How to Open a Business Bank Account With EIN Only - 2024 Guide

Learn how to open a business bank account with EIN only. Avoid unnecessary documentation. Simplify the process with our step-by-step guide.

March 11, 2024 / 14:12 IST

If you're a business owner struggling to open a bank account due to complex paperwork and administrative hurdles, there's no need to worry. You can now easily establish a business bank account by simply providing your EIN.

The process of setting up your business banking can be made simpler and faster without any frustration or delays. This informative article will guide you on how to open a business bank account using only your EIN. By following these steps, you'll be able to focus on growing your business and avoid any complications related to banking procedures.>> Check Out Bluevine Plans >>How to Open Business Bank Account With EIN Only in 7 Easy Steps

Open a business bank account with EIN only (Employer Identification Number) as shown below. This process is usually done online and can be completed following the steps below.Step 1: Determine the Type of Bank Account You Need

To begin with, it’s important to decide on the most suitable EIN bank account for your business, considering its requirements and objectives. You may want to contemplate several alternatives:- Savings account: If you have surplus funds you don’t need to use frequently, opening an EIN bank account can be advantageous for your business as it can earn you interest on the money.

- Checking account: The most widely used EIN bank account for businesses lets you deposit and withdraw funds and make payments and purchases through checks or debit cards. It’s essential to have this type of account for managing business finances.

- Merchant services account: In case you intend to receive payments through credit or debit cards, it's necessary to have a merchant services account. This account enables you to accept card payments and transfer the received funds to your EIN bank account.

Step 2: Choose a Bank

After determining the type of account required, conduct thorough research and evaluate various EIN bank accounts to identify the one that provides services and features that meet your business requirements. Key factors to consider include charges, interest rates, internet banking options, and quality of customer service. To open a business bank account with EIN only, opting for FinTech and online business banks instead of conventional brick-and-mortar banks is recommended. These banks offer cost-effective services, making them a preferred choice for online business transactions. In addition, they have fewer regulations and red tape, resulting in a more convenient and expeditious account opening procedure. For startups, there’s also an EIN bank account and banks specifically tailored to their needs.An EIN bank account is available for a business, tailored to meet specific requirements. This can include checking accounts, savings accounts, and credit union accounts. Businesses can opt for a business bank account with EIN that doesn’t incur monthly fees or require a minimum balance. If you want to start an open business bank account with EIN only without fees, you may refer to Bluevine and Novo. >> Check Out Bluevine >>Step 3: Gather the Required Documents

To initiate a business bank account with EIN, it’s necessary to furnish specific documents for validating your identity and business details, which usually comprise - Business license or permit

- Articles of incorporation, an LLC operating agreement, or a partnership agreement are examples of the business registration paperwork

- Owners of the company must provide photo identification, which can be a driver's license or passport

- Employer Identification Number of your business

Before you open a business bank account with EIN only, gathering all the documents is essential. One of these documents is the EIN, a distinct business identification number. Like a social security number, it has nine digits and is given by the IRS. Your EIN is essential for submitting your yearly business taxes and can be found on the IRS website. Additionally, other documents may be required depending on the type of business.- Partnership: In case your enterprise falls under the General Partnership (GP) or Limited Partnership (LP) category, you’ll likely have to submit a partnership agreement while opening an open business bank account with EIN only. This agreement contains crucial details about the partnership, such as all partners' names, ownership interests and profits shares, and information regarding the management structure. All partners must sign the partnership agreement. Some states may require Limited Liability Partnerships (LLPs) to register their partnership agreement with the Secretary of State. It’s crucial to ensure that all your documentation is accurate and up-to-date before opening a business account with EIN only to ensure that everything runs smoothly.

- Sole Proprietorship: If you’re conducting business under a name other than your legal name, you must file an official certificate with your local or state government. This certificate is a DBA (Doing Business As), Assumed Name, or Fictitious Name certificate. Sole proprietorships use the business owner's name as their legal name, while other business entities provide their legal name on formation documents.

- Corporation: If you own a Corporation and want an open business bank account with EIN only, it may be necessary to furnish your Certificate or Articles of Incorporation. This official document confirms the existence of your corporation and provides crucial information such as your address, purpose, business name, and the names of your directors and officers. Certain banks may also ask for your company's bylaws. These bylaws can guide your business, specifying the duties and functions of each officer, procedures for resolving conflicts of interest, and other significant details essential for your corporation's smooth operation.

- Limited Liability Company (LLC): If you want an open business bank account with EIN only for your Limited Liability Company (LLC), you'll likely have to provide additional documentation beyond the standard requirements. For instance, you may need proof of your LLC's registration with the state, such as Articles of Incorporation.

Some banks may require an Operating Agreement or Corporate Resolution which delineates your company's financial and operational decisions. Although banks can usually retrieve these documents from your state's Secretary of State website, keeping them on hand in case they're unavailable is advisable.These papers contain crucial details about your LLC, such as its purpose, stock offerings, and information about directors and officers. >> Use Bluevine >>Step 4: Open Bank Account With EIN Online

After selecting a bank and collecting all the necessary paperwork, you can submit your application electronically by accessing the bank's website and clicking the "open an account" option.Follow the instructions to complete the application form online, providing precise and current details about your company.Step 5: Verify Your Identity

Upon submission of your application, you may be required to authenticate your identity to safeguard against fraudulent activities and secure your EIN bank account. This process may entail providing supplementary paperwork or responding to security inquiries to confirm your identity.Step 6: Wait for Approval

After completing your application and confirming your identity, the bank will assess your submission, which may take several days, depending on the bank's policies and procedures. If there are any uncertainties or inquiries regarding your EIN bank account application, the bank may contact you for additional details.Step 7: Fund Your Open Business Bank Account With EIN Only

After your EIN bank account gets the approval, you’ll be provided guidance on financing it. This usually involves depositing money or transferring funds from another account. It’s important to follow the bank's instructions thoroughly to ensure the successful funding of your account. Well done on successfully establishing an open business bank account with EIN only!>> Visit Bluevine >>Reasons to Open a Business Bank Account

Having an open business bank account with EIN only protects your SSN from being needlessly disclosed. The advantages of obtaining an EIN and starting a business bank account comprise various benefits, including the following, although not limited to them.Protect Your Assets and Finances

The EIN is a unique number that identifies your business as a separate entity. This number is necessary to open a separate bank account for your EIN account, which is distinct from your personal bank account. You can also protect yourself from business debt by registering your business as an LLC or corporation.Maintaining a clear distinction between your finances and business dealings is important to prevent creditors from accessing your personal assets in case your company cannot pay its debts. Using a business account with EIN only for your company's finances can simplify bookkeeping and protect you from potential business liabilities.To minimize the threat of identity theft, it’s recommended to use an EIN instead of disclosing your social security number. While there’s still potential for theft of the EIN, instances of SSN theft are more prevalent.>> Check Out Bluevine Plans >>Simplify Tax Preparation and Accounting Tasks

Having a separate open business account with EIN only for your business can simplify tax preparation by consolidating all business-related income and expenses in one place. By employing tax preparation software, you can connect to your bank account data and automate several processes to avoid errors and maintain an accurate tax record. If you mix personal and business finances, it's more likely to make tax errors that could lead to IRS issues.If you handle your bookkeeping or plan to hire a tax preparer, having an open business account with EIN can only simplify the tax preparation process and save time. By having a separate account for your business transactions, you can avoid the hassle of sorting through personal and business expenses when it's time to organize your finances.It’s important to keep personal and business finances separate using an EIN bank account to use such programs' benefits fully.Additional Perks of Use of EIN to Open Bank Account

An open business bank account with EIN only offers several advantages not found in personal bank accounts. These perks comprise promotions such as cash incentives and attractive interest rates for savings and checking accounts, along with the opportunity to apply for business loans. Benefit From Tax Deductions

Any expenses arising from pursuing a hobby are liable for business taxation. Still, you can get tax deductions if you prove to the IRS that your hobby is more than a personal interest. The simplest method to show this is by seeking an EIN and establishing an open business bank account with EIN only. It’s crucial to maintain all financial documentation.>> Try Out Bluevine >>Enhance Your Professional Image

If you use invoices and wire transfers to transact money with your customers, having an open business account with EIN only can improve your professional image. Avoiding personal accounts is crucial as it may seem unprofessional and give your operations an illegitimate vibe, which could make your clients feel insecure about the use of an EIN bank account.Customers who receive invoices or wire transfers from an EIN bank account bearing your business name will consider your venture established and reputable. This branding indicates that you are serious about your business and have taken steps to maintain high professionalism rather than just treating it as a hobby.Build Business Credit

Maintaining an open business account with EIN only ensures that all financial transactions are recorded accurately, including customer income, expenses, taxes, and other relevant information. These records can be useful when applying for a business loan, as lenders can assess your eligibility and repayment ability by analyzing your banking data. Before granting a loan, it’s common for lenders to request to see your cash flow statements in your EIN bank account. If your statement contains personal expenses, it may not benefit your business and may decrease the likelihood of loan approval.A business line of credit can be useful when looking to grow your business or gain additional assets. Maintaining an open business bank account with EIN can also help establish credibility with potential lenders. Also, a strong credit history can increase the likelihood of securing favorable interest rates via your EIN bank account.Qualify for a Business Credit Card

Separating your business finances can simplify obtaining a business credit card, but obtaining a business bank account with EIN will still be necessary to apply for one. Customers with a business bank account with EIN may pay for goods or services with debit and credit cards. In contrast, those with only a personal bank account may be restricted to cash or check payments.>> Consider Bluevine >>Why Open a Business Bank Account With EIN Only?

Getting an EIN can provide your business with additional choices for banking services. By having an EIN, your business will access a wider range of benefits financial institutions offer. It’ll be easier for your business to meet the requirements for various options from credit unions, online, or physical banks with an open business account with EIN only. If you don’t possess an EIN, you’ll be required to provide an equivalent alternative: your social security number. Although this may appear acceptable, it could expose your SSN unnecessarily to other organizations, including the IRS.With an EIN, your firm may take on a personality of its own. You may do this to separate your personal funds and affairs from your business's. You shouldn’t be concerned that your personal assets will be taken if your company has legal issues.Opting for an open business bank account with EIN only simplifies establishing business credit. This can be advantageous when applying for loans through credit unions since they’ll only consider your business's trustworthiness in repaying debts. Even if your personal credit rating is low, it’ll not interfere with your business-related matters.>> Visit Bluevine >>Why Do You Need an EIN to Open a Business Bank Account?

The application process requires the inclusion of your EIN as a key element. The Employer Identification Number is a distinct identification code for your business, used by the IRS to recognize your business for tax-related matters. This number is particularly used when submitting your business's income tax returns.By obtaining an EIN, your business gains legitimacy and establishes its identity. It shows to financial institutions that your business is eligible for opening an open business account.Sometimes, having a business account with EIN may not be necessary. For instance, you aren't legally obliged to get an EIN if you have a sole proprietorship or a single-member LLC without employees.In case of uncertainty, refer to the IRS website to determine whether an EIN is required.It's important to remember that some financial institutions may ask for an EIN, even if you operate as a sole proprietorship or single-member LLC. Therefore, it's recommended that you confirm directly with the bank you plan to work with.Can I Open a Business Bank Account Without an EIN?

Before creating an open business bank account with EIN, most banks will require you to provide your business's identity and nature of business, which an EIN can prove. The policies of different financial institutions vary, and some may mandate that companies have an open business account with EIN only. To open a business checking or savings account with Wells Fargo, for instance, an EIN for your business and the SSN of individuals opening the account are mandatory.In contrast to an open business account with EIN, It’s possible to open a business bank account without an EIN sometimes, depending on the bank's policies. For example, sole proprietors may only need to provide their social security number. Lili Bank allows those operating under a DBA name or a single-member LLC to open an account without an EIN, and later add their business name by submitting documents such as tax returns or business licenses.>> Use Bluevine >>What Are the Best Business Banks to Open an Account With Only an EIN?

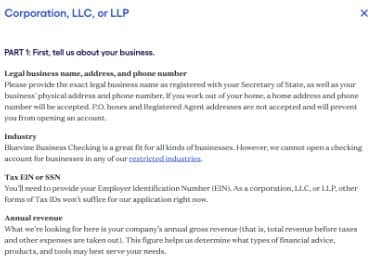

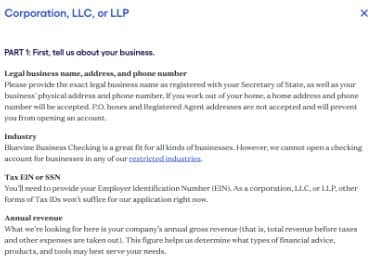

If you want to open a business bank account with EIN only, various choices are available. - Bluevine: Bluevine is a virtual business banking platform that presents a range of monetary solutions, such as business loans, credit lines, and checking accounts. To create an open business account with EIN only on Bluevine, you must submit your business's formation documents, a government-issued ID, and EIN. Bluevine's checking account doesn’t require any minimum balance or monthly fees and has unrestricted transactions. The platform also offers compatibility with well-known accounting software, mobile banking, and an easy-to-use interface.

- Novo: Novo is an online platform for business banking that provides business checking accounts with no undisclosed charges, minimum balance prerequisite, and unrestricted transactions. To start an open business account with EIN only with Novo, it’s mandatory to furnish your EIN, a government-issued identification card, and certain other business documents. Novo's checking account is compatible with leading accounting software, and it facilitates mobile banking and customer support through email and chat.

- Axos: Axos Bank is a financial institution that operates online, providing various financial services, such as business checking accounts. To open a business account with EIN with Axos, one must provide their EIN, government-authorized identification, and company formation documents. Axos's business checking account has no monthly charges, no mandatory balance requirements, and unrestricted transactions. The platform provides mobile banking, connectivity with bookkeeping software, and customer help through phone and chat.

In general, if business owners want to open a business bank account with EIN only, they can consider Bluevine, Novo, and Axos. Each platform offers distinct advantages and features, hence it’s crucial to conduct extensive research and select the one that aligns with the requirements of their business.>> Start Using Bluevine >>How to Open a Business Bank Account With EIN Only – Frequently Asked Questions

What Is an EIN?

An EIN, or Employer Identification Number, is a unique business tax ID number issued by the IRS that's necessary to file your company's income tax return and ensure that your business is correctly taxed. Suppose your business operates as a multi-member LLC, partnership, or corporation. In that case, an EIN is legally required, and certain business types or trades may also necessitate an open business account with EIN only. Hiring employees or contractors mandates getting an EIN. However, single-member LLCs and sole proprietors are exempt from needing an EIN if they have no employees. Possessing an EIN isn’t limited to IRS purposes, as it can offer advantages to small business owners. Apart from simplifying the process of an open business account with EIN only, an EIN can accelerate the business loan application process, reduce the risk of identity theft, establish business credit, and provide other benefits.How Do I Obtain an EIN for My Business?

To obtain an EIN, one can go to the IRS website and must keep their social security number or taxpayer identification number ready. It’s important to note that EINs don’t have an expiry date, and one must keep track of all previously obtained EINs. Gathering all required information beforehand is recommended, as the application session times out after 15 minutes of inactivity.Why Does the Bank Need My EIN to Open a Business Account?

Financial and banking organizations must comply with state and federal banking laws. Because of this, even Internet banking providers will want to confirm your legitimacy before offering to assist you in managing your company's funds. An EIN shows the legitimacy of your business transactions and your company's name.Bottom Line on How to Open a Business Bank Account With EIN Only

To ensure efficient bookkeeping and compliance with tax laws, it’s strongly advised to set up a corporate account using an Employer Identification Number (EIN) exclusively. By utilizing the business's identification for establishing a business account with EIN, it guarantees the separation of financial dealings.This practice enables the maintenance of a precise audit trail for the IRS, establishes credit for the business, and increases eligibility for loans that can contribute to its growth.>> Consider Bluevine >>Related Articles

Moneycontrol Journalists were not involved in the creation of the article. Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!