In a volatile market, a balanced advantage fund (BAF) comes across as your best friend, at least on paper. These hybrid funds invest in equity and debt, depending on how markets move.

BAFs, or dynamic asset allocation funds as they are also known, aim to remove fund manager’s biases. There are about 25 such schemes, with combined assets of close to Rs 91,000 crore—the two largest schemes have a 70 percent market share. Each of the schemes have its unique model to ascertain the equity–debt split, making the category complicated.

So, how did these funds do when the market was hammered in March and when it recovered in the following months? Did BAFs manage to reduce and hike the equity portions in time to make the most of the market volatility?

Different shades of BAFsMoneycontrol looked at BAFs across fund houses from January 2019 till August 2020 (September-end portfolio would take a few more days to be made public) to see what they did with their equity portions.

In the 20-month period, BAFs’ equity allocation was between 12 percent and 84 percent. To be sure, all BAFs aim to offer equity taxation and, thereby, bump up their equity allocation by adding derivative instruments to ensure that their equity component is at least 65 percent at all times.

For our study, though, we looked at their net equity allocation, which is the actual holding derived from their market outlook.

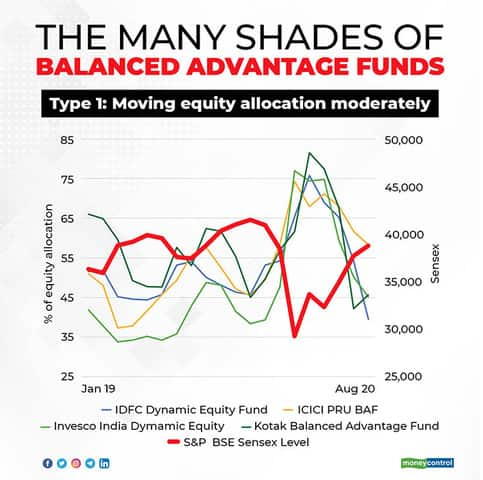

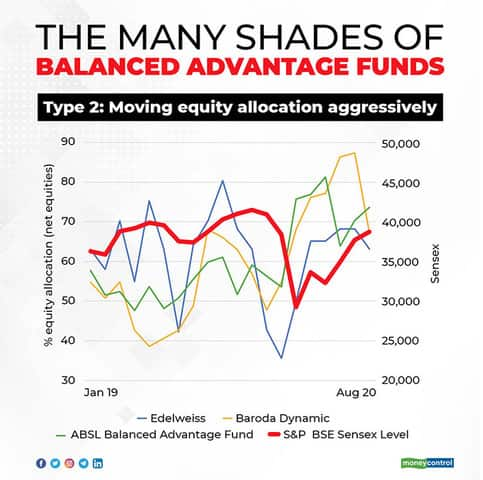

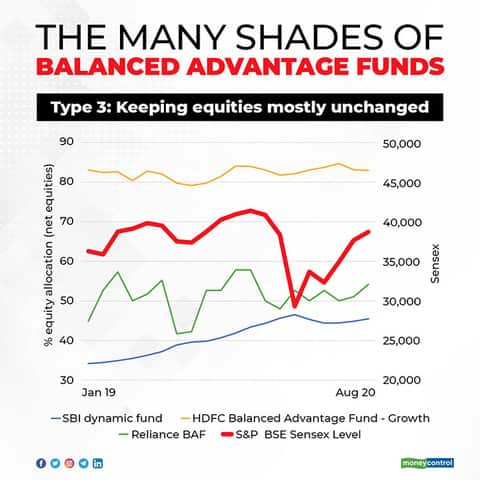

Broadly speaking, BAFs can be divided into three categories. See the below graphics for all categories discussed.

The first category of BAFs move opposite to the Sensex almost in a synchronized way.

IDFC Dynamic Equity fund, ICICI Prudential Balanced Advantage Fund, Kotak Balanced Advantage Fund and Invesco India Dynamic Equity Fund fall in this category.

Here, Invesco India Dynamic Fund is more aggressive than schemes like IDFC Dynamic Equity fund. Invesco India Dynamic Fund has held as little as 43 percent and as much as 81 percent in equities.

The second group of BAFs are aggressive. In other words, their equity allocation goes up and down sharply. Looking at the way their equity allocation has moved, three schemes can be slotted in this basket—Edelweiss Balanced Advantage Fund, Baroda Dynamic Equity Fund and Aditya Birla Sunlife Balanced Advantage Fund.

While the minimum equity in the first two dropped below 40 percent in the last year and half, all three schemes have even held a maximum equity of more than 80 percent in this time period.

A third set of BAFs are those whose equity allocation has been more or less steady or moved in a narrow range. Though this is not a good strategy since a BAF or a dynamic equity fund should ideally change its equities according to market’s moves.

Schemes that fit in this bucket are SBI Dynamic Asset Allocation Fund, HDFC Balanced Advantage Fund and Nippon Balanced Advantage Fund.

Rest of the schemes in this category, too, changed their equity allocation but when plotted against the Sensex they didn’t show a clear trend.

It’s complicatedMost BAFs, except perhaps the HDFC Balanced Advantage Fund, promise to hike and reduce equity allocation, depending on market movements but choosing one fund over the other also involves picking the method you like the most. And, here is where it gets complicated.

All BAFs come with their strategies to ascertain how much they should invest in equities (net equities; this excludes the derivatives portion) at a given time. Most though look at market valuations. To put it simply, most of them increase their equity allocation when markets go down and vice versa.

ICICI Prudential Balanced Advantage Fund, the second-largest scheme in this category with assets of close to Rs 27,000 crore, takes into consideration an in-house model that primarily looks at price-to-book and few other parameters to decide on net equity asset allocation (30-80 percent).

Some funds use a trailing price-to-equity ratio, others use forward earnings estimates to ascertain their equity allocation.

IDFC Dynamic Equity fund relies on a simple price-equity ratio model that determines its equities’ position anywhere between 30 and 100 percent of the corpus.

Edelweiss Balanced Advantage Fund has a different approach. It goes with the markets. Its equity position goes up and down with the market and not necessarily in the opposite direction.

Bharat Lahoti, fund manager of Edelweiss Balanced Advantage, says that since Indian markets typically move in a single direction—either up or down—over a long time, or as he says as ‘trending’ market, it doesn’t make sense to move in the opposite directions as most other BAFs do.

The scheme looks at the Nifty’s levels and compares it with the averages in the past, from a few weeks to months. If the Nifty is placed higher than the moving averages of the past, the fund assumes that the market will go up and its equity allocation remains high.

“We do not try to predict markets; whether markets are overvalued or undervalued. Because even if markets are over-valued, they can still go up because of, say, liquidity, low interest rates and so on,” Lahoti says.

Arpit Kapoor, fund manager at IDFC Dynamic Equity fund, swears by his approach of cutting exposure when equities are on a high and vice versa.

“In March after the market crash, I had not increased my own personal allocation to equities. But since IDFC Dynamic Equity fund is driven by a stated approach, it increased its equity portion. Therefore, such an approach removes personal biases,” he says.

In the market rise that ensued, IDFC Dynamic Equity gave 35 percent returns and finished in the top quintile, Value Research data shows.

Do BAFs deliver returns?Should you look at BAFs short-term or long-term performance? And, if BAFs change their equity allocation with the markets, they should outperform in rising as well as falling markets but that is not the case.

When markets plunged earlier this year, BAFs slipped 20 percent, as per Value Research data. Multicap funds declined 33 percent. Multicap funds can be compared to BAFs because typically BAFs, too, diversify their equity in companies across market capitalisation. But when equity markets rebounded, multicap funds (43 percent) outperformed BAFs (27 percent), as expected, due to their higher equity allocation, as on September 21. But as on that day, BAFs had outperformed multi-cap funds over the one-year and two-year time periods.

Over the three-year tenure, however, multicap funds had the edge. “But BAFs have lower volatility than pure-equity funds,” says Kapoor.

Not all BAFs give similar returns in the short run. The return pattern for 2020 shows that the BAFs that came in the top quintile when the market recovered from March lows had underperformed other BAFs during the January-March crash. The ones that did well in the crash, underperformed when the market recovered.

BAFs are a complex creatures. “It’s easier to do your own asset allocation using separate equity and debt funds. Deciphering the right BAF for you is tough because (it) tries to combine multiple objectives into one. Hence, a do-it-yourself investor should avoid BAF,” says Vidya Bala, founding partner and head, Research and Products at PrimeInvestor, a subscription-based research solutions platform. Bala says BAFs are suitable mainly for high-networth individuals and those in higher tax brackets.

Moneycontrol’s takeThe erstwhile balanced funds—now called Aggressive Hybrid Funds—that invest at least 65 percent in equities at all times never really serve much purpose.

A BAF is a better alternative if you wish to switch between equities and debt opportunistically. But if you manage your finances on your own, it’s best to do your asset-allocation through separate equity and debt funds. Opt for BAF as a satellite portion of your portfolio only if you have an adviser to guide you about a scheme’s strategy and long-term pedigree.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.