India’s Gen Z and millennials cannot have enough of the latest smartphones and other gadgets as they're finding it increasingly easy to acquire these even when they're in no position to afford them, thanks to personal loans.

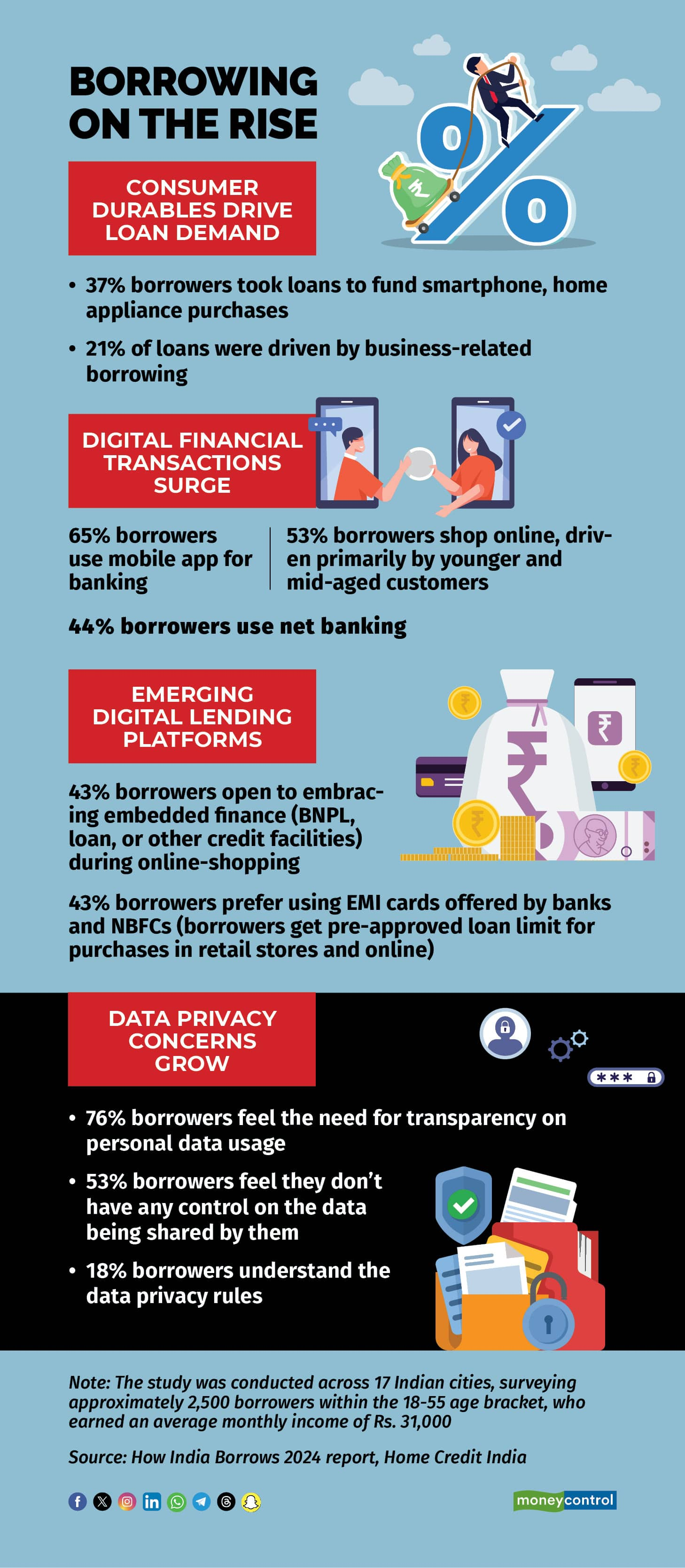

As a result, India is witnessing a surge in demand for personal loans to finance premium smartphones and consumer electronics. The share of such credit (among personal loans) has increased significantly, from 1 percent in 2020 to 37 percent in 2024, according to ‘How India Borrows,’ an annual report on consumer borrowing trends released by Home Credit India, a fintech firm.

The study was conducted across 17 Indian cities, surveying approximately 2,500 borrowers in the 18-55 age bracket, who earned Rs 31,000 a month on average.

Borrowing behaviour

There has also been a significant increase in borrowing for home renovation and construction, rising from 9 percent in 2022 to 15 percent in 2024.

This shows consumers' interest in upgrading their homes, fuelled by an optimistic economic outlook and a growing desire for home-ownership. As Ashish Tiwari, Home Credit India's Chief Marketing Officer, notes, "This trend indicates that individuals are now prioritising long-term investments in assets."

As for education loans, the study revealed consistent demand, maintaining a steady 4 percent share from 2022 to 2024, emphasising the enduring priority placed on children's education. Meanwhile, borrowing for marriage expenses saw a gradual increase from 3 percent in 2021 to 5 percent in 2024.

The share of loans for medical emergencies decreased substantially, from 7 percent in 2020 to 3 percent in 2024, Tiwari explains, citing improved financial planning and enhanced insurance coverage as key factors.

As per the report, between 2020 and 2024, the share of loans for cars and two-wheelers saw a six-fold increase, from 1 to 6 percent, demonstrating the growing consumer desire for personal transportation and increased mobility.

Rise in digital transactions

As consumers increasingly embrace technology, their borrowing habits are transitioning towards app-based banking, with 65 percent preferring this method, surpassing netbanking, which had a 44 percent share in 2024. The shift highlights consumers' desire for easy financial access.

Mobile banking apps have gained significant traction across generations, with millennials leading the adoption (69 percent), closely followed by Gen Z at 65 percent, and Gen X at 58 percent. However, the use of netbanking is relatively consistent among Gen Z and millennials at 47 percent each, while Gen X lags at 35 percent.

Also read | Applying for a personal loan from a fintech lender? Here are five parameters to consider

Beware of personal loan pitfalls

The primary drawback of personal loans taken to fund purchases of smartphones and home appliances is the high rate of interest they carry. Any failure or delay in repaying the loans or equated monthly instalments (EMIs) can lead to action by lenders, besides adversely affecting your credit score, making it difficult for you to access credit in future. You also need to factor processing charges, if any, while signing up for the loan, and bear in mind pre-payment penalties, should you decide to clear the loan before the end of its tenure.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!