Khyati Dharamsi

“Sabse Pehle Life Insurance,” was the life insurance industry’s first unified advertisement campaign started this year. While the industry has been looking to attract more eyeballs, the insurance regulator has ensured that the product per se became more investor friendly by modifying the surrender clauses, changing the revival period and ensuring that customers understand what they are paying for, through customised benefit illustrations.

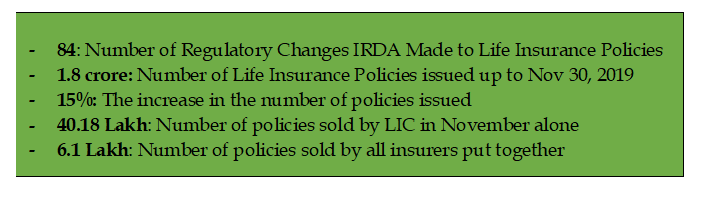

While the fresh policies compliant with these rules were supposed to have hit the market from December 1, 2019, the insurance regulator IRDA granted a two-month extension to life insurers. These firms were given additional time to roll out the new compliant products owing to the challenges in system preparedness and training. But there would be no further extensions and, hence, by February, you can be assured of getting life insurance policies with improved features.

Kamlesh Rao, MD & CEO of Aditya Birla Sun Life Insurance, says, “This calendar year has been rare, when insurance customers have seen products favour them and the matrices looked better for insurance companies too. On the back of closure of certain products, November 2019 saw the highest month-on-month growth ever, thus clocking the highest year-on-year growth too. Private insurers saw a growth of 65 per cent.”

Though the changes have been announced, some of them clash with the taxation limits prescribed by the government and more clarity would be awaited in the 2020 Union Budget.

Surrender of Policy

For every policy for which premium has been paid for at least two years, there would have to be a guaranteed surrender value, which needs to be in proportion to the premium paid. Apart from the guaranteed surrender value, the special surrender value too is applicable, which includes the fund value and other benefits accrued.

Reduction in premia

There would now be an option to reduce the premium one pays under a policy by up to 50 per cent, if the policy has completed five years. This is a measure to correct the drop outs after the lock-in period of five years under linked policies, where the life insurance cover is miniscule. So, instead of surrendering the policy, one can look at a reduction in premium. However, once you reduce the premium, you cannot restore it to the original amount again.

As a result of these moves, “Going forward, persistency will look better,” says Rao.

Suicide and Insurance

There have been many discussions about the clause of suicide in life insurance, especially within the first year during which the policy has been acquired. The regulator has specified that if any insured person dies due to suicide within 12 months from the start of the cover or revival of the policy, then at least 80 per cent of the total premium paid till the date of death or the surrender value should be paid for all policies in force.

Revival Period

In a move that would correct the persistency ratio of life insurance firms, the regulator increased the revival period – wherein one can restore the benefits of a life insurance policy by paying the unpaid premium – of a linked policy to three years, from two years earlier. Non-linked or traditional life insurance policies can be revived in five years instead of two years earlier.

Explaining how this change helps, Ajay Sehgal, director, Allegiance Financial, says, “Under traditional Plans, the stickiness of an investor was low, as after the first few years, insurance agents do not follow up with clients. As a result of missing out on the premium payment, the policyholder wouldn’t be able to enjoy the maturity benefit. These changes in terms of increase in policy revival period, better surrender clauses are in the interests of policyholders.”

Least possible Life Cover

The debates on the investment role in life insurance have sprung up again with the Insurance Regulator reducing the minimum possible life insurance coverage in unit-linked insurance plans (ULIPs) to 7 per cent, instead of the 10 per cent earlier.

Similarly, the minimum sum assured was brought down to 7 per cent of annualised premium for regular premium and 125 per cent for single premium products. Before opting for ULIPs, one needs to understand that, currently, only products that offer a minimum of 10 per cent life insurance coverage are allowed tax exemption at the time of maturity.

“There is an anomaly in this, as the section 10(10)D states that the maturity value under a life insurance policy would be tax-free only if the sum assured is at least 10 times the annual premium. If the minimum sum assured is reduced to 7 times the annual premium, we need to see whether the ambiguity on the tax treatment is addressed in the Union Budget.

Pension Plans and Annuity

The withdrawal limit under Pension Plans offered by Life Insurers has been enhanced to 60 per cent, from one-third the kitty, in line with the changes made in the National Pension System (NPS). The remaining amount has to be compulsorily used to purchase an annuity or a product that pays you actual pension at regular intervals.

Those suffering from lifestyle diseases and have been denied cover in the past were brought under the insurance ambit through freshly launched products of insurers.

The extension in the deadline for these modified products to be introduced in the market means that those looking for life insurance would have to stick to the old policies in force. “While the basket of the new life insurance products would be available only during the last 45 days of the tax-saving season, investors can consider other products that have better features,” suggests Sehgal.

Life insurance policies didn’t seem to feel the pinch of debt papers not being honoured and large-scale value erosion. “There was no adverse news with regard to investment papers and this reassures that the regulations have safeguarded the investor’s funds and long-term nature of investments work better,” says Rao.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.