Loans against mutual funds is in the spotlight on the back of a rising equity market, that has opened up another avenue for investors to borrow, by pledging their mutual funds. Mirae Asset Financial Services (MAFS), part of the South Korean- Mirae Asset Group, is a significant firm in this market. MAFS has a loan book of around Rs 620 crores in loan against mutual funds (including equity and debt category) and shares, as on July 5, 2024. It has grown from a Rs 100 crore loan book in July 2023. The average ticket size of a loan now is around Rs 12 lakh sanctioned amount.

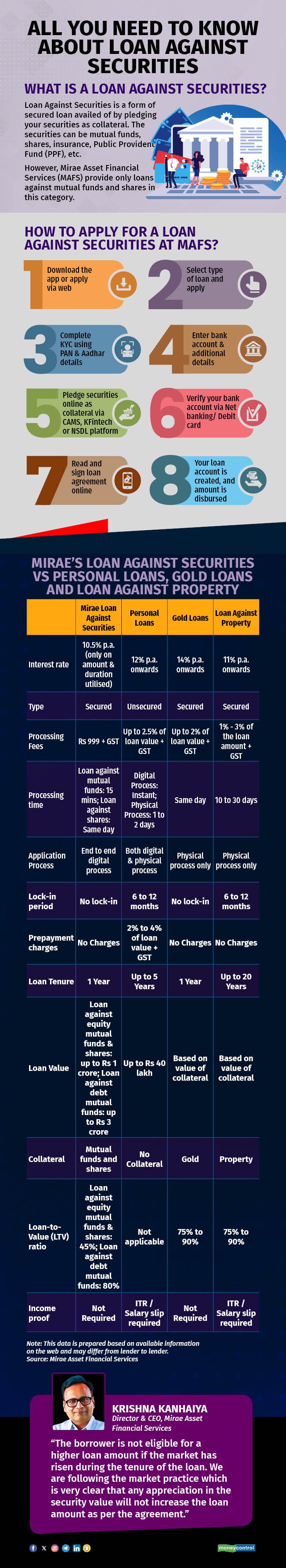

In an exclusive interview with Moneycontrol Krishna Kanhaiya, Director & CEO, Mirae Asset Financial Services who has been working with this group for the last 17 years discusses how loan against mutual funds and shares work, compares features with personal loans, gold loans and loan against property. He also discusses loan-to-value ratio for equity mutual funds and shares, explains parameters borrowers need to consider while shortlisting a lender and more.

How does the loan against mutual funds and shares facility work?

The loan against mutual funds and shares is provided as an overdraft facility. Based on the value and type of mutual funds (i.e. equity or debt mutual funds) or shares (as per a pre-defined category by MAFS) pledged you will get an overdraft account with an eligible limit (value of mutual funds/shares pledged multiplied by loan-to-value ratio). You can pledge certain units from the mutual fund folio. You can withdraw any amount within the eligible limit of your overdraft account. You can repay the utilised amount (principal) anytime during the loan tenure which is one year. However, you can renew the loan at the end of the one year tenure.

How is the interest calculated and charged?

Interest is charged only on the amount utilised and debited on a monthly basis from the registered bank account via NACH mandate. You will be notified on your registered email ID to maintain sufficient balance.

What happens when the interest is not paid?

In case of interest bounce from the registered bank account, the entire interest amount and other charges become overdue. The borrower will be requested to make overdue payment using the pay now facility. If the borrower fails to make overdue payment within 60 days, MAFS reserves the right to invoke/sell the underlying securities to the extent of overdue amount and recover.

Also read | Why loans against mutual funds are gaining in popularity

Why is the loan-to-value ratio for equity mutual funds and shares kept at 45 percent?

As per RBI regulations, the maximum Loan-To-Value (LTV) ratio for equity mutual funds and shares can be 50 percent, however, we provide an LTV of 45 percent to keep a buffer of 5 percent. A time period of 60 days is given to clients to regularise their accounts if the LTV ratio exceeds 45 percent up to 50 percent whereas a time period of 7 days is given if the LTV ratio exceeds 50 percent as per RBI norms. Loan accounts may also get regularised automatically due to a rise in the market before the end of the stipulated time period. We recommend our clients to utilise less than 100 percent of the loan limit and to maintain a buffer to avoid such margin calls.

The margin calls with a deadline of seven days may cause huge trouble to retail borrowers. We are willing to forego business from customers insisting on 50 percent LTV instead of causing them inconvenience.

What is a margin call? When can MAFS sell the securities?

The securities in the overdraft account are revalued every day. If the value of your securities drops, the eligible limit of your overdraft account also drops, (revised collateral value x LTV%). If the utilised amount is more than the revised eligible limit, the difference between the eligible limit and the utilised amount is considered to be overdue. In such cases a demand is made asking the borrower to clear the overdue amount either by making payment towards the overdue amount or pledging additional securities. This is known as a margin call. The borrower needs to clear the overdue in the stipulated time (see graphic). If their value increases, your eligible limit automatically increases and if the utilised amount is less than the revised eligible limit then your account will not have overdue amount.

What are the parameters borrowers need to consider while shortlisting a lender?

The important parameter for a borrower to consider is smooth loan application process and exit from the loan after repayment. Then know the interest rate, LTV ratio, processing fees, securities eligible for pledge and other charges. These are the basic things that you should consider while shortlisting a lender.

Also read | Explained: Loan against property and how to get the best of it

Important terms borrowers need to be aware of while pledging the mutual funds and shares for a loan?

When you pledge your shares, all benefits keep accruing to you. So, suppose a stock whose shares are pledged has declared a dividend and bonus shares. You will be eligible to get a dividend and bonus shares. However, till the time pledge is there you cannot sell your shares. Similarly, in mutual funds you cannot sell your pledge units nor can you switch to other mutual fund schemes.

Also explore: Online personal loan up to Rs. 15 Lakhs via Moneycontrol

Is the borrower eligible to take a loan on already pledged MF units/shares after price has risen?

The borrower is not eligible for a higher loan amount if the market has risen during the tenure of the loan. We are following the market practice which is very clear that any appreciation in the security value will not increase the loan amount as per the agreement. However, we are working on a solution to introduce where if your security value has gone up then by paying a small fee you can opt for increasing the loan amount.

Can a borrower pledge close ended MFs and funds with lock-in such as the ELSS scheme?

Close-ended or locked-in units of mutual funds are not part of the approved list of mutual funds. Lock-in free units of ELSS funds are eligible for pledging or lien marking and availing loan against mutual funds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.