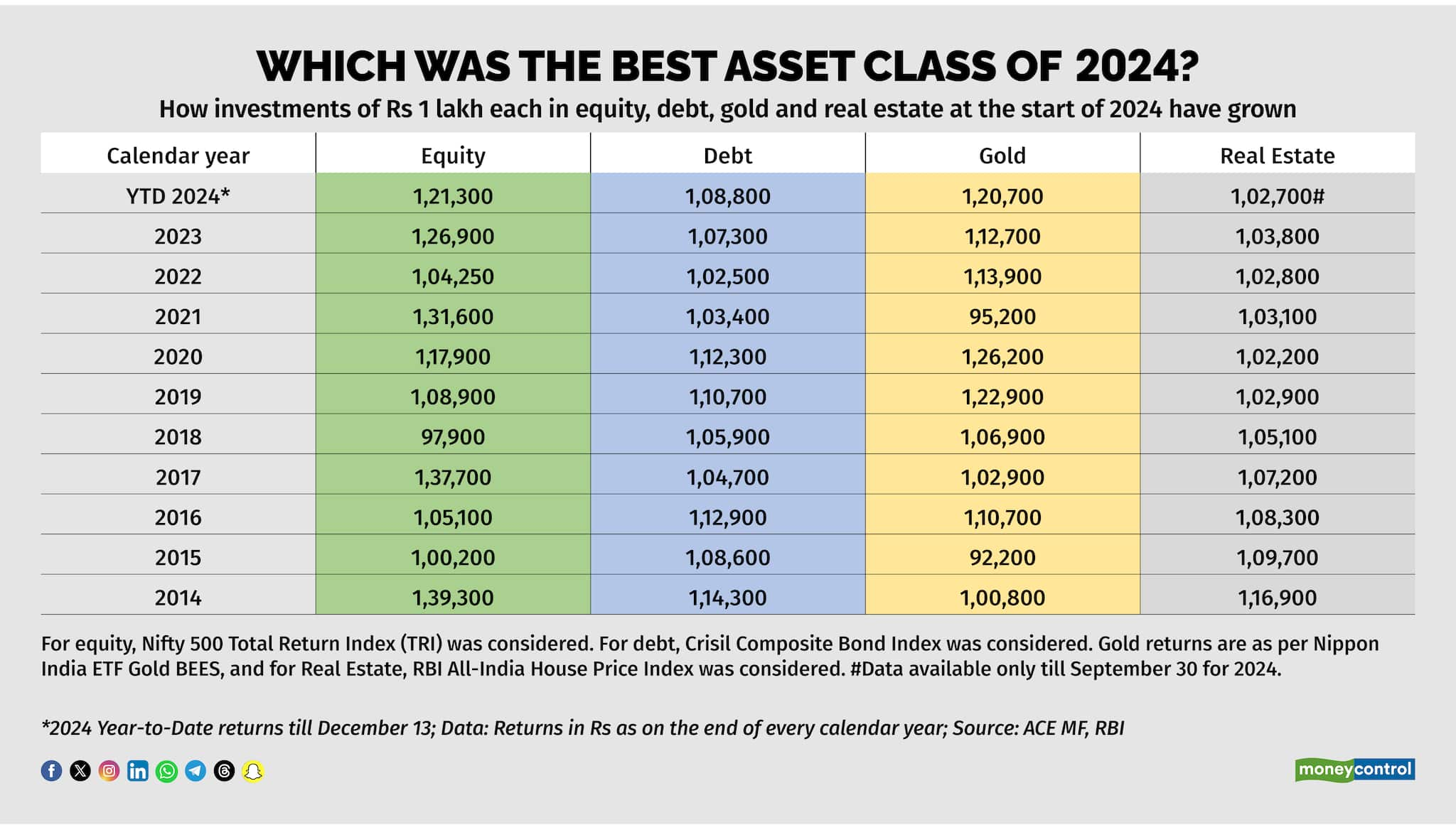

Indian equities continued to be the top-performing asset class of the year 2024 for the second consecutive calendar year. If you had invested Rs 1 lakh in broad-based Nifty 500 Index at the start of the year, it would have grown into Rs 1,21,300 by now.

Despite knowing that equities can outperform all the other asset classes in the long run, financial advisors advise against investing all your savings in equities.

To check how different asset classes have performed over the years, Moneycontrol ran some numbers.

For equity, the Nifty 500 Total Return Index (TRI) was considered. For Debt, Crisil Composite Bond Index was taken into account. The reference point for gold returns was Nippon India ETF Gold BEES, and for real estate, RBI All-India House Price Index (HPI) was considered. To be sure, HPI data was available only till September 30 for 2024.

Also read | All-round mutual fund show: Defence, mid-cap, long-duration, silver funds, all turn chart toppers in 2024

All-round performance

While equity was the top-performer in 2024, gold as an asset class was a close second as Rs 1 lakh invested at the start of the year turned into Rs 1,20,700 by December 13, 2024.

Meanwhile, debt as measured by the Crisil Composite Bond Index turned into Rs 1,08,800.

Real estate, which has been lagging for some years, turned your Rs 1,00,000 into Rs 1,02,700 till December 13. The Reserve Bank of India (RBI) publishes a quarterly HPI for 10 major cities in India — Ahmedabad, Bengaluru, Chennai, Delhi, Jaipur, Kanpur, Kochi, Kolkata, Lucknow and Mumbai.

Table 1

Table 1

Winners keep rotating

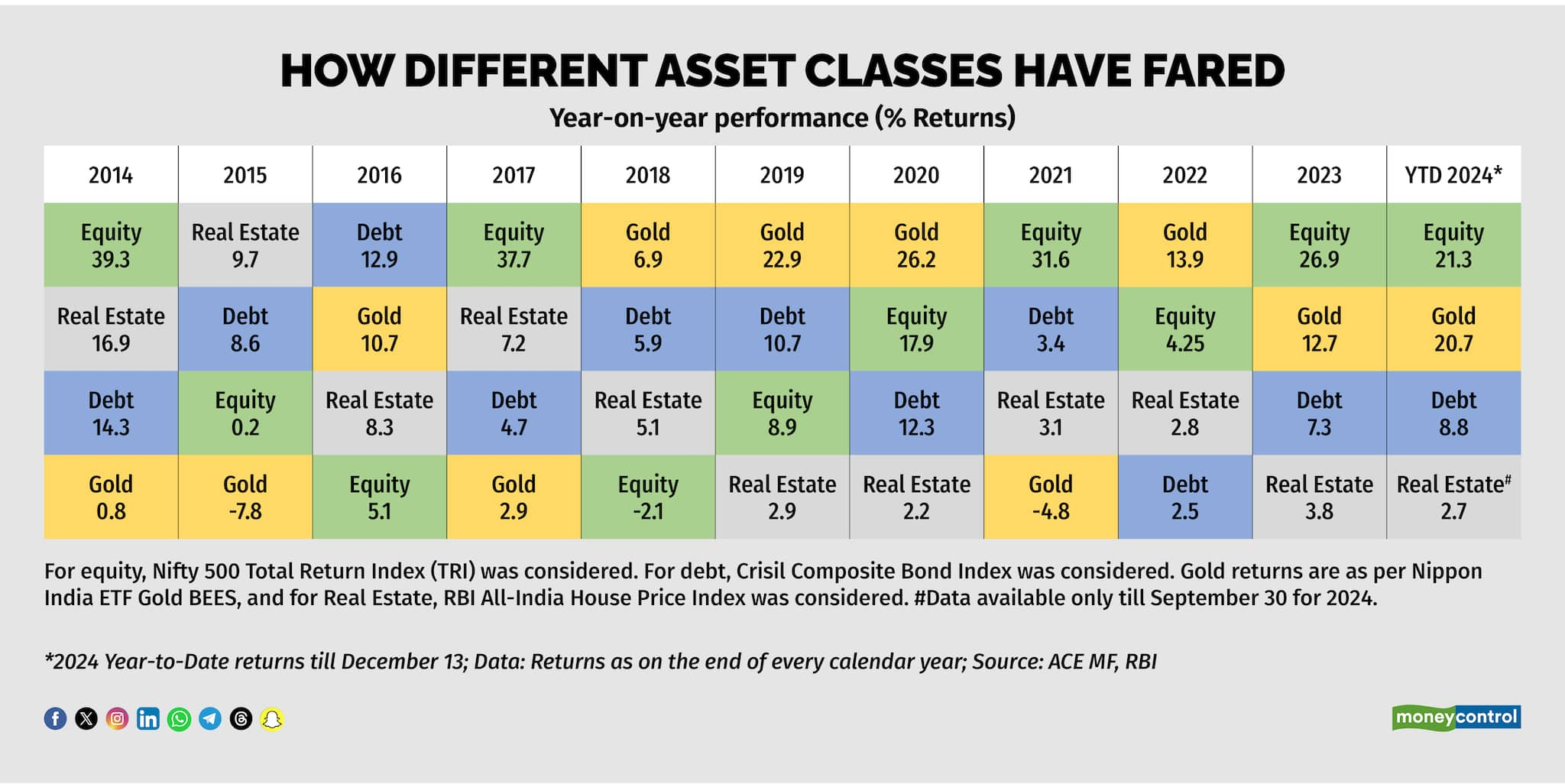

While equities have been on a roll over the past two years, data shows that over the past decade, equity has been the top-performing asset on five different occasions (see Table 2), while gold took the top spot for four years.

Real estate and debt, which are relatively stable assets, and hence, with lower-expected returns, were top-performers on one occasion each in the last 10 years.

Also read | How to position your investments amid shifting growth-inflation dynamics

Data clearly shows that diversification or asset allocation is one of the most fundamental principles of smart investing as a well-constructed portfolio not only captures market gains during rallies, but also provides protection during downturns.

Table 2

Table 2

All asset classes don't perform in a linear format. During 2015, 2016, 2018 and 2022, when equity returns were tepid, other asset classes such as gold and debt did well.

Further, a portfolio consisting of a single asset class might underperform as data shows that gold and real estate have been the worst performers on four instances each during the last 10 years.

Which asset allocation works best?

We took seven different asset allocations, consisting of equities, debt and gold, and calculated their yearly performance from 2014 to 2024 (till December 13, 2024).

Asset allocation #1:

Equity: 60%, Debt: 40%, Gold: 0%

Asset allocation #2:

Equity: 70%, Debt: 20%, Gold: 10%

Asset allocation #3:

Equity: 60%, Debt: 30%, Gold: 10%

Asset allocation #4:

Equity: 50%, Debt: 40%, Gold: 10%

Asset allocation #5:

Equity: 50%, Debt: 30%, Gold: 20%

Asset allocation #6:

Equity: 34%, Debt: 33%, Gold: 33%

Asset allocation #7:

Equity: 20%, Debt: 60%, Gold: 20%

Table 3

Table 3

Data shows that 60:40 (equity:debt) asset allocation, which is the simplest portfolio allocation and most followed globally, has not been working over the past few years.

However, adding a touch of another asset like gold has worked well. Over the past few years, equity-tilted portfolios with a touch of gold such as Asset allocation #2 (Equity: 70%, Debt: 20%, Gold: 10%) and Asset allocation #3 (Equity: 60%, Debt: 30%, Gold: 10%) have been the top performers.

On the other hand, the defensive Asset Allocation #7 (Equity: 20%, Debt: 60%, Gold: 20%) has been the worst-performer.

But keep in mind that during years 2015, 2016 and 2018, when equity markets underperformed, Asset Allocation #7 was the top-performing strategy.

So, which asset class works best for you?

A key to any successful investing strategy is identifying your goals. Are you saving for retirement, to buy a home or to fund your kid’s education?

Also read | Got Rs 10 lakh to invest? Here's the best option to get the most out of this market

Next, when determining asset allocation, try to strike a balance between risk and return that matches your financial goals, investment timeline and comfort with risk. Your risk tolerance should guide how much of your portfolio is allocated to high-risk investments (like stocks) versus lower-risk options (like bonds).

The next important thing is the time horizon, or how long you plan to invest before needing to access the money. Shorter-term goals may require a more conservative approach to protect against market volatility.

Diversification is one of the most effective ways to manage risk and enhance long-term returns, data shows.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.