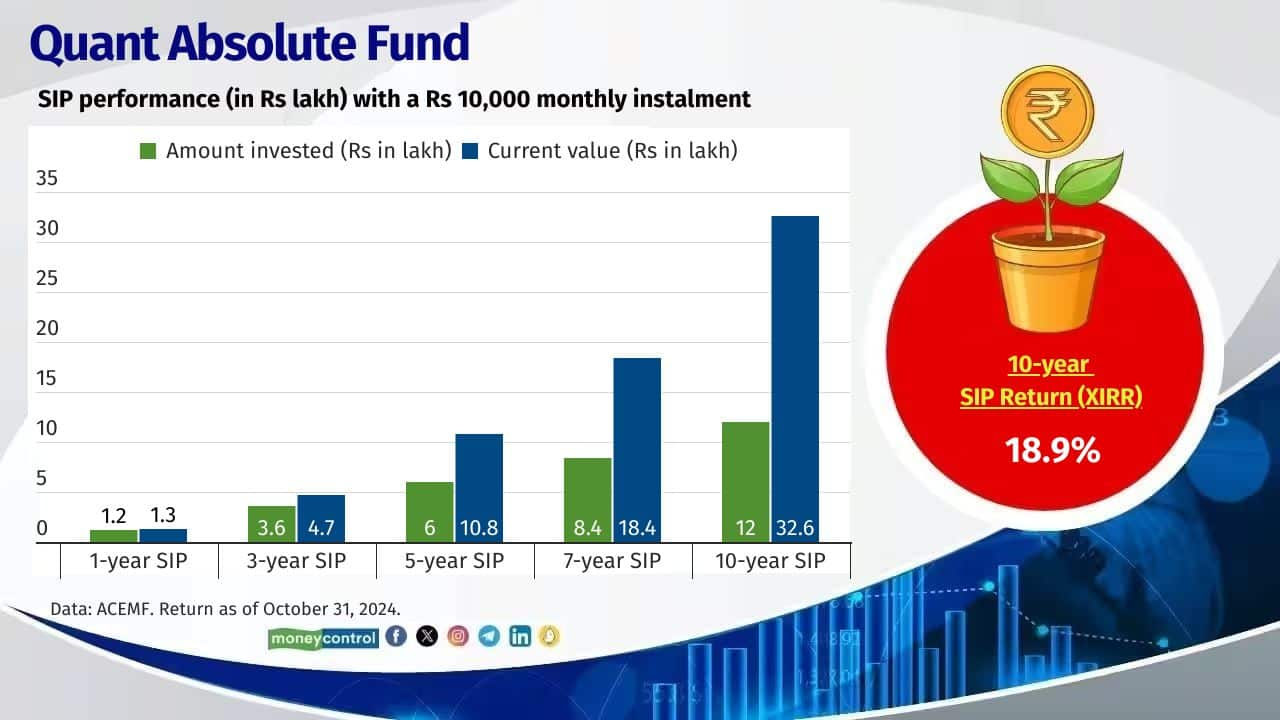

Quant Absolute Fund

10-year SIP return (XIRR): 18.9%

Fund Manager: Ankit A Pande, Vasav Sahgal and Sanjeev Sharma

Also see: How Step-up SIP in mid-cap funds helps to achieve larger corpus and higher returns than a normal SIP

10-year SIP return (XIRR): 18.9%

Fund Manager: Ankit A Pande, Vasav Sahgal and Sanjeev Sharma

Also see: How Step-up SIP in mid-cap funds helps to achieve larger corpus and higher returns than a normal SIP

4/10

ICICI Prudential Equity & Debt Fund

10-year SIP return (XIRR): 18.5%

Fund Manager: Mittul Kalawadia and Sankaran Naren, Akhil Kakkar, Manish Banthia, Sharmila D'mello and Sri Sharma

10-year SIP return (XIRR): 18.5%

Fund Manager: Mittul Kalawadia and Sankaran Naren, Akhil Kakkar, Manish Banthia, Sharmila D'mello and Sri Sharma

5/10

JM Aggressive Hybrid Fund

10-year SIP return (XIRR): 17.5%

Fund Manager: Asit Bhandarkar, Satish Ramanathan, Chaitanya Choksi and Ruchi Fozdar

Also see: Wealth managers are recommending multi-asset funds amid volatility in equities

10-year SIP return (XIRR): 17.5%

Fund Manager: Asit Bhandarkar, Satish Ramanathan, Chaitanya Choksi and Ruchi Fozdar

Also see: Wealth managers are recommending multi-asset funds amid volatility in equities

6/10

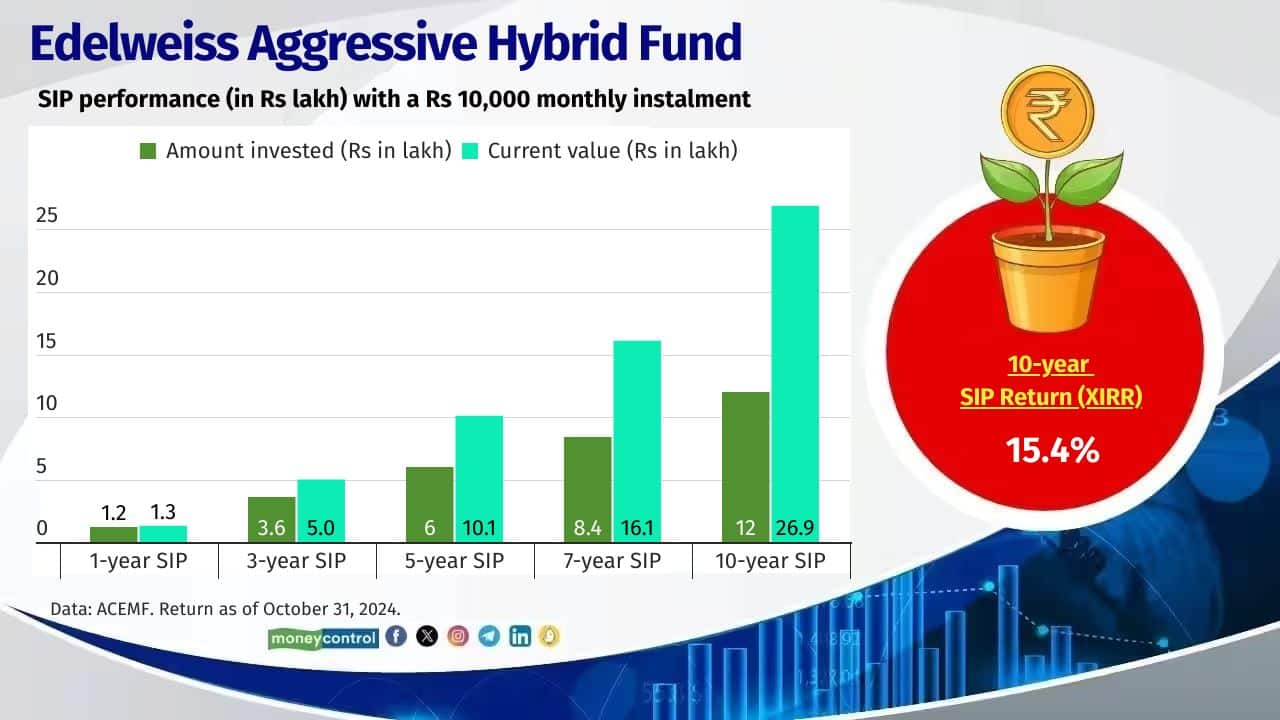

Edelweiss Aggressive Hybrid Fund

10-year SIP return (XIRR): 15.4%

Fund Manager: Bharat Lahoti, Bhavesh Jain, Rahul Dedhia and Pranavi Kulkarni

Also see: Mid-cap stocks that fund houses sold ahead of volatility

10-year SIP return (XIRR): 15.4%

Fund Manager: Bharat Lahoti, Bhavesh Jain, Rahul Dedhia and Pranavi Kulkarni

Also see: Mid-cap stocks that fund houses sold ahead of volatility

7/10

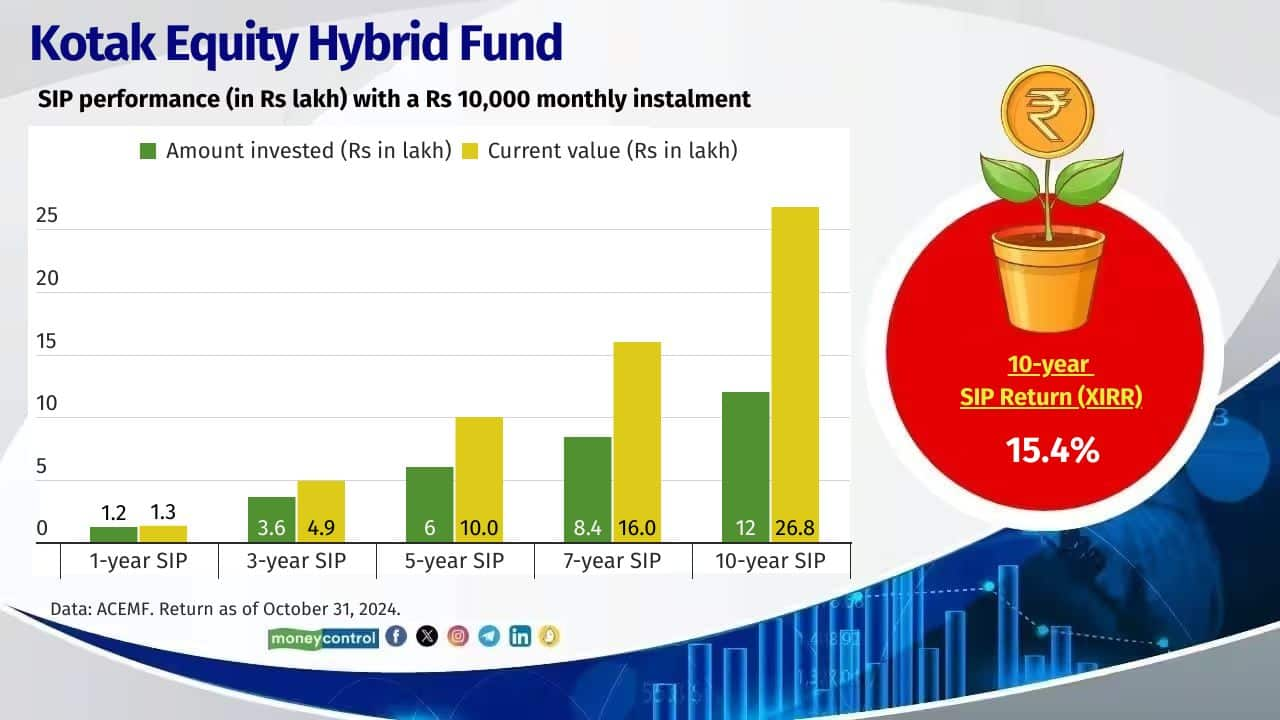

Kotak Equity Hybrid Fund

10-year SIP return (XIRR): 15.4%

Fund Manager: Abhishek Bisen and Atul Bhole

10-year SIP return (XIRR): 15.4%

Fund Manager: Abhishek Bisen and Atul Bhole

8/10

UTI Aggressive Hybrid Fund

10-year SIP return (XIRR): 15.2%

Fund Manager: V Srivatsa and Sunil Madhukar Patil

Also see: Top microcap multibagger stocks added by mutual funds, amidst volatility

10-year SIP return (XIRR): 15.2%

Fund Manager: V Srivatsa and Sunil Madhukar Patil

Also see: Top microcap multibagger stocks added by mutual funds, amidst volatility

9/10

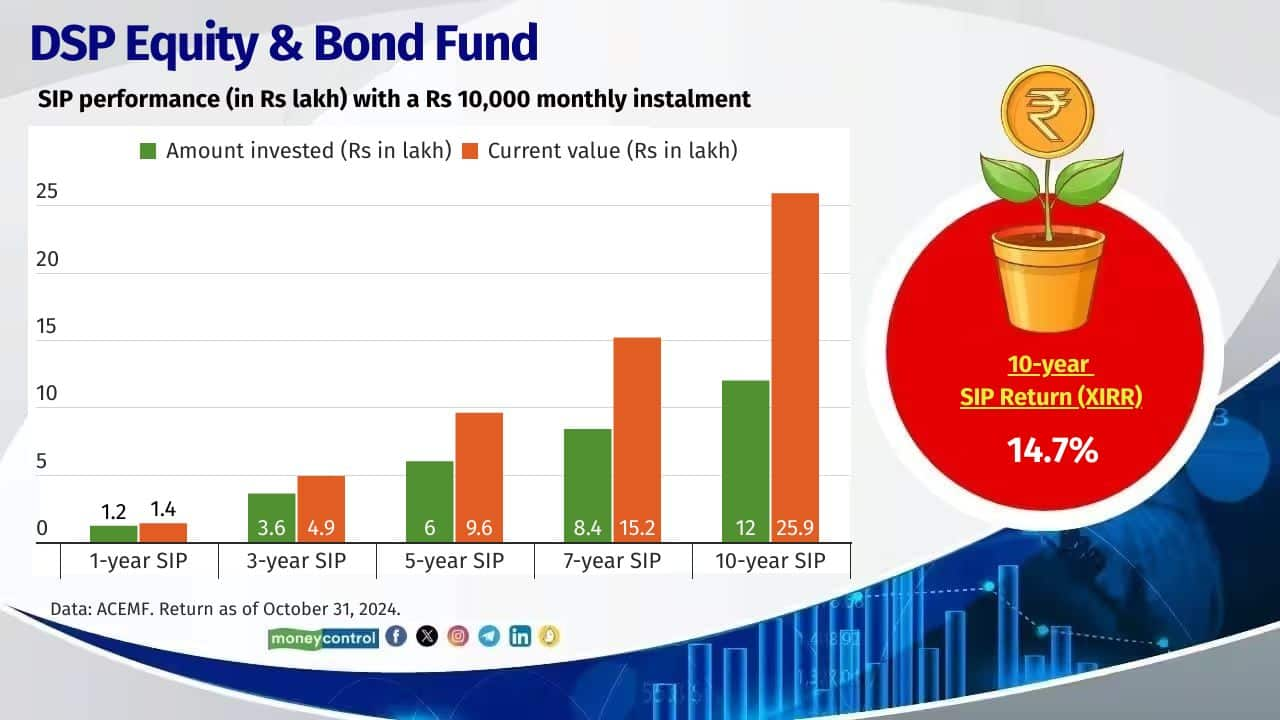

DSP Equity & Bond Fund

10-year SIP return (XIRR): 14.7%

Fund Manager: Abhishek Singh and Kedar Karnik

10-year SIP return (XIRR): 14.7%

Fund Manager: Abhishek Singh and Kedar Karnik

10/10

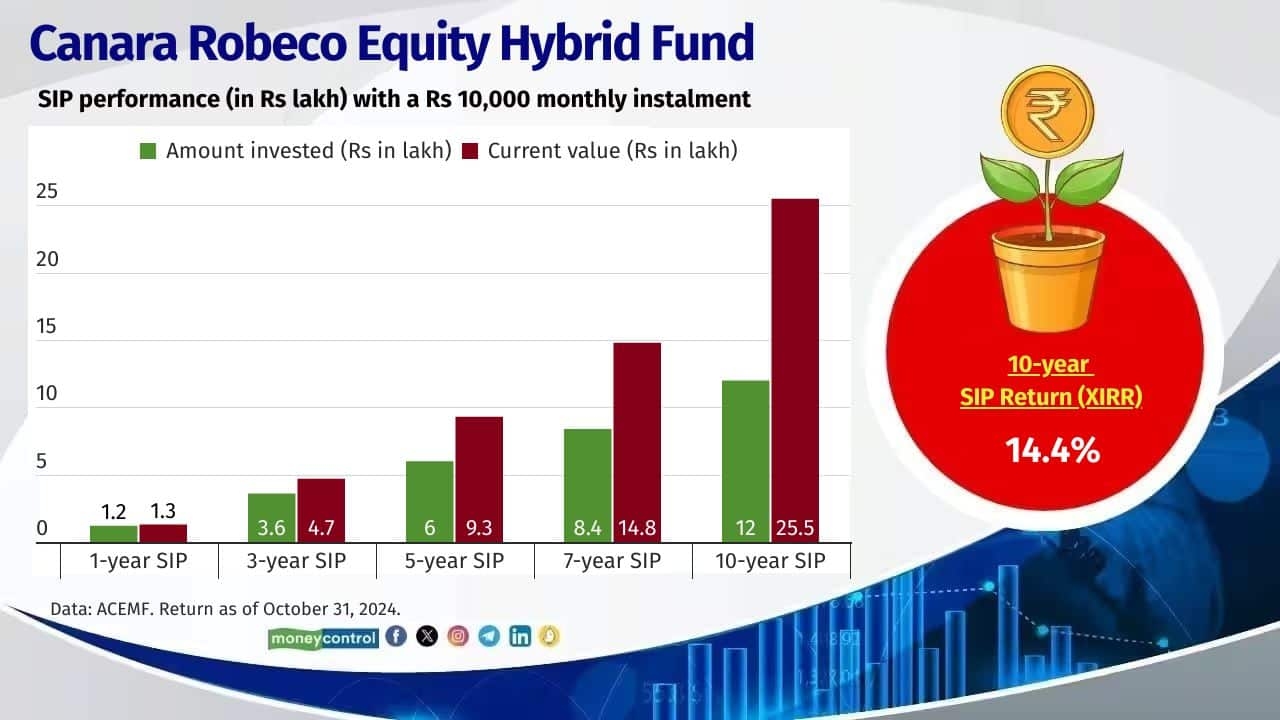

Canara Robeco Equity Hybrid Fund

10-year SIP return (XIRR): 14.4%

Fund Manager: Ennette Fernandes, Shridatta Bhandwaldar and Avnish Jain

Also see: Chasing Chinese dragons: What's in store for Indian mutual fund investors?

10-year SIP return (XIRR): 14.4%

Fund Manager: Ennette Fernandes, Shridatta Bhandwaldar and Avnish Jain

Also see: Chasing Chinese dragons: What's in store for Indian mutual fund investors?

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!