Mounting credit card debt is a burden, especially with its high finance charges. Uncleared credit card debt not only accrues interest but also makes your fresh transactions ineligible for the interest-free period. The situation could be even worse if you are trying to juggle multiple credit card debts. In such cases, a credit card balance transfer can help you consolidate multiple credit card debts and save on the overall interest cost.

Through the balance transfer facility, you can transfer the outstanding balance from one card to another. Balance transfers also carry interest but it will be much lower than credit card finance charges. You may also be able to avail low or no interest balance transfers as an introductory offer for 3 to 12 months, depending on the bank. If the credit limit allows, you can also transfer balances from multiple cards into a single credit card to consolidate your debt and make repayments easier.

How does a balance transfer help your finances?

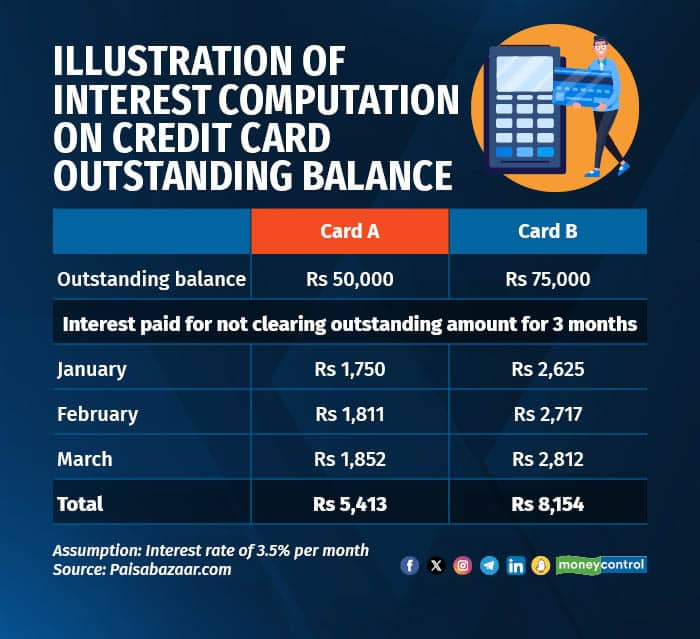

On transferring your balance to a different credit card, though your total overdue remains the same, it will just be easier for you to pay it off. Let us understand this with an example (see graphic).

However, if you transfer the balance from Card A and Card B to Card C and the interest rate of the balance transfer is 1.5 percent per month, you will have to pay an interest of Rs 1,875 per month approximately on your total outstanding of Card A and Card B.

If Card C offers a zero percent introductory offer for the first 3 months, you will not have to pay any interest.

Hence, balance transfers significantly bring down the overall interest outgo. Since the balance on your other cards will be cleared, new transactions will no longer accrue interest from the first day, again reducing the overall burden. However, it is advised not to put too many spends on the other cards until you get better control over debt repayment.

An important point to note here is that interest is not the only cost associated with balance transfers. A one-time balance transfer fee will also be applicable which may range between 3 percent and 5 percent of the amount you transfer. In the above example, if a 3 percent transfer fee is charged, the user would have to pay Rs 3,750 (i.e. 3 percent on the outstanding balance of card A and card B). Though it is a one-time charge, it can be an important consideration when you have multiple cards to choose from for balance transfer.

You can transfer your overdue balance from one credit card to an existing credit card or apply for a new card to avail the facility. When transferring into an existing card, the credit limit available on the card should be sufficient to transfer the balance.

Also read | Why are banks charging 1% fee on utility payments using credit cards?

Should you opt for a balance transfer?

A credit card balance transfer should help ease your financial burden and save on interest and other penalties. You should check the finance charges on cards with pending dues and compare it with the interest rates offered on the balance transfer options that you are considering. Check the balance transfer fee, interest rates and the associated terms and conditions.

If you opt for a low or no interest introductory offer, you must consider the duration for which such an offer is valid and the interest rate applicable after the promotional period ends. For example, SBI Card offers zero percent interest if you can clear the balance within 60 days and 1.7 percent per month interest if you choose a 180-day period. With the latter, you also get a zero processing fee benefit.

You will save a significant amount if you choose the zero percent interest offer. However, the EMI amount will be higher for a lower tenure, which could again be difficult to manage, thus defeating the very purpose of a balance transfer. Hence, you should choose a tenure that suits your financial situation and allows comfortable repayments.

Also read | New credit card allows you to spend on Mastercard, UPI-linked Rupay. A Moneycontrol review

Seamless process

The process to avail balance transfer has also become seamless nowadays. You can initiate a balance transfer through internet banking or mobile app of the issuer. If you are applying for a new credit card to transfer the balance, the new application might lead to a temporary drop in your credit score.

Transferring debt from one credit card to another should be a part of your overall debt management strategy. Frequently opting for balance transfers just to avoid interest costs could ultimately make your finances more complicated. Hence, understand your requirements, calculate potential savings and opt for a balance transfer only if it aligns with your financial situation and helps manage your debt more effectively.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!