For entrepreneurs running small businesses, having a checking account that supports instead of obstructs their daily operations is crucial. The Bluevine Business Checking account may provide some relief for these individuals.

Launched in 2013, the online business banking platform offers a corporate bank account with unlimited transactions, minimal fees, and various other beneficial features. In this assessment, we thoroughly assess what Bluevine Business Checking brings to the table for business owners and how it measures up against its competitors. This way, you can determine whether it's the optimal choice for your needs.

>> Try Bluevine >>

There are minimal costs and many features with Bluevine Business Checking. It has a business checking account that offers such a competitive rate implies more money for small firms, mainly if you maintain higher balances. Many company checking accounts either don't pay interest or interest at a meager rate.

Bluevine Business checking isn’t the best option for company owners that like in-person banking services since it lacks branches. You may never have to enter a bank again since it provides many options for managing your money via ATMs, cash transactions, and smartphone access. The Green Dot cash deposit charge can put off businesses that often make cash deposits.

Bluevine Business Checking only provides one business checking account, so you could need accounts at several institutions to meet your financial requirements. Having your bank accounts in one place is easier, and having different accounts may have relational advantages. Yet, Bluevine Business Checking could be worth the trouble given its benefits and absence of costs.

Pros

● Using cash deposits

● Endless transactions

● An extensive ATM network

● Minimal additional expenses and no monthly charge

● Obtains a favorable interest rate

● Rights to write checks as well as two free checkbooks

Cons

● Deposit of cash fee

● Unpopular mobile banking application

● Having no savings

● No actual branches

● Only weekdays are accessible for customer assistance

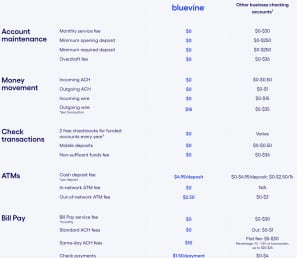

| Bluevine | Features |

| Monthly Fee | $0 |

| Minimum Deposit | $0 |

| Overdraft Fees | $0 |

| APY | 2 to 4.25% |

| Transactions | Unlimited |

| Account Types | Business checking and business loans |

| Cash Deposits | $4.95 |

| ATM Fees | $0 in-network, $2.50 out of network |

| Outgoing Wires | $15 |

Online business checking accounts typically provide no fees and limitless transactions. Still, Bluevine business checking review raises the bar with its free, high-yield business bank account.

One of the most excellent rates offered by a business checking account is the Bluevine business checking review account, which pays 2.00% interest on balances up to $100,000. Also, Bluevine account members may make cash deposits, although at a cost, in contrast to the bulk of online-only accounts.

A financial technology firm called Bluevine was founded in 2013, and in 2019 it started providing corporate checks. Coastal Community Bank offers banking services, and all accounts are covered up to $250,000 by the Deposit Protection Corp.

Bluevine Business Checking can be an excellent choice for businesses that want to keep costs low, make as many transactions as they need to without worrying about fees, and earn interest on their new capital.

As long as your business can quickly deposit cash, and you aren't too concerned about access to in-person banking services, the Bluevine Business Checking is worthy of a spot on your shortlist.

The ideal small company owners for Bluevine business checks are those who:

● Like to do much of their financial management online

● You want a cost-free company checking account with interest

● Have no need for a physical branch

● Only one business debit card is required

>>Consider Bluevine >>

Bank fees may be a headache, particularly as you work to manage and grow your company. By getting rid of several standard fees and minimums, Bluevine Business Checking benefits businesses by providing:

● No minimum down payment is necessary

● No ongoing monthly fees

● The checking account further offers unlimited, fee-free transactions each month

● No minimum balance is necessary

● No fines for insufficient funds

● More than 37,000 MoneyPass ATMs around the country have no ATM fees

Any ATM transaction outside of the MoneyPass ATM network, which collaborates with Bluevine to provide ATM services, will result in a $2.50 fee from Bluevine.

>> Try Bluevine >>

Bluevine only allows one account, yet it has an incredible array of features. An interest-bearing online business checking account offers a competitive 4.25% APY.

You must deposit $2,500 in monthly accounts receivable into your Bluevine Business Bank account via ACH, wire transfer, mobile check deposit, or straight from your merchant payment processing provider to receive the 2.00% APY.

You must also spend $500 monthly with your Bluevine Business Debit Mastercard.

With Bluevine Business Checking, paying suppliers is comparatively simple. As a small company owner, you can access several payment options, including ACH, wire transfer, and cheques. You may pay bills once or automate monthly payments via your account for added convenience.

You may prevent late payments by using regular payments, which let you know when the money will arrive at the recipient. Bluevine business checking review offers a list of 40,000 registered suppliers online, or you may add more as necessary. Using Bluevine's online payment system, credit card payments are also possible.

Bluevine is a platform for Internet banking. No branches are open for in-person assistance. Nonetheless, because of alliances with other financial networks, clients have access to various transaction choices.

Two checkbooks and a Bluevine Business Debit Mastercard are included with the Bluevine Business Checking. Via a relationship with the MoneyPass ATM network, Bluevine clients have access to more than 38,000 fee-free ATMs across the United States.

Small company owners may still deposit funds with Bluevine despite the absence of Bluevine branches thanks to a collaboration with Green Dot. At over 90,000 participating U.S. retail locations, you take cash deposits straight to the register to finish the purchase.

Be aware that each cash deposit at Green Dot is subject to a cost of up to $4.95. The daily restrictions set by Green Dot may also apply to cash deposits.

Bluevine isn’t a bank but a financial technology provider. Via a relationship with Coastal Community Bank, Member FDIC, Bluevine offers banking services. For all Bluevine Business Checking accounts, Coastal Community Bank offers FDIC protection up to the permitted limits.

Customers that use Bluevine checking have access to Bluevine's mobile app, which enables them to conduct daily transactions and make mobile check deposits as required. The app allows small company owners to monitor their accounts and cash flow from anywhere.

You may use a company credit line for up to $250,000 in addition to your bank account to make such giant expenditures. Interest rates are as low as 4.8% here, and approval might happen quickly.

You must have a FICO score of at least 600, $10,000 in monthly revenue, and at least six months of experience running a company incorporated or functioning in a U.S. state. Bluevine will decide on your loan after asking you more questions and reviewing recent bank statements. If you're considering obtaining a negative credit business loan, consider the finest alternatives.

>> Consider Bluevine >>

Online or using the Bluevine business checking app, you may create a Bluevine business account. Owners of businesses may use Bluevine business checking in all 50 states and the District of Columbia.

You must be at least 18 years old, a citizen of the United States, or a resident with a legal residence inside the country to be eligible (not a P.O. Box). Some business categories are prohibited.

To establish a Bluevine business account, you must supply some basic information about yourself and your company. Applicants may also be required to provide certain documents, depending on the sort of business company.

● Personal information: Date of birth, first and last names, residential address, cell phone number, and social security number. Each person who controls 25% more than the firm is expected to provide this information.

● Business information: Name of the company, kind of corporation, physical location, and phone number. You must also provide your yearly income, industry, and EIN or tax ID.

● Required documentation: Depending on the sort of company, these might include documents like articles of incorporation, certificates of formation, Doing Business As (DBA) paperwork, or partnership agreements.

Application reviews for Bluevine business checks usually take three business days. After being accepted, you may activate your account, purchase a Bluevine debit card, and fund it.

If you achieve one of the two monthly criteria, you may earn 2.00% APY on balances up to and including $100,000 with Bluevine business checking accounts. Use your Bluevine business debit card to make a $500 purchase.

>> Try Bluevine >>

Users of Bluevine Business Checking Accounts have a few choices for deposits and withdrawals.

Customers may make deposits in the Bluevine Business Checking account using four major methods:

● Check deposit: Customers may deposit checks via the Bluevine mobile app.

● Wire transfer: Bluevine will not charge a fee for incoming wires. However, the sending institution almost certainly will.

● Account transfer: Bluevine Business Checking Account users can move funds out of their external bank accounts and into their Bluevine bank account.

● Cash: Any retail establishment within the Green Dot network will accept cash deposits for the Bluevine Business Checking account. But, it's crucial to remember that each deposit has a fee.

>> Start Using Bluevine >>

In addition to the standard methods of withdrawing funds from a checking account, such as writing checks and wire transfers.

Owners of Bluevine Business Checking accounts also receive a business debit card that can be used to make fee-free cash withdrawals from any of the more than 38,000 MoneyPass ATMs (a sizable, nationwide network of ATMs) located all across the United States.

Customers can anticipate paying a fee for ATM withdrawals outside their network. Also, a function called Bluevine Payments makes sending money directly to other people possible.

There aren't any open disputes with Bluevine. A+ is the rating given to Bluevine by the Better Business Bureau. A firm with a high BBB rating will have truthful advertising, excellent customer complaint handling, and openness about business procedures.

Yet, a stellar BBB rating does not ensure that your interactions with a firm will be positive. You could still be interested in learning more about Bluevine through friends and relatives or by reading online consumer reviews.

Bluevine's primary rival Novo is comparable because it solely provides checking accounts for business use. There are extremely few costs for utilizing any service component and none for signing up.

Unlike Bluevine, you'll be charged a $27 fee if you overdraw your account. But, you are not obliged to maintain a minimum monthly amount, and the bank reimburses ATM costs wherever they are used.

The Novo mobile app makes banking on the move simple. Both Android and iOS smartphones support the software download. The lack of the ability to put any actual money into your account makes Novo fall short when it comes to cash.

Pros

● No minimum amount or monthly fees are necessary

● Mobile application

● Gives back all ATM fees

Cons

● Cash cannot be deposited

● Charge for overdrafts

● Lack of savings accounts

>>Try Novo >>

With a free tax optimizer to avoid overpaying for underpaying, Lili increases the stakes. Because there are no unpleasant shocks when tax season rolls around, you may automatically put away money. The program also helps categorize business and personal costs so you understand what to deduct.

The bulk of Lili's products are free to use, and no charge or minimum amount is needed to join up. Nevertheless, certain financial restrictions on withdrawals and deposits may not be suitable for bigger enterprises. Wire transfers cannot be carried out via Lili either.

Lili enables you to construct an account to save money for a large purchase. Choose Lili Pro if you want to earn 1% interest or have access to extra services like overdraft protection. The $4.99 monthly fee for this service should cover its expenses only in interest.

Pros

● Tax optimization

● No monthly fees or minimum balance

● May save cash in jars for potential use later

Cons

● The free account has no APY

● Zero wire transfers

>> Consider Lili >>

Beside offering corporate checking accounts, Axos also provides personal and business savings accounts. There are no minimum balance requirements and no sign-up or maintenance fees for its basic business account. Wherever you go, this account will repay you for any ATM costs you pay.

While interest rates are fairly modest at 0.20%, business owners may also participate in a savings account. The minimum starting deposit for the premium savings account is $25,000. Nonetheless, the APY remains the same.

In actuality, Axos' rates aren't all that terrific. Moreover, CD rates are 0.20%, which doesn't provide many incentives to purchase a certificate. Axos even offers the option to open personal checking and savings accounts.

Pros

● Several possibilities for checking accounts

● Unlimited refunds for domestic ATM fees

● Basic checking has no minimum balance requirement

Cons

● Poor CD interest rates

● Accounts with low APY for business savings

● Certain accounts need substantial deposits

>> Use Axos >>

These questions concerning Bluevine Business Checking review are commonly asked. After reading this review, go through these to discover the answers to any remaining questions.

Yes, to answer briefly. A financial technology firm called Bluevine. The bank with a Utah state license and FDIC membership, Celtic Bank, issued the Bluevine line of credit. Bluevine also provides a checking account for small businesses. According to the startup tracking website Crunchbase, the private business has received $769.2 million in investment.

The total daily cap for cash withdrawals from ATMs, cash back at points of sale, and over-the-counter transactions is $2,000. ATM Owner-Operators, businesses, and partner institutions may set cash withdrawal fees and limitations. Surcharge-free cash withdrawals are available at MoneyPass ATMs.

Yes, The Bancorp Bank provides FDIC insurance for Bluevine (FDIC certificate No. 35444). Your money is safeguarded in the case of a bank collapse with up to $250,000 per depositor, for each account ownership type, when you deposit money into a Bluevine FDIC-insured account.

The Bluevine Business Checking account is a popular choice among small businesses due to its affordable fees and the opportunity to earn interest on balances up to $100,000. This account stands out as one of our recommended business checking accounts that offer interest on your balance.

Moneycontrol Journalists were not involved in the creation of the article.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!