Traditionally, health insurance policies have served the purpose of taking care of your hospitalisation-related medical expenses. But today, there are health insurance policies that come with in-built OPD covers that can be used for meeting your OPD - outpatient treatment that does not involve hospitalization - expenses.

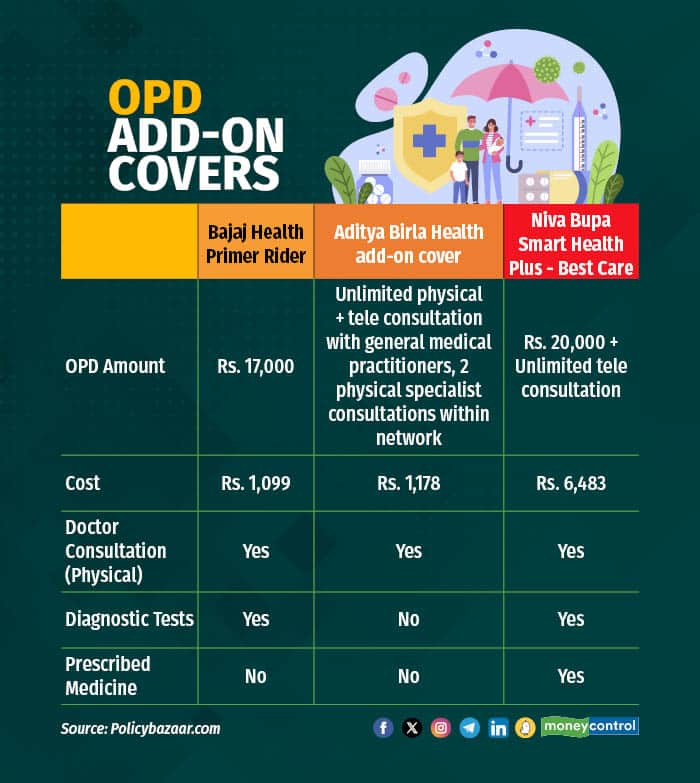

Apart from this, many insurers offer what is called an OPD rider or add-on cover that you can buy on top of your regular health insurance policy to cover your outpatient treatment expenses.

So, what do health insurers typically cover under OPD?

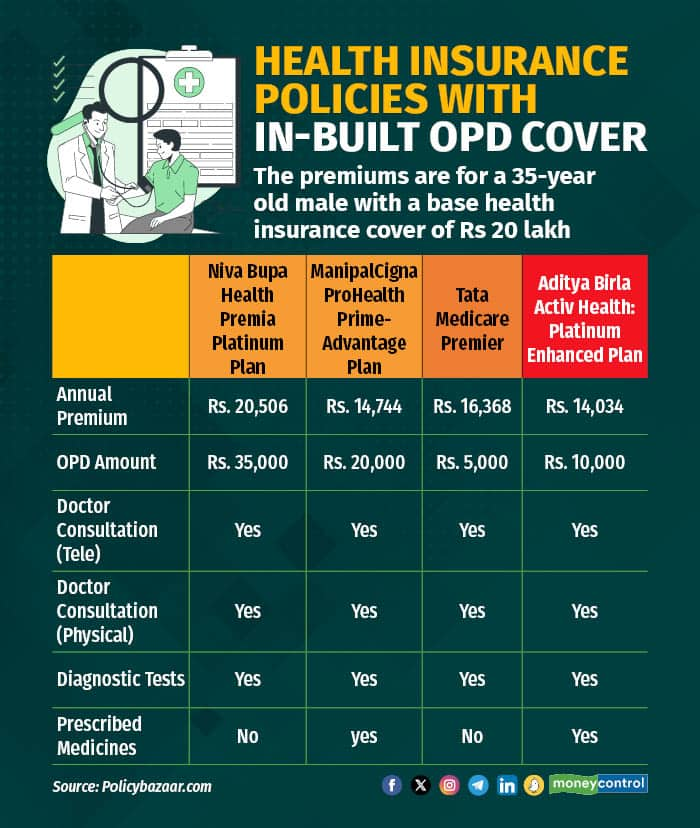

What’s covered, what’s notWhile this varies depending on the policy or the rider that you have, OPD expenses broadly fall under three categories – doctor consultations, diagnostic tests and pharmacy (medicines). And not all health insurance products cover expenses related to all three.

The Niva Bupa Health Premia (Platinum) plan covers outpatient expenses relating to all three categories. Likewise, the ManipalCigna ProHealth Prime Advantage plan covers all three categories, with limits on pharmacy expenses. The Bajaj Allianz My Health Care Plan, however, does not cover pharmacy expenses.

Similarly, there are variations across add-on covers too. Aditya Birla Health Insurance Company’s OPD add-on cover gives you unlimited doctor consultations (physical and / or virtual depending on the variant chosen) across the insurer’s network of hospitals. But diagnostic tests and pharmacy expenses are not covered.

The Niva Bupa Smart Health + rider comes in many variants. Its Best Consult and Best Care variants give the policyholder unlimited teleconsultation with Apollo 24X7. But consultations availed outside of this network are not covered. Also, unlike Best Care which covers medical investigations and medicines too, Best Consult covers only tele-consultation.

ManipalCigna Health Insurance Company’s Health 360 OPD add-on cover comes in three variants – with the first one covering only consultation, the second one, both consultation and prescribed diagnostics, and the third one, covering all three including prescribed pharmacy products.

The overall amount of OPD cover can range from as low as a few thousands to up to Rs 50,000 per year.

Going by the illustration in ICICI Lombard's Health AdvantEdge policy document, you get an OPD cover of Rs 5,000 for a base SI of Rs 10 lakh. But if you opt for a base SI of Rs one crore, you get an OPD cover of Rs 50,000. Similarly, the Tata Medicare Premier policy provides an OPD cover of Rs 5,000 for base SI of Rs 50 lakh and of Rs 7,500 for base SI of Rs 75 lakh and so on.

In the case of Niva Bupa Heartbeat (Platinum) plan, depending on the base SI chosen – which can be Rs 15 lakh, Rs 20 lakh, Rs 50 lakh or Rs 1 crore, you get an OPD cover of Rs 15,000, Rs 20,000, Rs 35,000 or Rs 50,000, respectively.

It works very differently in case of the Bajaj Allianz – My Health Care Plan where the OPD benefit is two times the premium. For example, if you are paying a premium of Rs 10,000, you get an OPD cover of Rs 20,000. For the base policy, you can choose an SI of as low as 3 lakh, going all the way up to Rs 5 crore.

Note that each of these policies and add-on covers can have very different premiums (see table).

You should also check whether you can carry forward any unused OPD cover amount from the previous year.

Both the Niva Bupa Health Premia (Platinum) plan and Heartbeat (Platinum) plan allow you to carry forward 80 percent of the unutilised amount to the immediately succeeding year as long as the total amount (including the unutilised amount) does not exceed 2.5 times the OPD cover amount provided under these policies.

The Bajaj Allianz – My Health Care Plan provides many benefits such as teleconsultation and in-person consultation for a certain number of times during each policy year. If you do not utilise these benefits fully, they cannot be carried forward to the next year. Likewise, the cover meant for diagnostic tests, if unused, too cannot be carried forward.

Any unutilised amount under the ManipalCigna Health 360 OPD add-on cover too, cannot be carried forward to the following year.

That apart, when it comes to OPD add-on covers, note that, in some cases, these can be taken only on top of a base health insurance policy offered by the same insurer. In fact, even with the same insurer, you may be able to take the add-on cover only with certain policies.

Then, there could be other conditions. For instance, the Niva Bupa Smart Health + rider can be taken only as an individual plan.

In addition, the OPD add-on cover could also limit you to the insurer’s network of hospitals, as is the case with Manipal Cigna Health Insurance Company. On the other hand, others such as Bajaj Allianz General Insurance Company have provision for consultation and diagnostic tests outside of the insurer’s network of hospitals, if needed.

Also hear: Simply Save | Your guide to picking the right health insurance policyShould you choose a policy for OPD?It may be tempting to go for a health insurance policy that offers a substantial built-in OPD cover. But many times, these can be high-end policies with higher premiums. Unless you intend to take such a policy for all its other features, this may not be an economical option. (see earlier table)

The other option is to go for an OPD add-on cover. But these may come with only select OPD cover amount options and may have certain exclusions (see table). So, check whether these add-on covers provide what you need, before opting for them.

Explaining why OPD can add significantly to the premium, Dr. Bhabatosh Mishra, Director - Claims, Underwriting & Product, Niva Bupa Health Insurance Company says, “OPD is a high utilisation product, so the premium for this is a high percentage of the sum insured. This is not so for regular health insurance plans that cover hospitalisation, the probability of which is not that high.”

Nikhil Apte, Chief Product Officer, Royal Sundaram General Insurance Company further makes a similar point, and says, “Standalone OPD is not an insurable event as it is a reality for every household. Insurance can work only for probabilistic events such as hospitalisation where everyone pays a premium but only a few require it.”

He further adds, “We have to manage all our expenses within 30 percent (IRDAI requires general insurers to cap their expenses at 30 percent of gross written premiums) plus there is 18 percent GST, so 48 percent is already gone.” This apart, insurers feel that such covers could be prone to misuse as keeping a check on OPD consumption is not easy. “So, OPD cannot work as a viable standalone product for an insurer. Having said that, insurance companies are providing comprehensive OPD benefits (pre- and post-hospitalisation) when it is linked to a hospitalisation event,” adds Apte.

According to Dr Mishra, given the demand for OPD products, the industry is moving in the right direction (many OPD products have been launched) but there is scope for more to be done.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.