Fund managers are waiting for clarity on the market direction, reflecting in the cash holding of active equity funds, which has been trending around 4.8 percent over the past six months.

Benchmark indices Sensex and Nifty 50 have fallen around 7 percent over the past six months as of February 17, 2o25, owing to several global factors, foreign selling and concerns over earnings.

Global macroeconomic uncertainties and concerns over a tariff war in the second term of US President Donald Trump have further dampened sentiment. The rising US bond yield and a strengthening dollar, both have led to capital outflows, with foreign investors shifting toward safer returns in developed markets.

Also Read | Asset allocation in 2025: Optimise and diversify your portfolio to thrive in uncertain times

Foreign portfolio investors have sold over $10 billion worth of equities from Indian stock markets this year.

Cash Holdings

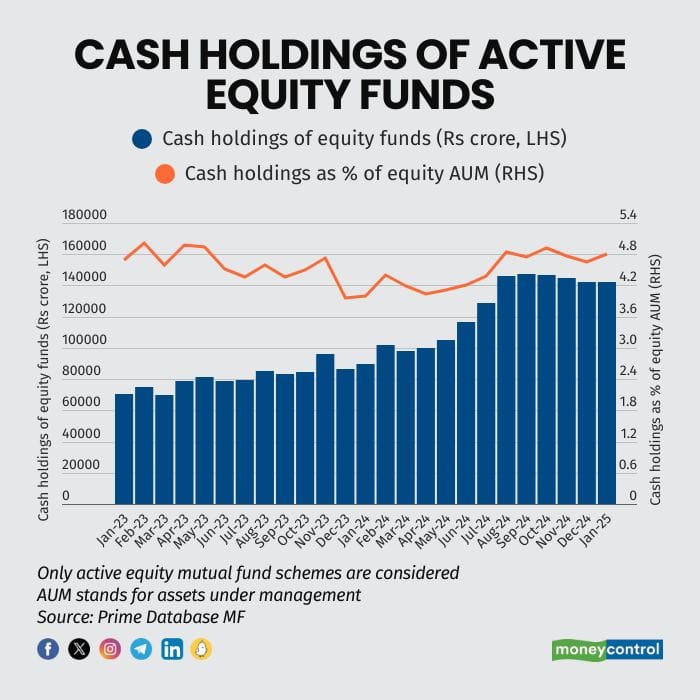

Numbers from Prime Database show that the cash holding of active equity funds is at Rs 1.42 lakh crore as of January 2025, as against Rs 1.46 lakh crore at the end of August 2024.

Active equity funds include the entire range of multicap, largecap, mid and smallcap, dividend yield, contra, value, focused, sectoral/thematic, Equity Linked Savings Scheme (ELSS) and flexi-cap schemes.

This cash holding as a percentage of mutual fund industry's equity assets under management (AUM) has remained between 4.8 percent to 4.85 percent over the last six months.

Despite moderations in valuations, equity mutual funds are waiting on the sidelines, and still waiting for more clarity.

“The higher cash holdings may continue till fund managers feel more comfortable with valuations. They are waiting for clarity because every day there is fresh news and that is impacting various sectors and stocks. This may be a time-based correction, which might bring up some evaluation discrepancies, as in when the next quarterly earnings are out,” said Ravi Kumar TV, founder of Gaining Ground Investment Services.

Contrasting Stance

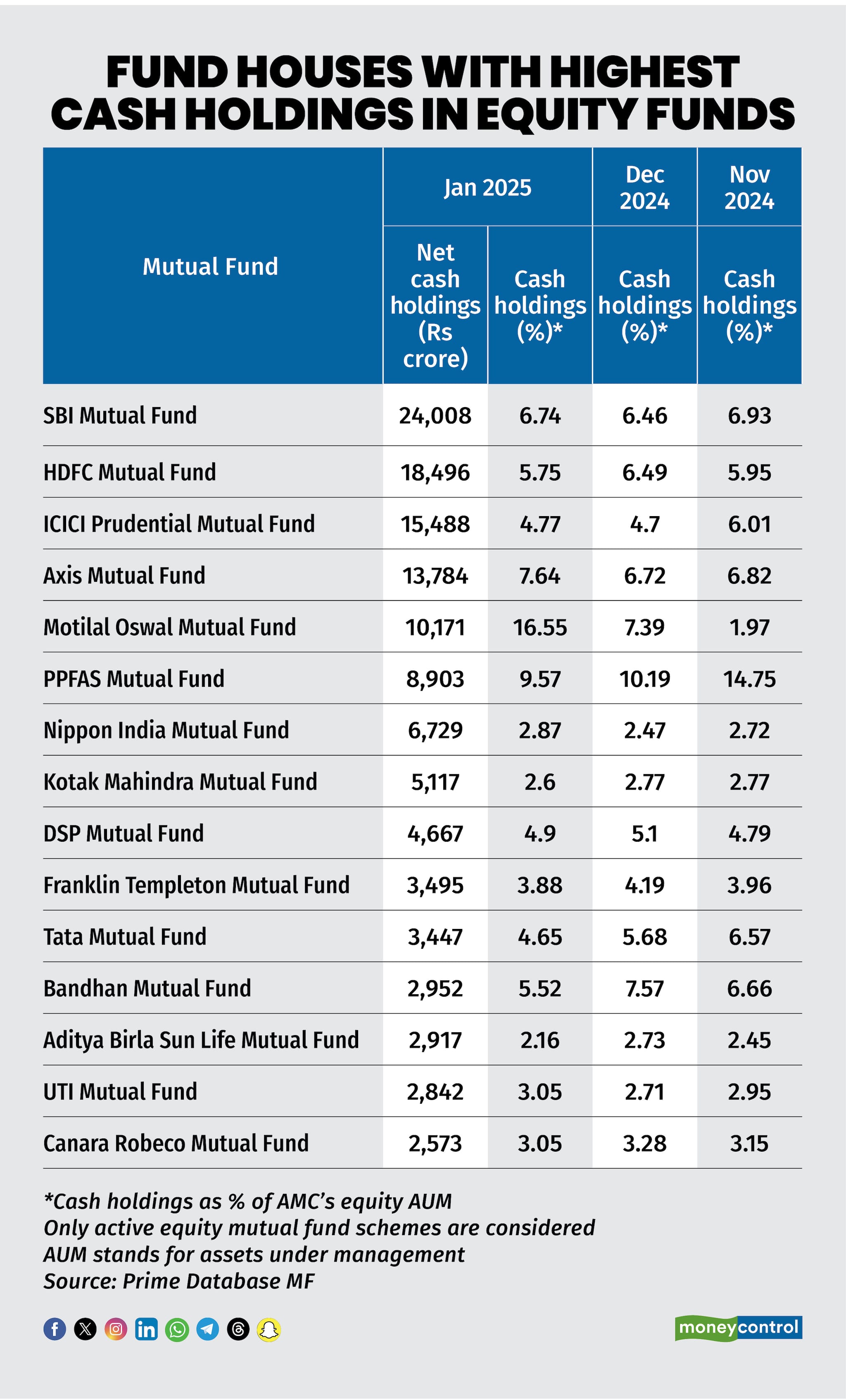

The biggest asset management companies (AMCs) - SBI Mutual Fund, HDFC Mutual Fund and ICICI Prudential Mutual Fund - continue to have the highest cash holdings at Rs 24,008 crore, Rs 18,496 crore and Rs 15,488 crore, respectively.

In terms of cash holding as a percentage of an AMC's equity AUM, Motilal Oswal Mutual Fund had the highest holding at 16.55 percent in January 2025, which was more than doubled from 7.39 percent in December 2024. Motilal Oswal MF held just 1.97 percent cash holding in its active equity funds in November 2024.

Also read | New India Co-op Bank crisis: Customers should change bank mandates for EMIs, redirect MF SIPs

Among the few fund houses that have been deploying cash during market correction is PPFAS Mutual Fund, with its cash holding down to 9.57 percent in January 2025 against 14.75 percent in November 2024.

PPFAS in a recent note had said that they continue to look at individual investments on their own merits, and will not hesitate to invest if an opportunity looks attractive.

“As usual, our investment stance does not depend much on the macro-economic situation but is focussed on individual companies. We have about 20.84 percent in cash holdings, debt & money market instruments and arbitrage positions which can be deployed in long term investments at appropriate levels,” PPFAS had said.

Overall Cash Holdings

Domestic mutual funds’ overall cash holdings rose to 5.62 percent in January 2025 against 4.52 percent in December 2024. The net cash holding rose to Rs 3.75 lakh crore as against Rs 3.02 lakh crore on a month-on-month basis.

This data includes all mutual funds including debt, hybrid, equity, commodity, overseas and passive fund categories.

The overall cash holding of domestic mutual funds has been rising since March 2024, when the net cash holding was at Rs 1.83 lakh crore, or 3.45 percent of the AUM.

In terms of individual fund houses, SBI Mutual Fund, ICICI Prudential Mutual Fund and HDFC Mutual Fund are holding the highest cash holding at Rs 53,806 crore, Rs 47,040 crore and Rs 41,200 crore, respectively.

What This Means for Investors?

The cash holdings of mutual funds can provide investors with valuable insights into market sentiment, risk appetite, and potential future market movements.

Investors often track mutual fund cash levels as a contrarian indicator - high cash levels could mean a market bottom may be near, while low cash levels might imply an overheated market.

Also read | Smart bet: How factor investing rotates risk across cycles in a cost-effective and efficient manner

According to Rushabh Desai, Founder, Rupee With Rushabh Investment Services, valuations in the largecap space have become very reasonable. Smallcaps too have also started to look reasonable, but the midcap space is a bit expensive comparatively.

“Purely from a price point of view, we are at very good discounted levels. We have been very vocal that these are good levels to enter. If someone has Rs 100 today, at least Rs 60-70 can be comfortably invested. I would spread out the rest Rs 30-40 and invest depending on how the markets are panning out over a couple of months as there is still immense weakness in the markets and it is really tough to predict the market bottom,” said Desai.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.