Did you know that whenever you invest in a gold exchange-traded fund (ETFs), there is physical gold stored, even if you don’t see it?

Gold ETFs are linked to the price of gold. Each unit of a gold ETF is pegged to a certain value of gold. Now, gold ETFs invest and hold physical gold on behalf of investors. Here are many other facets to gold ETFs.

How is gold valued?Mutual funds have to follow SEBI’s rules on valuing gold. The value needs to be derived on the basis of prices polled on the London Bullion Market Association (LBMA). These prices then need to be converted to Indian metrics and Indian currency. Further, transportation charges that may be incurred on bringing such gold from London, notional customs duty, taxes and other levies also need to be added to the gold price.

SEBI regulations require Gold ETFs to buy gold as per the standards of LBMA. The gold bars must have a purity of at least 99.5 percent as per the LBMA standards. Fund houses appoint custodians to handle the physical gold who, in turn, appoint a vaulting agency to store the gold in vaults.

Gold ETFs charge an expense ratio that includes charges for storage and handling of gold, as well as the insurance cover to protect the gold kept in vaults against calamities or disasters.

“The custody and insurance are the major costs in running of a Gold ETF. We have kept the TER for our Gold ETF at 79 basis points,” says Hemen Bhatia, Deputy Head-ETF, Nippon Life India MF.

As per SEBI’s regulations there is an upper limit of 1 percent TER on ETFs.

Gold ETFs invest in gold with the highest purity. There is uniformity on what you are getting charged as an investor, with a fixed upper limit. Even then the competitive nature of the mutual fund industry ensures TERs are below the maximum limit. Contrast this to gold jewellery, where you would also have to pay making charges, which would differ from one jeweller to another. Making charges can be 5 percent or higher when you purchase gold jewellery, with the addition of GST. While the Mandatory Hallmarking of Gold Jewellery has come into force from this year, there is no mandatory requirement for hallmarking of gold for jewellers with annual turnover of less than Rs 40 lakh. Hallmarking is the process of certifying the purity and fineness of gold. For now, hallmarking is mandatory only in 256 of 700-odd districts. Special types of jewellery such as Kundan, Jadau and Polki are exempted from hallmarking.

What is the minimum investment needed?This depends on the prevailing prices of gold, but right now you can invest as little as Rs 41-Rs 42 in a Gold ETF. This is because several mutual funds have pegged each unit of their Gold ETFs to 0.01 gram of gold price in the spot market, making them more affordable for small investors.

Nippon India ETF Gold BeES, HDFC Gold ETF, ICICI Prudential Gold ETF, Kotak Gold ETF, UTI Gold ETF and Axis Gold ETF, have pegged each unit of the ETF to 0.01 gram of gold. SBI ETF Gold, Aditya Birla Sun Life Gold ETF, IDBI Gold ETF and Invesco India Gold ETF have pegged each unit of ETF to 1 gram of gold. So, the current price of these ETFs is somewhere between Rs 4,200-Rs 4,400 per unit. These fractional units allow you to make small investments in gold and build your gold portfolio over time.

Can I convert my Gold ETF into physical gold?Yes, you can do that. But for that you need to have a minimum number units that are worth one kg of gold. This is because the standard size of one gold bar is one kilogram. For ETFs with units pegged to 0.01 gram of gold, this comes to around 1.15 lakh units. For ETF units pegged to 0.5 gram of gold, this comes to a minimum 2,000 units. You can go directly to the fund house, and either ask for physical gold or liquidate your investments for cash.

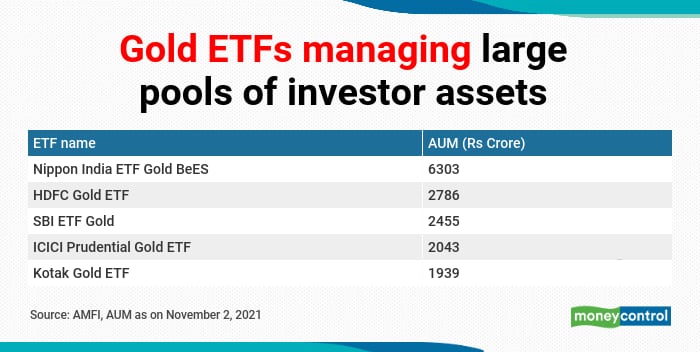

If you ask for cash, the fund house will sell the gold on your behalf and give you the money. If you ask for physical gold and don’t have a GST number, remember you would also incur GST on the transaction. There is also the problem of finding a safe place to store your gold. So, it is advisable to sell the units of the ETF on the exchange or to the fund house and withdraw your investments, rather than opt for physical gold. But, go for an ETF that has large asset size and sufficient traded volumes on the exchanges, so that there are not much impact costs when you transact on exchanges.

How are gains from Gold ETFs taxed?Long-term gains after three years of holding are taxed at the rate of 20 percent with indexation benefit. Short-term capital gains before the three-year holding period are added to your income and taxed at your slab rate.

What should investors do?Keep 5-10 percent of your portfolio allocation in financial instruments linked to gold as it can be a good hedge against inflation and a diversifier. But first check your existing gold investments, before committing more.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.