If you are dissatisfied with the service provided by a bank or by other RBI-regulated entities, such as non-banking finance companies, payment system participants (those facilitating payments via NEFT, RTGS, UPI etc.) or credit information companies, help is at hand.

Thanks to the RBI’s Internal Ombudsman for Regulated Entities guidelines and its Integrated Ombudsman Scheme, customers have recourse at more than one level.

In November 2021 the central introduced an Integrated Ombudsman Scheme consolidating the three RBI Ombudsman Schemes to ensure uniformity and simplicity for consumers. The regulator made a similar change just over a month ago, on December 29, by updating and integrating the Internal Ombudsman Schemes for regulated entities into one integrated scheme.

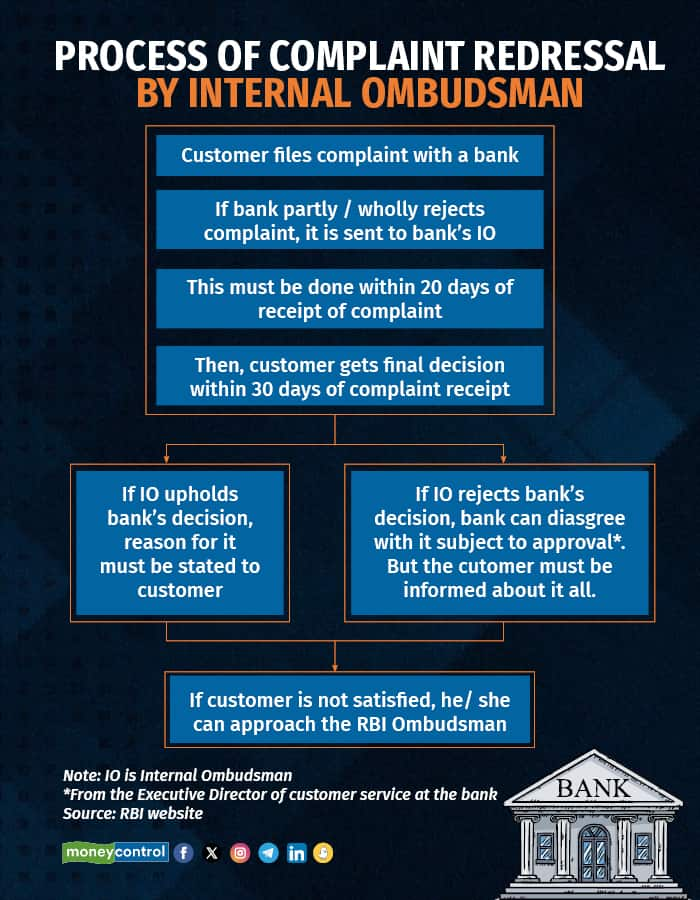

An Internal Ombudsman (IO) is appointed by each regulated entity and functions as the first level of redress for a grievance before a consumer can approach the RBI Ombudsman.

The latest data from the RBI shows that approximately 3 lakh complaints were received by the RBI Ombudsman in financial year 2021-22. Of these, complaints against banks accounted for the bulk—88 percent of the total—followed by another 11 percent against NBFCs.

The overall rate of disposal of complaints stood at close to 98 percent for FY 2021-22.

Also read: Banks to pay Rs 5,000 a day for delay in returning property documents: RBIWhere to beginTo begin with, you must approach the entity concerned, say, a bank. If your complaint gets partly / wholly rejected by the bank, it then gets automatically sent to the IO of the bank (see table).

A customer cannot make a direct complaint to an IO. Apart from that, certain kinds of complaints have been kept outside the purview of the IO (See table for examples).

Depending on the volume of complaints, a regulated entity may even appoint more than one IO and one or more deputy IOs. The RBI has laid out the rules for their appointment.

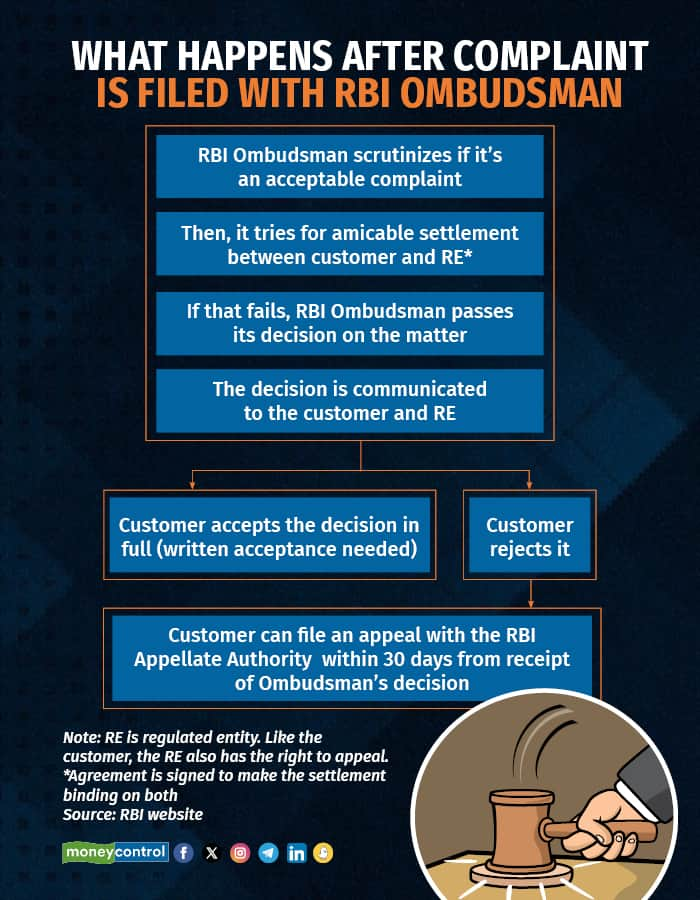

Also read: RBI panel suggests penalty for home loan providers on loss of borrowers' documentsWhat’s nextIf you are not satisfied with the decision of the IO, you can approach the RBI Ombudsman (a senior RBI official appointed for this purpose). A complaint can be filed for any deficiency in service by a regulated entity except for certain specified exclusions (see table for examples).

Note that you can reach out to the RBI Ombudsman only after you have already complained to the regulated entity (RE) in writing and one of the following has happened: the RE has not responded within 30 days of your lodging the complaint or it has rejected the complaint wholly/partly or you are not satisfied with its response/resolution.

To file an online complaint with the RBI Ombudsman, go to https://cms.rbi.org.in. Detailed instructions (videos) have been provided on how to go about the process. You can also send your complaint via email at crpc@rbi.org.in or in physical mode to the ‘Centralised Receipt and Processing Centre’ at the Reserve Bank of India, 4th Floor, Sector 17, Chandigarh - 160017 in the prescribed format.

Also see: RBI’s new ombudsman scheme: Here’s how you can file complaintsTable 4 shows how your complaint progresses once you have filed it with the RBI Ombudsman.

Remember that there is no charge or fee to be paid for filing a complaint with the RBI Ombudsman.

Bear in mind that only those complaints where the compensation sought for the loss suffered is Rs 20 lakh or lower (there is no limit on the amount of disputed transaction) are admissible with the RBI Ombudsman. In addition, the Ombudsman can also provide compensation up to Rs 1 lakh for mental agony, harassment etc.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.