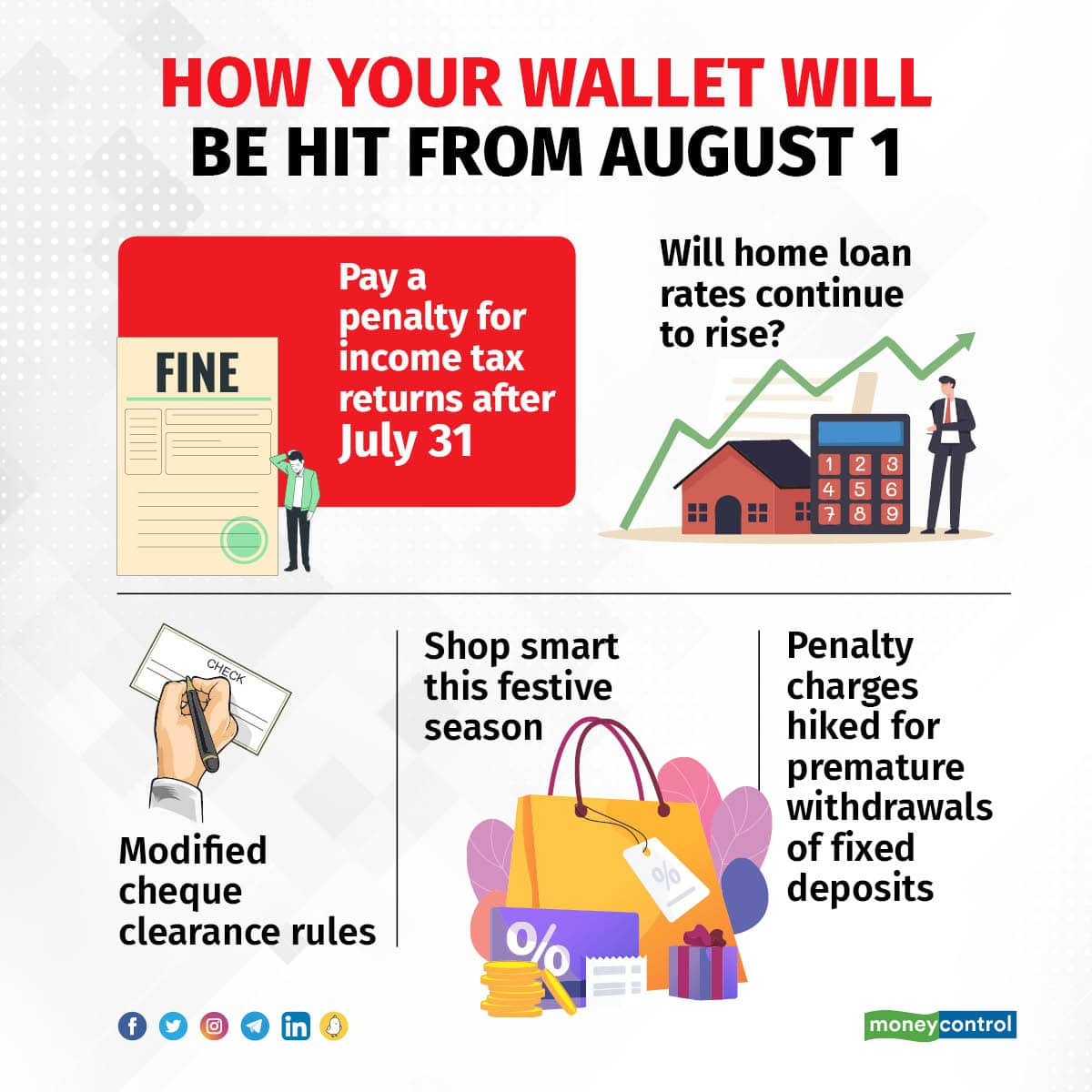

Whether you have invested in fixed deposits, taken a home loan, or you are an income-tax payer, there are a number of important changes coming up in August that will impact your piggy bank.

Aggressive monetary policy announcement by the RBI

For June, India's headline retail inflation rate, as measured by the Consumer Price Index (CPI), was 7.1 percent. This takes the average inflation for April-June to 7.3 percent, 20 basis points lower than the Reserve Bank of India's (RBI) forecast of 7.5 percent, according to data released on July 12 by the Ministry of Statistics and Programme Implementation.

To curb high inflation, RBI will remain aggressive over the next few monetary meetings in terms of policy rate action, according to economists.

“We expect another 50 basis point rate hike at the August meeting (one basis point is one-hundredth of a percentage point), taking the policy rate to 5.4 percent, above the pre-pandemic peak of 5.15 percent but with far higher inflation now than then,” says Kunal Kundu, India economist, Societe Generale. Based on the rate hike announcement, banks may start raising interest rates on home loans and other loan products linked with the repo rate as an external benchmark as per terms of the loan agreement.

Pay penalties for belated income tax returns

Did you not file your income-tax returns (ITRs) by July 31? Then be prepared to pay a penalty for filing belated returns. A belated return is a return which is filed after the due date mentioned in the income tax rules. The deadline for filing ITRs is July 31, but one can still file returns till December 31 of the assessment year (2022-23 at present). A penalty of Rs 5,000 will be charged for a delay in filing returns, if the total income to be reported exceeds Rs. 5 lakh. If the total income of the person is less than Rs 5 lakh, then the penalty payable is up to Rs 1,000.

Cheque clearance rules modified at BoB

In a message to account holders, Bank of Baroda has announced modifications in its cheque clearance rules. From August 1, 2022, the bank has said that customers have to electronically confirm important information about cheques exceeding a value of Rs 5 lakh. Earlier, customers had to confirm certain details for cheques of Rs 10 lakh and above. The customer needs to authenticate the cheque with the bank before it can be cleared under the bank’s Positive Pay System.

Positive Pay is a tool designed to detect fraudulent activity. It does this by matching information related to the cheque presented for clearing: the cheque number, cheque date, payee name, account number, amount, and other details, against a list of cheques previously authorised and issued by the issuer. The process involves reconfirmation of key details of large-value cheques.

Yes Bank increased the penalty charges for premature withdrawals of fixed deposits

Effective August 8, Yes Bank has raised the penalty for premature withdrawals of fixed deposits (FDs) booked for a tenure of less than or equal to 181 days, to 0.50 percent from 0.25 percent earlier. Similarly, it has hiked the penalty for premature withdrawal of FDs with a tenure of more than 182 days to 0.75 percent from 0.50 percent earlier. The bank will charge the penalty on all FDs booked / renewed for less than Rs 5 crore. The premature withdrawal penalty is not applicable to senior citizens.

Spend smartly this festive season

In August, thanks to Raksha Bandhan, Independence Day and other festivals, there are shopping offers from e-commerce websites, retail chains and independent neighbourhood stores. Make a budget and track your shopping expenses during the festive season. Prepare a list of gift items to avoid impulsive spending. Use cards of partner banks for additional discounts and cashbacks. Redeem reward points for additional savings. Avoid shopping for stuff you may not use immediately, and zero-cost EMI schemes, as they are debt traps.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.