If you have invested in debt mutual fund schemes, you may have got emails from many fund houses of late informing changes in risk-o-meters of your debt funds. A scheme’s risk-o-meter is its risk indicator, depending on its month-end portfolio.

Of late, emails from fund houses say that many schemes’ risk levels have gone up. The risk-o-meter has six levels of risk as defined by the capital markets regulator, Securities and Exchange Board of India (SEBI), starting from ‘low’ to ‘very high’. The risk-o-meter is dynamic in nature and measures the level of risk a scheme has taken by factoring in risk weights to each security held by the scheme.

Now that your scheme’s risk-o-meter has gone up, is that cause for concern?

Increasing the risk quotient

The risk-o-meter reading of Tata Gilt Securities Fund (TGSF) has increased from ‘low to moderate’ to ‘moderate’ over the last one month, indicating higher risk.

Tata Dynamic Bond Fund’s (TDBF) risk-o-meter has also changed from ‘moderate’ to ‘moderately high’.

LIC MF Government Securities Fund (LGSF) too has seen its risk-o-meter reading going up to ‘moderate’ in July 2022. Earlier, its risk-o-meter was ‘low to moderate’ in the month of June 2022.

These schemes have increased exposure to long-term government securities, leading to increase in interest rate risk, and hence, the risk level has gone up.

Not only debt funds, but hybrid funds also have reported an increase in their risk levels, of late. Union Balanced Advantage Fund’s (UBAF) risk-o-meter has risen to ‘very high’, from ‘moderately high’.

Positioning for a fall in interest rates?

Rising interest rates have made the fund managers consider some changes in their portfolios where they are allowed to increase the duration — by investing in long-term bonds.

LGSF’s Macaulay Duration has gone up to 3.6 years on July 31, 2022, compared to 0.98 years in the previous month. Explaining this rise, Marzban Irani, Chief Investment Officer - Debt, LIC Mutual Fund, says, “The financial markets saw massive infusion of liquidity and low interest rates in 2020. We anticipated the interest rates to rise, and hence, remain invested in short-term government securities. However, as the yields rose, recently we started increasing the duration of the portfolio by buying long-term government securities.”

Irani says that he intends to further increase the duration to take advantage of the “next leg of the interest rate cycle”.

Interest rates may soon peak and then gradually come down. When interest rates fall, debt security prices — and the net asset values of debt funds that invest in them — go up. The impact is more on long-term bonds.

Explaining TGSF and TDBF’s increase in risk-o-meter readings, Anand Varadarajan, Business Head - Banking, Alternate Products and Product Strategy, Tata Mutual Fund, says, “Our portfolios were running low duration. We have started adding longer duration in our funds which has resulted in a change in risk-o-meters. We believe investors can start looking at duration funds and can benefit from both higher yields and some mark-to-market gains as and when it happens.”

Sensing opportunities

Debt fund managers also see an opportunity for investing in medium-term bonds. Take the example of Franklin Templeton Banking & PSU Debt Fund (FTBPDF). The scheme has picked up some medium-term government securities, which has led to increase in the average maturity of the scheme’s portfolio and thereby increase in interest rate risk. The risk-o-meter’s reading has hence, gone up to ‘moderate’ from ‘low to moderate’.

Equity markets have seen a good bounce back over one month. However, the month of July threw up some opportunities to savvy fund managers of actively managed schemes. Even hybrid schemes allocating money to stocks acted on it and raised their equity allocation.

The readings of their risk-o-meters went up accordingly.

For example, Edelweiss Equity Savings Fund’s risk-o-meter reading went up to ‘high’ from ‘moderately high’, as the net equity exposure climbed to 38.5 percent from 30 percent in June 2022.

UBAF’s net equity exposure of the scheme has gone up to 52 percent from 46 percent.

G Pradeepkumar, CEO, Union Mutual Fund, says, “Our allocation model prescribed low allocation to equity, of around 30 percent, for almost a year, as the stocks were expensive. However, as the market became more reasonably valued, based on the model, we raised allocation to equity in Union Balanced Advantage Fund.”

As the equity allocation exceeds 50 percent currently, the risk-o-meter reading changes to ‘very high risk’ as per the SEBI-prescribed formula, he adds.

Equity allocation went up in hybrid funds as relatively low stock prices offered some comfort, as well as robust earnings reporting for the first quarter of FY2022-2023 by leading companies indicating better earnings ahead. Sometimes the movements in prices can also lead to changes in allocation, which may change the risk score.

What should you do?

A scheme’s risk-o-meter indicates the level of risk a scheme has taken. The thing to remember here is, active fund managers buy and sell scrips on an almost daily basis to make the most of opportunities in the markets. Such changes may lead to changes in the risk-o-meter.

Not all changes are bad, says Vinayak Savanur, Founder and CIO at Sukhanidhi Investment Advisors. “You need to figure out why the risk-o-meters have changed. If the fund manager has increased exposure to low-rated bonds, or if there is a credit downgrade of a bond held in the portfolio, then such incidences need to be looked at in detail,” says Savanur.

If you have designed your portfolio based on your financial goals, risk appetite and in line with your asset allocation, then in most cases there is no need to act in a hurry just because the risk-o-meter has changed. In most cases, the risk levels would change within the permissible limits for the scheme. For example, in case of a flash crash in stocks, a balanced advantage fund would end up investing more in stocks, if its allocation model gives more importance to valuation. In such cases the risk-o-meters may show higher risk.

“But if the fund house has proposed a change in the potential risk class matrix of the scheme, then you should study it in detail or seek expert advice,” Savanur adds.

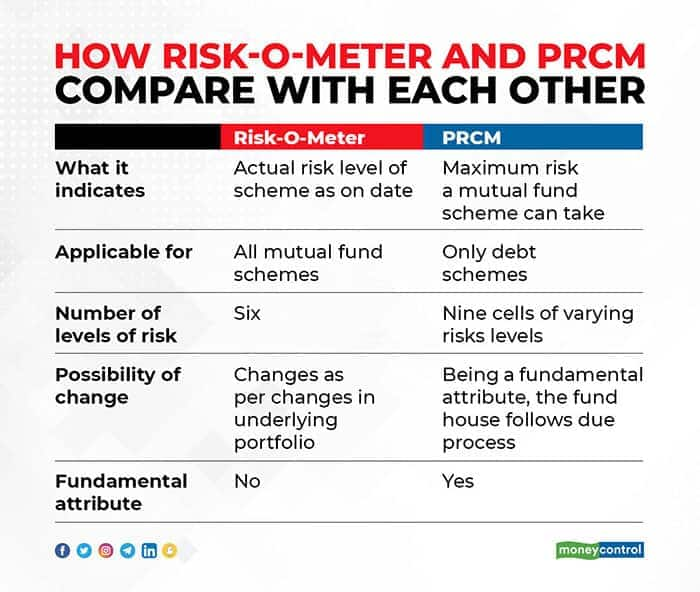

A scheme’s risk-class matrix defines the scheme’s boundaries within which the scheme must operate. Any changes within these boundaries get reflected in your scheme’s risk-o-meter.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.