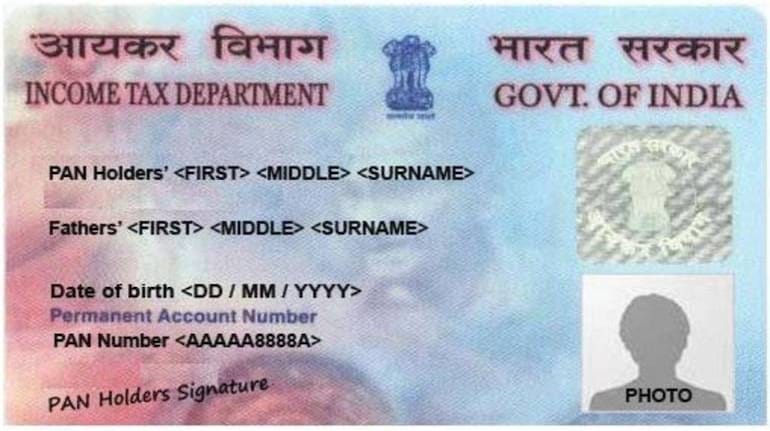

You will have to shell out penal charges of Rs 500 to Rs 1,000 if you fail to link your Permanent Account Number (PAN) and Aadhaar within two days. March 31 is the deadline for completing this exercise.

Penalty for failure to seed PAN with Aadhaar by March 31

The Central Board of Direct Taxes (CBDT) has decided to impose a fine of Rs 500 if you miss this deadline, but complete the seeding process within three months – that is, by June 30, 2022. If you are unable to do so, you will be charged double the penal fee.

Also read: Money matters that need your attention before March 31

Non-linked PAN to be inoperative after March 31, 2023

However, the CBDT has clarified that non-linked PAN will continue to be valid till March 31, 2023. Your PAN will become inoperative after this date if the linking process is not complete. “Any failure may lead to the PAN becoming inoperative, which means that a person had no PAN for income-tax purposes. Tax payers should check the income tax portal and ensure that the Aadhaar and PAN are linked. NRIs may have some concerns since in some cases, they do not have Aadhaar,” said Amit Maheshwari, Tax Partner, AKM Global, a tax and consulting firm.

Consequences of non-compliance

An inoperative PAN can be catastrophic for several financial transactions. "For one, you will not be able to file your income tax returns without the PAN," says chartered accountant Karan Batra, Founder, Chartered Club. Also, your mutual fund SIP transactions will not go through. Not seeding your PAN with Aadhaar will have repercussions on your mutual fund transactions too. Markets regulator Securities and Exchange Board of India (SEBI) had earlier said that investments of only those investors whose PAN is mapped to Aadhaar will be operational. You will not able to open a new broking or demat account unless your PAN and Aadhaar are linked.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!