When India’s largest insurance company sponsors a mutual fund house that is India’s 24th largest in terms of assets under management, there is a problem. But TS Ramakrishnan, Chief Executive Officer and Managing Director of LIC Mutual Fund, who has just completed a year at the fund house, has a plan to resuscitate it from the insignificant existence it has had for a long.

Ramakrishnan believes that like the sponsor, the fund house should logically be among the top asset management companies in the country.

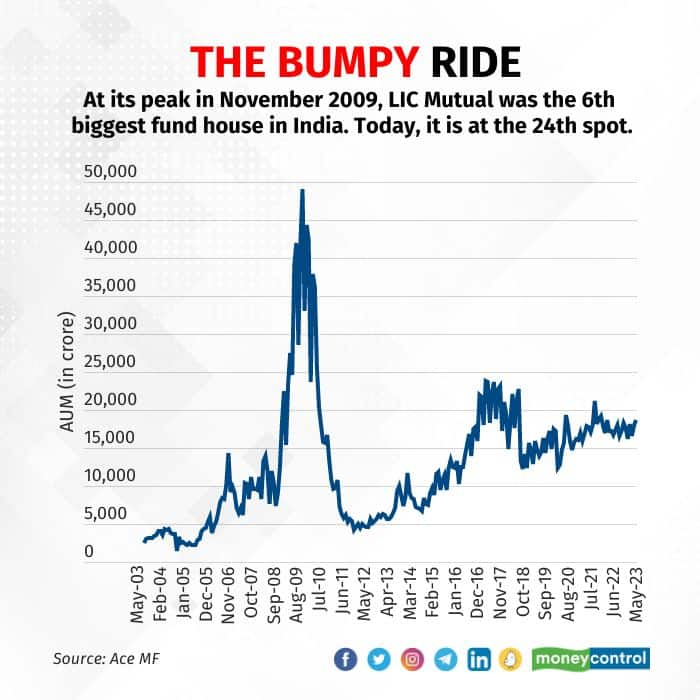

Launched in 1989, the fund house was the sixth biggest AMC in November 2009 with assets of around Rs 50,000 crore. However, it had assets worth just Rs 18,719 crore at the end of May 2023.

In an interview with Moneycontrol, Ramakrishnan, who took over one of the oldest asset management companies (AMC) in India in March 2022, shared what has weighed on the fund house and listed the roadmap for the next five years.

Also read | How much health insurance should a fresher get?

Ramakrishnan says the AMC hopes to become more aggressive in fund launches, get consistent in its performance, explore the inorganic route and shift focus to equity to rise up the asset ladder.

Pivot to equity

Historically, the fund house has tilted towards debt mutual funds. Much of the Rs 50,000 crore mentioned above was in its liquid fund, which used to come and go from big corporates, including LIC.

Further, schemes such as assured return and monthly income were in demand at the fund house many years ago. But over the years, the capital market regulator Securities and Exchange Board of India has prohibited mutual funds from offering such schemes, which has weighed on the company.

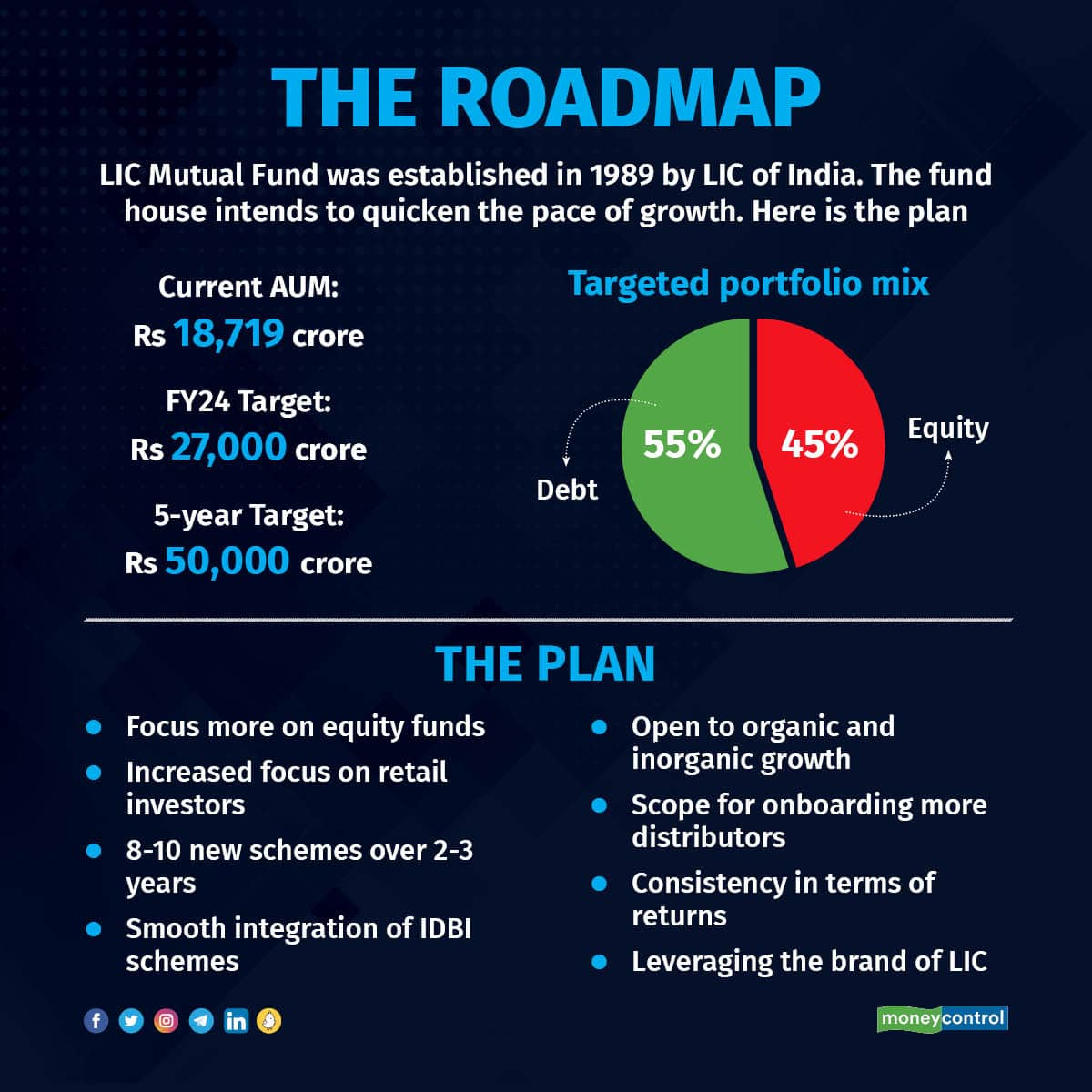

“We had a strategic plan last year wherein we had planned to take our assets, at least, to say the Rs 40,000-50,000 crore league in the next five years and we are slowly progressing in that direction. For the current year, we have kept a target of Rs 27,000 crore average AUM by the end of March,” said Ramakrishnan.

Since the last three years, the fund house has started focussing on equity. While, the assets have remained stagnant at around Rs 18,000 crore, the equity portion has gone up from 21 percent to 42 percent within this period.

“We are looking forward to taking equity to 45 percent by March,” the head of the fund house said.

Aggressive stance

LIC Mutual Fund over the last three years has launched just three schemes out of which two had been in equity. LIC MF Balanced Advantage Fund was launched in November 2021 and it had mopped up Rs 1,100 crore via a New Fund Offer. On the other hand, the multi-cap fund, launched last October, got around Rs 500 crore.

Also read | Is it a good time to invest in RBI Floating Rate Savings Bonds?

As per Ramakrishnan, there are gaps in their scheme portfolio such as dividend yield, which they will look to fill.

The fund house looks to get aggressive with its fund launches and plans to bring out 8-10 schemes over the next two-three years.

For a greater equity push, the fund house intends to focus on retail investors. Right now, around 46 percent of the AUM is from the direct investing route, but this includes corporates and investments in liquid funds, which is again from corporates.

In terms of equity, the share of direct investment stands at around 17 percent at the fund house, which it intends to raise, going ahead.

The IDBI boost

LIC Mutual Fund is in the process of acquiring IDBI Mutual Fund, and as per Ramakrishnan, the acquisition will be completed within the next two-three months.

The immediate impact of the merger will be a boost of around Rs 4,000 crore in terms of assets to LIC MF, while certain gaps in the scheme profile such as mid-cap and small-cap, and the gold fund, will get filled.

In total, LIC MF will be onboarding 10 new schemes from IDBI Mutual Fund.

“Over the last year, we wanted to launch some of these schemes. But since this discussion with IDBI was going on, it made no sense for us to launch such schemes. We are not in the commodity segment right now, so that is an advantage for us,” said Ramakrishnan.

Also read | Has the time come for credit risk funds again? Yes, says R Sivakumar of Axis MF

The LIC MF head admitted that scaling is becoming increasingly difficult for smaller fund houses in terms of organic growth.

“We are always open to both organic and inorganic growth. So IDBI MF, for example, it's inorganic. So, if an opportunity comes in the future, we are open for that. Once we have inorganic growth, possibly the organic growth will also become a little easier,” he said.

Leveraging the LIC brand

The fund house as of now has around 50,000 distributors, out of which the active distributor count is in the region of 8,000. As per Ramakrishnan, the active distributor number stood at around 4,000 three years back.

In terms of leveraging the LIC brand, the fund manager has around 5,000 distributors who are LIC agents. “There is a scope for onboarding more distributors, both from LIC family as well as from outside. Even within the LIC family, we are in the process of onboarding more and more agents as distributors. At the same time, we are also very much open and happy to accept people who are outside LIC being our distributors,” Ramakrishnan said.

Bringing in consistency

As per data from Value Research, none of the LIC MF’s schemes has featured in the top quartile in terms of performance over the three-year and five-year period. Only the LIC MF Banking & Financial Services Fund has performed decently over the past one year.

Ramakrishnan acknowledged this to be an issue, saying, “A distributor who has a choice of marketing, say 40-42 mutual funds, always has the habit of marketing four or five mutual funds where he sees consistency in performance… At the same time, we understand that our equity schemes can perform better.”

The head of LIC MF shared that some of the schemes, such as flexi-cap, BFSI and balanced advantage fund, have started performing well in the recent past.

Also read | 12 fresh midcap stocks that PMS fund managers picked in May. Do you own any?

“A little more consistency is required in that area, and once the schemes start performing, the people will start noticing the change. Automatically, then distributors will start marketing our scheme, because they would also like to market our schemes because of the parent’s name, LIC, getting attached.”

One thing that has worked for the fund house is that it came out unscathed through the credit crisis post the Infrastructure & Leasing Finance Co Ltd debacle. Its fixed income team has been consistent in terms of the high quality of securities in its portfolios.

Going ahead, the fund house is also looking to add to the fund manager count to shore up performance. From five fund managers in the last couple of years, the count has increased to nine. Further, along with new fund managers from the IDBI MF, LIC MF plans to add two-three managers.

“Compared to what the situation was two-three years back, a lot of distributors have enrolled with us and are marketing our schemes. It has not turned into a wave, but two years down the line, you will be able to see that,” said Ramakrishnan.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.