Gold has been in the spotlight with its record run, surpassing the Rs 90,000 per 10 grams milestone for the first time recently, as safe haven demand has soared on geopolitical and trade-related uncertainties. Silver too is not behind, and has reached a new high of over Rs 1 lakh per kilogram, reflecting a growing demand, and a dual role as both a monetary as well as an industrial metal.

Silver, historically referred to as the 'poor man’s gold', has had significant industrial usage too, including in electronics, renewable energy and high-tech manufacturing, and some forecasts project it to surpass gold's returns in the coming quarters.

Also read | Gold above Rs 90,000 ahead of Trump's tariff rollout; what should investors do?While gold remains a safe haven, silver’s industrial demand, relative undervaluation, supply concerns and monetary appeal could set it up for better gains.

Silver’s Historical Outperformance During Bull RunsTraditionally, silver has had a history of outperforming gold during precious metals bull runs, more so as the rally peaks. During the pandemic years, silver prices surged nearly 63% in 2020, outpacing gold’s gains, and now, a similar trend appears to be emerging in 2025. Last year, gold touched a year high of around 26%, while silver quietly climbed up by 34% to deliver higher returns, and playing a dual role - both as a safe-haven and as a critical industrial metal.

Industrial Demand Fuelling a Bull RunUnlike gold, whose value primarily comes from its role as a monetary metal, silver is deeply embedded in modern technology. More than half of global silver's demand comes from industrial applications such as electronics, solar panels, and electric vehicles (EVs). According America's Silver Institute, the demand for industrial silver is expected to exceed 700 million ounces in 2025, making it the primary driver of a rally.

The ongoing clean energy transformation also provides a significant tailwind, with the solar industry alone accounting for nearly 15% of total silver consumption, and demand expected to rise as governments push for net-zero emissions.

Advancements in artificial intelligence and high-performance semiconductors too depend on silver's unmatched conductivity, further boosting its global demand.

Also read | Why Malta’s Golden Visa is gaining traction as a gateway to EuropeThese factors position silver as one of the most sought-after commodities of 2025.

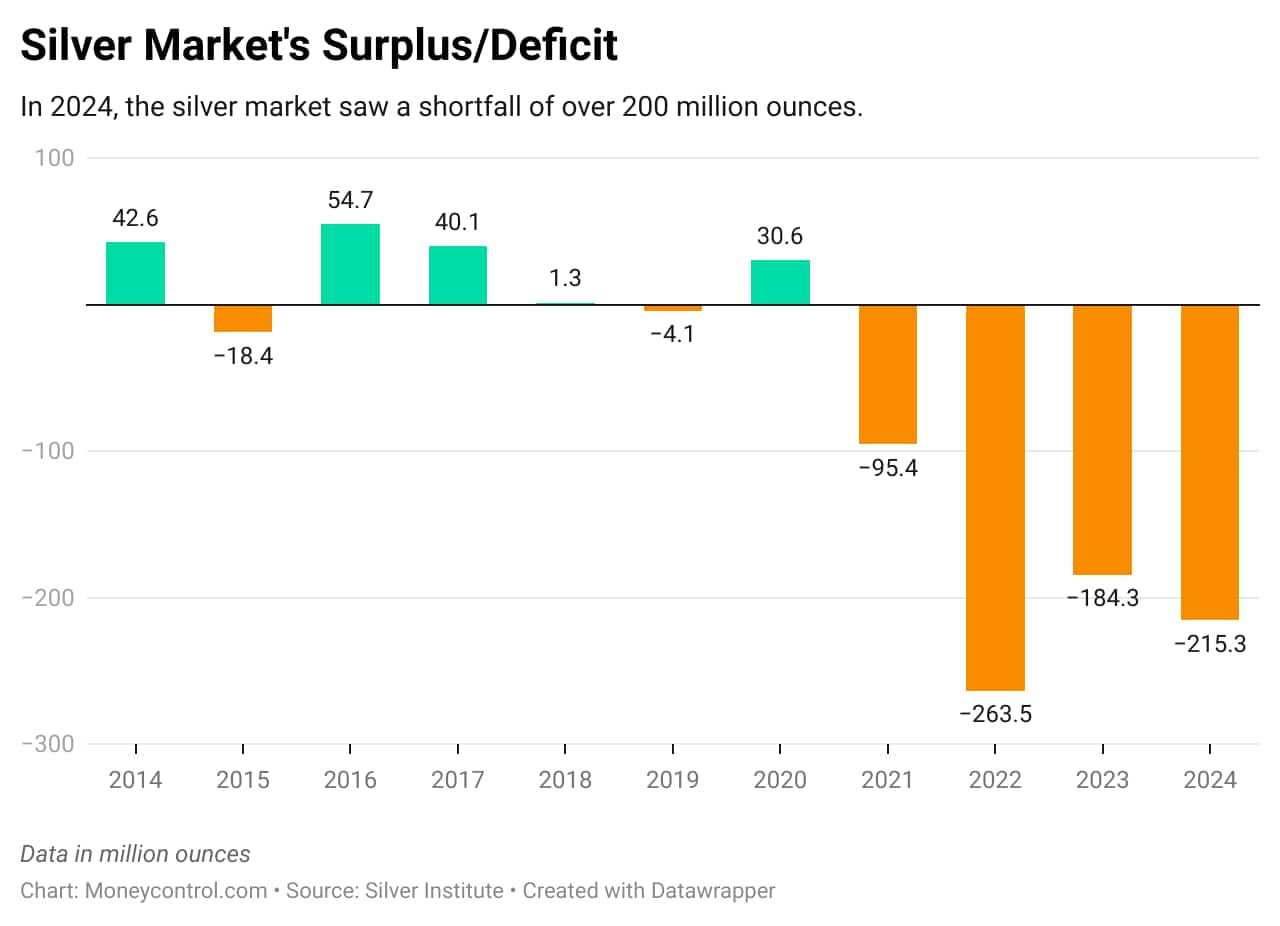

For years, silver has seen a supply deficit, with demand consistently surpassing production. In 2024, the silver market saw a shortfall of over 200 million ounces, one of the largest in recent history. Experts now anticipate that this trend may persist in 2025, pushing prices further higher.

Beyond industrial demand and supply constraints, macroeconomic conditions are in favour of a rally in silver prices. The precious metal also shares several monetary drivers with gold, such as inflation, central bank policies, and currency devaluation.

Historically, silver has performed well in low interest rate environments due to its lower opportunity cost of holding, as well as a weaker US dollar, inflation fears, and a higher industrial or investment demand. The US Federal Reserve’s anticipated rate cut trajectory in 2025 too could create a favourable tailwind for silver, similar to previous periods of monetary easing.

Additionally, the rising global debt and fiscal instability in key economic geographies too enhances silver’s appeal as a safe haven asset.

Gold-Silver Ratio (GSR)The gold-silver ratio (GSR) - a gauge of how many ounces of silver it takes to buy a single ounce of gold - has declined from its one-year high, but is still elevated at over 88.9, compared to its long-term historical average of around 60. This ratio enhances silver’s appeal as an investment opportunity.

Also read | Mindful asset allocation the key to investment successDuring the 2008 financial crisis and the Great Recession of 1929, the GSR initially spiked to over 80:1 before falling to 30:1, after the US Federal Reserve ramped up money supply through printing of dollars. Similarly, in 2020, the GSR hit a record high of 123:1 during the pandemic before plunging to around 60:1, as central banks injected liquidity into global economies.

With industrial demand surging and supply deficits not coming down, silver is shaping up to be one of the most promising investment opportunities of 2025.

While gold has traditionally been the cornerstone of wealth preservation, silver’s dual nature as a monetary safe haven and an industrial powerhouse positions it as a potential outperformer. Investors seeking to diversify their portfolios may find silver increasingly appealing as 2025 unfolds.

The author is a Fund Manager at Kotak Mahindra AMCDisclaimer: The views expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.