G Pradeepkumar, Chief Executive Officer of Union Asset Management Company, is a veteran of the mutual fund industry who has seen the business grow over the last three decades.

Under his leadership, Union AMC, which was launched in December 2009, has seen assets more than double from Rs. 3,574 crore to Rs. 8,254 crore in March 2020.

It was set up in collaboration with KBC Asset Management NV, a Belgium-based AMC, and was initially known as Union KBC Mutual Fund. When the partnership ended in 2016, Union Bank of India purchased the fund house.

Subsequently in 2017, Japan’s Dai-ichi Life acquired a 39.2 percent stake in the company.

Before Union AMC, Pradeepkumar worked as chief marketing officer with IDFC Investment Advisors Ltd. He has also served as the Senior Vice President at UTI Asset Management Company Pvt. Ltd. and director and CEO at UTI International Ltd.

He has seen many market cycles in his time in the industry and knows that markets go up and down. In a conversation with Moneycontrol, he talks about where investors should invest if they have Rs 10 lakh to spare today. Edited excerpts:

The S&P BSE Sensex has been extremely volatile this year. We have seen three troughs and 3-4 peaks, with swings of nearly 10,000 points. Should we wait to put in more money or just invest now?

Investors in equity should certainly stay invested. Market volatility is inevitable, it’s impossible to time the market. In volatile markets, SIP (Systematic Investment Plan) and STP (Systematic Transfer Plan) make a lot of sense as far as spreading one's investment and reducing risk is concerned. Timing the market is extremely difficult. Also, it is interesting to note that while the broader market, as represented by Nifty50, has been slightly negative over the past one year, SIPs in many of the actively managed equity funds have given respectable returns.

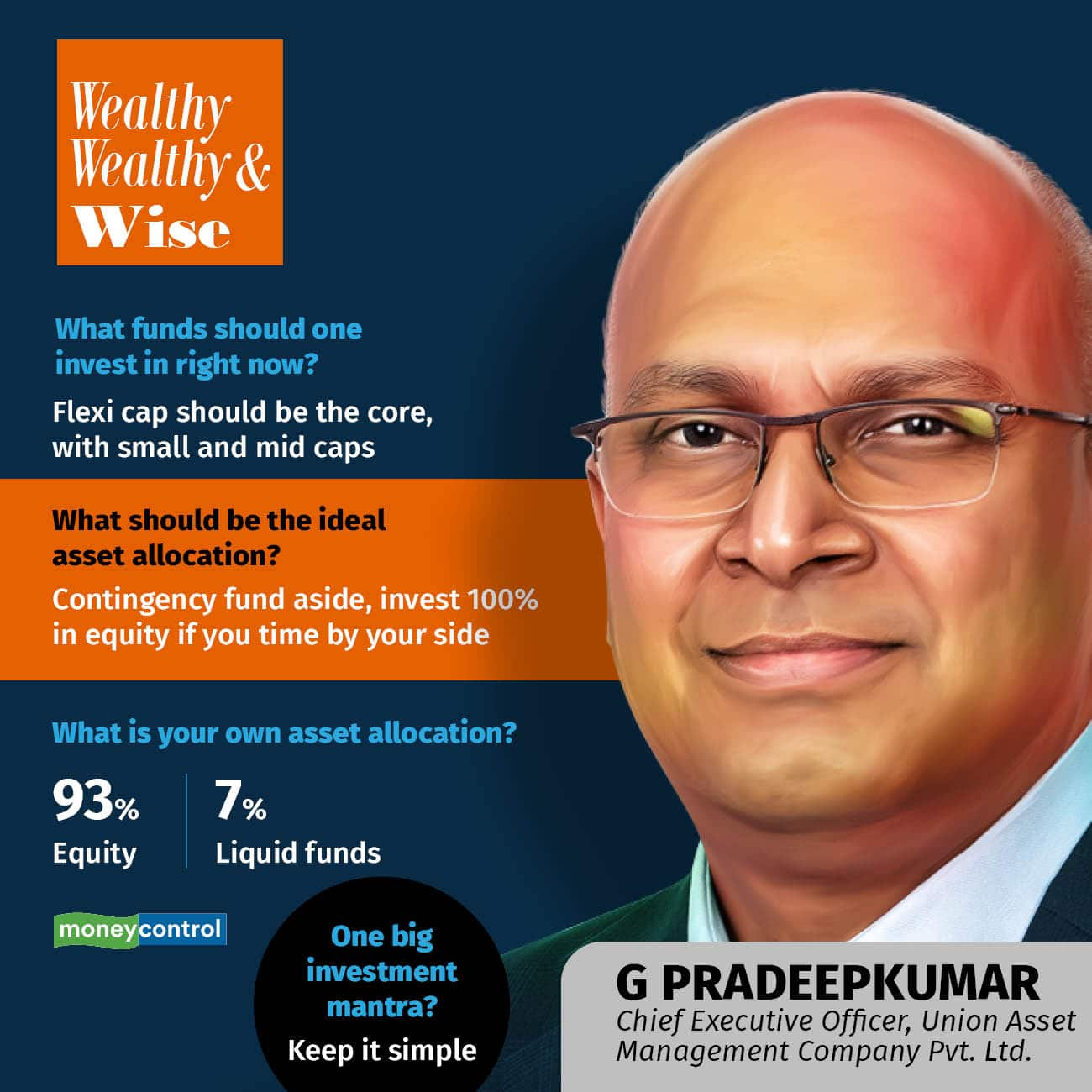

What should the ideal asset allocation be?

For someone who is in their early 30s, with enough time on their side, I would suggest 100 percent in equity. In a country like India, where the future prospects look so bright, there is no need to be there in any other asset class. Equity markets should be able to offer the best possible returns.

What type of equity funds would you recommend in these markets?

Invest in a Flexicap. This has to be the core investment of your portfolio, as it invests across sectors and stocks of all market capitalisations. Then you can add some spices to the food and allocate some to mid-caps and small caps. If an investor doesn’t like much volatility, they can look at balanced advantage funds.

After an investor has made enough diversification in the Indian market, I would suggest some allocation to global funds too.

What are your views on debt funds in this rising interest rate scenario?

I would actually urge investors to give serious consideration to debt funds also because the yield on debt paper, particularly government securities, has moved up significantly and the current levels offer a very good entry point. I would recommend gilt funds, that carry no credit risk for someone who has a three-year time horizon.

When we talk about asset allocation, what do you think about investment in gold as a diversification tool? This is Diwali time so there is a lot of demand for gold.

For most retail investors, anything that I would recommend other than equity and debt is gold. That too purely from a safe haven point of view. Investing through a gold ETF is the best option in that case.

Gold has gone up around 4 percent in the last one year. Personally, I would not like to own gold in my portfolio, but if someone wants to use it for diversification, it is best to spread it over four to six months.

A lot of young investors, especially in their 20s, are drawn to new-age companies that have got listed in the last one year or so like food-delivery companies and so on whose services we all use on a daily basis. Additionally, young investors are also driven to cryptocurrencies. What are you thoughts on these?

To invest in any company - new-age or old ones, you need to analyse their money-making prospects. I don’t think a retail investor is in a position to analyse these businesses and take an informed decision. My principle is to simply not indulge in something that you don’t understand.

Similarly for crypto, if you are willing to lose the money that you put in, it’s fine. But do not confuse cryptocurrency as an investment.

What is your own asset allocation?

I have only equity and debt in my portfolio. If you keep aside the house I am living in, I have 93% in equity and 7% would be in liquid funds for short-term purposes.

What is your one big investment mantra?

Don’t invest in anything that you don’t understand and keep it simple.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.