If you are a health-conscious individual with a stellar track record of achieving fitness goals, you could have more to gain than a fitter body and a sharper mind.

Insurance companies, such as Star Health, Aditya Birla Health Insurance, Niva Bupa and Care Health, among others, offer wellness benefits and points that can then be redeemed to earn discounts on renewal premiums.

“The whole idea is to positively reinforce the importance of staying fit and inculcating healthy habits. When people are aware of the discounts they are eligible for, they will take better care of their health. The long-term impact on claims is secondary. It is important that they are sensitised to the benefits of maintaining good health,” said Dr Bhabatosh Mishra, Director, Underwriting and Claims, Niva Bupa.

Discounts act as incentives to follow a healthy lifestyle and keep associated diseases at bay. “Renewal discounts encourage people to keep their health parameters like body mass index (BMI), cholesterol levels, blood pressure, smoking, and drinking habits in check. It further encourages them to go for regular health screenings and requires them to regulate and document their activities,” said Ajay Shah, Head – Distribution, Care Health Insurance.

Also read: How staying fit benefits your health as well as your health insurance premium

Be active, reduce premiums

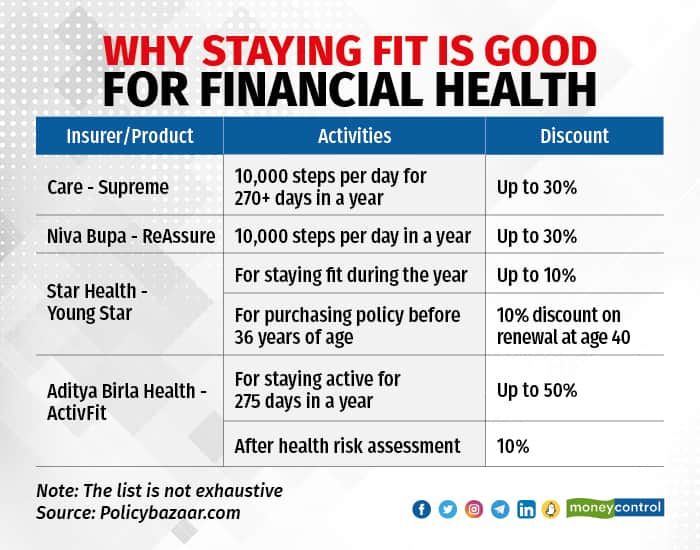

Most such reward programmes are built around the number of steps that you clock in a day, as monitored by the company’s app over a period of time. For instance, Niva Bupa and Care Health offer discounts on renewal premiums of up to 30 percent if you log 10,000 steps per day over 12 months.

Besides reward points for staying active, Aditya Birla Health offers a 10 percent discount for policyholders who undergo health risk assessment medical check-ups every year (see graphic).

Likewise, under Star Health’s Youngstar policy, policyholders can earn points that can be redeemed to avail of discounts on premiums, if they participate in walkathons or marathons, sign up for health club memberships, and preventive health assessment check-ups. “The fitter a person is, the lesser the propensity to make a claim. It’s a win-win for the customer and the insurance company,” says Siddharth Singhal, Business Head, Policybazaar.com, an online insurance aggregator and broking portal.

The rate of discount ranges from 10 percent to 30 percent, depending on the insurance company and its offering.

“Typically, rewards ― that is, renewal discounts ― on such products are linked to the number of steps that you log in a year. For instance, if you walk 10,000 steps a day for 325 days in a year, the subsequent year’s premium could be lower by 30 percent. The company’s app will track this data through the year,” says Singhal.

Then, there are other modes of earning discounts. The product conditions could require you to go to a particular network gym and burn a certain number of calories for a specified number of days. These, too, will be monitored by the app or a wearable gadget. Only the steps recorded by the app or the device will count.

Also read: Moneycontrol SecureNow Health Insurance Ratings: Your guide to picking the right policy

Consistency is key

Insurers feel claim reduction benefits, if any, will come through only in the long term. But in the short term, these plans act as loyalty programmes.

“In this hyper-competitive health insurance market, it is critical for insurers to retain their existing policyholders to build bottom lines in the long run. Insurers have partnered with wellness companies to offer wearables and health apps, which in turn, will capture data points on (policyholders’) health behaviours and patterns. These indicators allow insurers to give premium discounts for following a healthy lifestyle, making it a good risk for the underwriters,” says Amjad Khan, Executive Director - Employee Benefit Practice and International Business, Anand Rathi Insurance Brokers.

In other words, policyholders have to use company-designated apps, wearables like a smartwatch or a fitness band that capture their activities and transport the data back to the insurance company. Discounts for maintaining fitness levels are significant, but it is important to be consistent.

However, if you fail to follow the fitness regimen the following year, you will have to pay regular premiums ― premiums applicable to others in your age group or what you would have to pay, if not for the discounts ― then.

Little scope for frauds

Industry watchers do not foresee too many cases of policyholders manipulating the devices or apps to achieve fitness targets to earn discounts. “The adoption rate in this category remains low ― only around 7-8 percent of the policy base makes use of these offerings. So, frauds are not a major challenge yet,” says Policybazaar.

Also, for someone to commit a fraud, say, deceiving the app or the wearable gadget by attaching it to a moving device, to be able to record steps in a day, the policyholder would have to do it every day, consistently through the year.

However, insurers do not rule out the possibility and put checks and balances in place to prevent fraud.

"Policyholders can manipulate the apps or wearable devices to earn discounts unfairly, and insurers are aware of this possibility. Insurers employ advanced data analytics and algorithms to detect unusual patterns or discrepancies in the collected data. By analysing this data over time, insurers can identify inconsistencies in an individual’s numbers that may indicate manipulation. Statistical analysis and anomaly detection techniques help in identifying suspicious activities,” says Shah of Care Health Insurance.

“Our app (installed to track policyholders’ steps) picks up the data from Android and iOS health apps. The algorithms of these apps, too, can detect abnormal step counts,” says Mishra.

Privacy concerns

Given that the apps or devices track your activity data round the clock, privacy concerns are bound to arise. However, insurers say no information beyond what you have consented to will be monitored. “Only data related to steps will be picked, and nothing else. For instance, in our case, the app is customer log-in based. Customers have complete control over the credentials and can set the passwords ― we cannot get into the app to view any other details,” explains Mishra.

Read the terms and conditions before signing up for the apps. “A lot of customers use fitness devices ― Apple watches, FitBit synced with mobile apps, and so on. They only record the number of steps taken; no personal information is captured,” says Singhal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.