The rise of lifestyle diseases on account of stress and a fast-paced life has given rise to the need to have a critical illness cover in your health insurance portfolio. To make things easy—and to pack in as much as they can—life insurance companies offer critical illness riders along with base life insurance policies.

And then, there are standalone critical illness policies and disease-specific covers.

The question is: Must you buy a separate policy just for critical illnesses or does a single, holistic insurance cover with an add-on benefit work better?

Also read: Know how a critical illness policy can ease treatment cost burden

The importance of critical illness coversA health insurance policy comes in handy if you were to be hospitalised for treatment. To financially secure your family in case of your death, you can rely on your pure risk term insurance policy.

But what if you were to be diagnosed with a critical illness such as stroke resulting in paralysis where treatment could continue for years and require recurring expenses that would render your health insurance policy inadequate? Moreover, it might lead to prolonged loss of income, which again your health insurance will not cover.

Also read: How much health insurance coverage do you need?

Enter critical illness plans. These specialised plans pay out a lump sum upon diagnosis, irrespective of whether you have made a claim under your health insurance policy or not. These are defined benefit plans, where you know the amount you will get, irrespective of the actual cost of treatment.

You can not only use the sum to pay your hospitalisation bills but also to fund any loss of income, lifestyle modification costs, purchase of equipment, long-term physiotherapy sessions and so on.

They cover dreaded diseases such as heart attacks, cancer, cardiovascular ailments and renal disorders, apart from organ transplants, loss of sight and even Parkinson’s disease and Alzheimer’s disease. The list of illnesses covered vary as per the insurance company and the plan variant chosen—the more ‘premium’ the variant, the wider the coverage.

Typically, a lump-sum amount (the entire sum assured) is paid out once the ailment is diagnosed and the policyholder completes the survival period, which can range from nil to 30 days post-diagnosis, depending on the insurer and the product.

The policy ceases to exist once the payout is made, unless your product comes with clauses where, say, the payout can be restricted to 25 percent in case of certain listed (under the product) ‘minor’ illnesses such as loss of hearing in one ear. In such cases, the balance sum assured will be available for other listed illnesses.

There could be caps on the sum assured that will be released for certain procedures such as angioplasty—the maximum claim payout could be limited to, say, 50 percent or an ad-hoc amount of Rs 12 lakh.

While choosing a policy, ensure that the coverage is adequate to cover major illnesses and treatment procedures. The cost of a liver transplant, for example, can easily go upwards of Rs 25-30 lakh. “Critical illness sum assured should be sufficient to cover the entire cost of a critical illness, including taking a second opinion from international experts, if required. Taking a sum assured of Rs 1-2 lakh would be grossly insufficient. HNIs (high net-worth individuals) should consider a sum assured of Rs 50 lakh or more,” says Abhishek Bondia, principal officer and managing director of insurance broking firm Securenow.in.

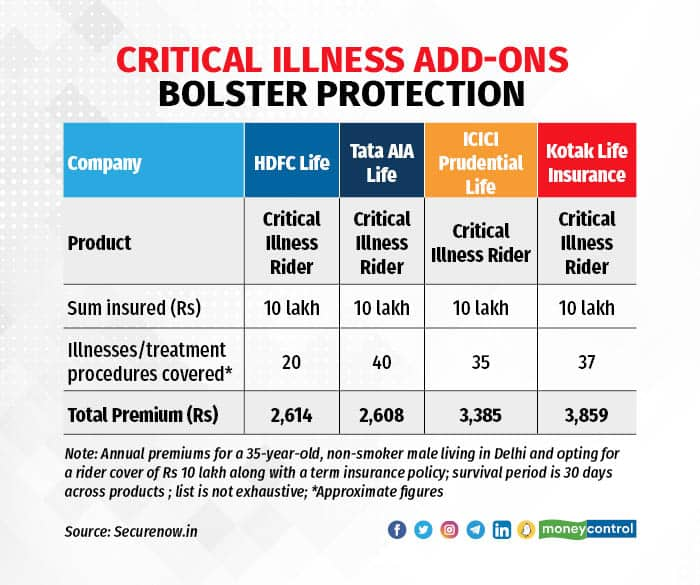

Before identifying the right cover amount and the insurer, decide whether you want to opt for critical illness riders—offered primarily by life insurers—or a standalone critical illness policy sold typically by general insurance companies. “While a few health insurance companies also offer such rider benefits to go with their base plans, they are not as popular, and the uptake is limited,” says Bondia.

“Both work on the same principle, in the same way. They essentially provide income replacement if the policyholder is incapacitated due to a critical illness listed in the policy. However, on the life side, you can usually buy a rider only at the time of buying the base life insurance policy. Some do allow you to add the rider at renewal, but most do not,” says Rhishabh Garg, head, term insurance, Policybazaar, an insurance aggregator firm.

Critical illness riders—premiums could be cheaper, but linked to base life coverRiders add heft to your protection portfolio. While the life policy secures your family financially, a critical illness rider can help you and your family should you be faced with a dreaded disease and the prospect of income loss during recuperation.

As per Insurance Regulatory and Development Authority of India (IRDAI) guidelines, a critical illness rider’s premium cannot be higher than that of the base life insurance policy. The maximum benefit amount paid out has to be lower than the base policy’s sum assured. So, if you are buying a life insurance policy of Rs 50 lakh, it will also be the upper limit for the critical illness benefit.

“A rider cover can be beneficial if bought together with a base policy for ease of maintenance of policy and payment of premiums together with base policy. Sometimes, rider cover may come at a cheaper cost compared to standalone policy,” says Bikash Choudhary, chief actuarial and governance officer, IndiaFirst Life Insurance.

So, if you are convinced of a critical illness cover’s importance, ensure that the rider benefit is substantial—at least Rs 25-30 lakh—and choose your life insurance policy’s base sum assured accordingly. Do not settle for a rider benefit that is just a small fraction of your life insurance cover. However, if you do not need such a large life cover, you should consider buying an independent critical illness policy.

“Critical illness riders attached to life insurance policies come with coverage that is a percentage of the larger base sum assured. If your term insurance policy’s premium is low (as is the case for younger buyers), the critical illness rider’s premium will be even lower and the coverage that you get at that price may prove to be inadequate,” says Bhabatosh Mishra, director, products, underwriting and claims, Niva Bupa Health Insurance.

Also, a critical illness rider’s term is equivalent to that of the base policy. So if your term insurance cover’s tenure ends with your retirement, which is typically the case as it is meant to replace your income, you will not be able to enjoy the rider’s benefits after this date, when the need could be greater.

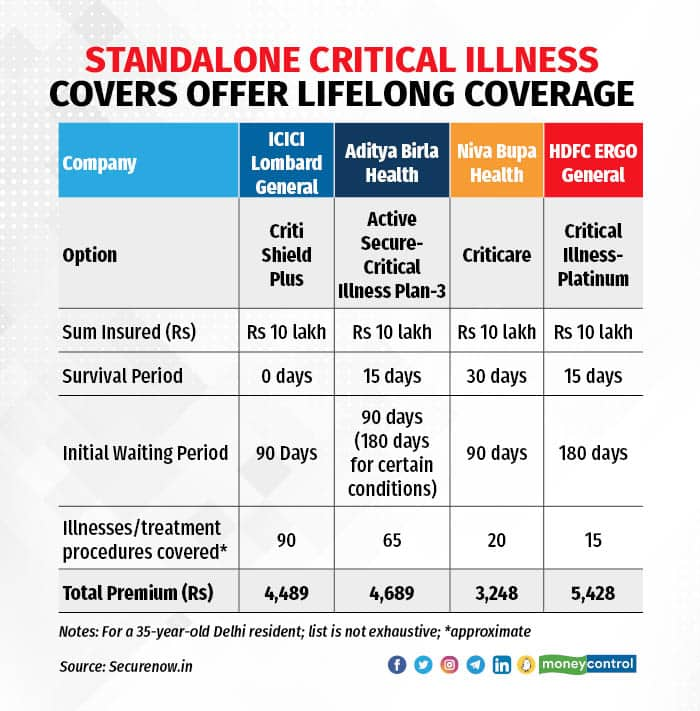

Standalone covers—renewable for lifetime, but premiums can increaseStandalone covers offer greater flexibility to choose or even switch insurers. With the rider, you are tied to the cover as it will be linked to the base term insurance policy. “The comprehensive, standalone critical illness cover is better. The number of illnesses covered makes up for the higher cost,” says Bondia.

A third choice—disease-specific policies such as cancer covers—offers more in-depth coverage for that particular ailment. For example, the cancer specific policy may cover early-stage cancers as well, as opposed to advanced-stage cancers in a comprehensive critical illness policy. “Such plans can be recommended if there is a family history of such illnesses, else comprehensive critical illness covers are preferable,” says Bondia.

Like other health policies, these are renewable for lifetime. “A standalone critical illness policy will come with a regular tenure of one year (or two to three years if you choose to pay multi-year premiums at one go). You also have the option of covering your parents, spouse and children under family floater variants, which is not the case with critical illness riders,” says Garg of Policybazaar.

However, unlike a rider add-on where the premiums will be fixed throughout the tenure, standalone covers’ premiums could be reviewed periodically based on the insurance company’s claim experience and healthcare inflation, among other things. “There is also the affordability aspect to this choice. Full-fledged, standalone critical illness covers are generally more expensive than riders,” points out Choudhury.

Moneycontrol's takeThe answer to whether you should choose standalone cover or rider will depend on these key factors – premiums, illnesses or treatment procedures covered, whether you need the cover post your working years, convenience of paying premiums and so on.

If you are looking for lifelong and larger cover with greater flexibility, a standalone critical illness cover would work better. You can opt for a rider if you can settle for a relatively smaller cover (since it cannot exceed life policy’s sum assured) and want fixed premiums.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.