In the December monetary policy, the Reserve Bank of India (RBI) kept the benchmark interest rate unchanged at 4 percent. For fixed deposit (FD) holders, there is relief as the banks may not reduce interest rates on deposits further.

However, you shouldn’t ignore investing in FDs due to lowering interest rates. FDs play an important role in realising your short-term goals and while saving for your emergency corpus. It gives you assured returns and is considered to be safest investment avenue. It offers flexible tenures and liquidity in your portfolio to withdraw in case of uncertainty.

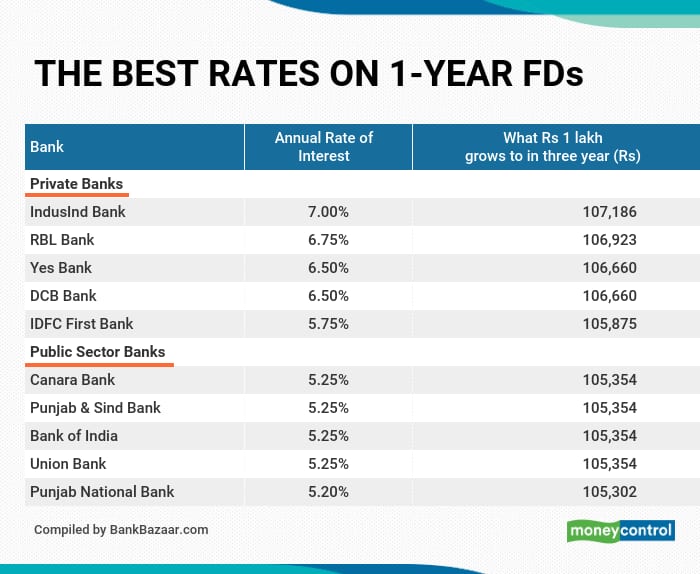

Despite falling interest rates, you can invest certain percentage of your portfolio in FDs offering higher returns on one-year FDs from the table given. The smaller private banks tend to top the rate chart on fixed deposits, given the competition they face in garnering deposits. You should do a thorough risk assessment and due diligence of the bank before investing.

Higher rates offered by smaller private banks

Smaller private banks offer interest rates of up to 7 percent on one-year FDs, according to data compiled by BankBazaar. For instance, IndusInd Bank tops the chart and offers 7 percent interest on one-year FD, followed by RBL Bank which is offering 6.75 percent interest on one-year FD. These interest rates are higher compared to those offered by public sector banks.

Leading private banks such as ICICI Bank and HDFC Bank offers 4.90 percent interest on one-year FDs. Axis Bank offer 5.15 percent interest. Kotak Mahindra Bank offers 4.60 percent interest on one-year FD, which is the lowest rate among all private banks.

Public sector banks such as Union Bank, Bank of India, Punjab & Sind Bank and Canara Bank offers 5.25 percent interest on one-year FDs. Established banks such as State Bank of India (SBI) and Bank of Baroda (BOB) offers 4.90 percent interest, on their one-year FDs.

Investments in fixed deposits of up to Rs 5 lakh are guaranteed by the Deposit Insurance and Credit Guarantee Corporation (DICGC), a subsidiary of the RBI.

The minimum investment amount varies across banks. At private and public banks, the amount ranges from Rs 100 to Rs 10,000.

Also read: Amidst falling interest rates, should investors choose debt funds over fixed deposits?

A note about the table

The data on FDs is as on December 16, 2020, as given in the respective banks’ websites. Interest rates of all listed (BSE) private banks and foreign banks considered for data compilation. Banks for which verifiable data is not available are not considered. The minimum investment amount may vary depending on the type of the term deposit account. For all FDs, quarterly compounding is assumed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.