People are busy borrowing money like there's no tomorrow. The year-on-year credit growth exceeded 19 percent in the fourth quarter of FY24, according to credit bureau Experian India.

When people borrow, their credit scores come into the spotlight. And as the lending and regulatory landscape has changed with technology, innovation and customer demands over the last two decades, much about how credit scores are calculated and what affects them have also changed.

During the recently concluded BankBazaar’s Credit Score Awareness Week, Manish Jain, Country Managing Director, Experian India, explained how credit scores are calculated.

What are credit bureaus?Credit bureaus, also known as credit rating agencies or consumer reporting companies, play an integral part in the financial lives of crores of people. They gather and organize information about consumers to create consumer credit reports.

In India, there are four such companies: CRIF High Mark Credit Information Services, Equifax Credit Information Services, TransUnion CIBIL and Experian Credit Information Company of India.

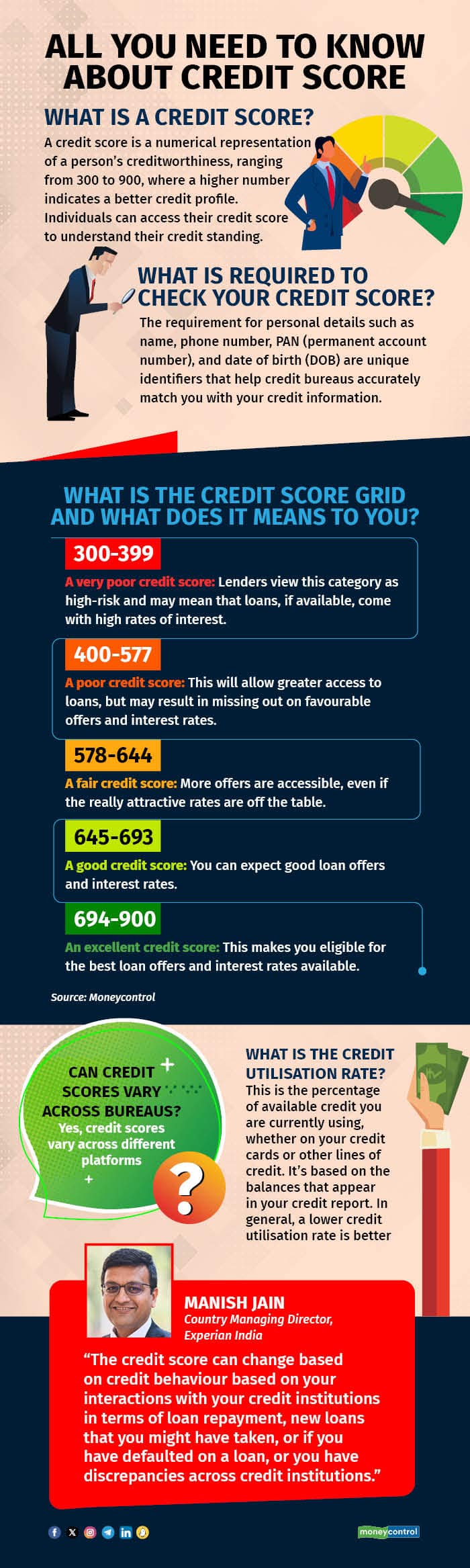

Can a credit score vary across the four bureaus?According to Jain, the first thing to keep in mind is that credit scores vary across platforms. “That’s because the scores are built on algorithms, and every organisation looks to build those algorithms based on their data set, availability of information, and no single method is the right method,” said Jain.

There are multiple ways a score can be computed, because every score is supposed to predict a probability of default, and a bureau might arri ve at an algorithm that may take into consideration Attribute A versus another bureau may consider Attribute B, he added.

How frequently can credit scores change?A consumer should be aware that a credit score is not a static number that someone computes every month or six months or once a year. It is arrived at dynamically—when you make a request for your credit report or for the score, it is computed based on the data available at that very point of time.

“The credit score can change based on credit behaviour based on your interactions with your credit institutions (like banks, non-banking financial companies) in terms of loan repayment, new loans that you might have taken, or you have defaulted on a loan, or you have discrepancies across credit institutions,” said Jain. Any change in any of these pointers might lead to a change in the credit score.

It is widely believed that whenever your credit score gets pulled out, it is adversely affected because somebody is checking it. That is not the case now, said Jain. “They used to, in the past... At least at Experian, we do not use inquiry information to impact your score," he said.

To be sure, a soft inquiry or credit pull happens when you simply check your own credit report. This doesn’t impact your credit score. A hard inquiry or pull happens when you apply for new credit and the creditor seeks out your credit file.

Elaborating on the point of soft and hard pulls, Jain pointed out that credit pulls were a standard procedure conducted by banks and financial institutions to assess creditworthiness. This routinely happens, for example, when a bank considers offering a customer a better financial product.

Additionally, customers may initiate multiple credit pulls. These inquiries may be conducted not only to evaluate credit but could also be tied to initiatives aimed at enhancing financial literacy or driven by an individual’s curiosity about their credit standing.

Also explore: Free credit report and regular credit score updates on the Moneycontrol app and website. Can refinancing or a balance transfer of a loan affect your credit score?The score works on data reporting from credit institutions. Let's say you have a home loan from Bank A and you’ve decided to do a balance transfer to Bank B. If Bank A, at the time of closing your loan, failed to report that to the bureau, there is a lag in that reporting, Jain pointed out.

If that loan remains on your file, and a new loan opens up (even though it is just a transfer), as far as the paper reality is concerned, there are two loans that exist in the credit files. This impacts your credit score.

Hence, it is crucial that when you are switching loans that you check your credit report to see that one loans is shown as closed and the other open.

Also read | Four tips to build a high credit scoreHow is credit utilisation viewed?Your credit utilisation rate is the percentage of available credit you are using on your credit cards and other lines of credit. It is based on the balances that appear in your credit report. In general, the lower the utilisation rate, the better.

Let’s assume you have three credit cards and you hit 80 percent of the limit on all three. The credit bureau sees this as high credit utilisation.

But if someone uses up to 80 percent of one credit card's limit and barely uses the other two cards, Jain explains, that’s fine, usually. This situation typically indicates that the individual has a preferred credit card they use more frequently than others. Or if the total utilisation across all cards remains below 30 percent of the individual's overall credit limit, then too it is not problematic.

Also read | Credit Scores: A beginner’s guide to good financial healthCredit data should reach the bureaus with greater frequencyJain argued that to get a true picture of your credit score—in real time, preferably—it’s not just the credit bureaus that should use technology efficiently. Banks and finance firms too must transmit data in a timely manner to credit bureaus. “The data should be updated weekly, if not daily. Else, in the age of pay-day, three-day, seven-day, 21-day loans, the score you get to see may not be a true representation of your financial behaviour today,” said Jain.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.