After COVID-19 first wave hit the Indian shores last year, the central government and regulators had scrambled to roll out relief measures for the economy and individuals.

Allowing employees to dip into their employees’ provident fund (EPF) corpus to tide over the COVID-19-induced financial crunch was amongst the key measures and a number of employees did utilise this option. As on May 31, Employees Provident Fund Organisation (EPFO) had settled over 76.31 lakh COVID-19 advance claims, with disbursals amounting to Rs 18,698.15 crore. Now, this relaxation has been extended further due to the second wave. Such claims will be prioritised and settled by the EPFO within three days.

In addition, the labour ministry has also brought the dreaded Mucormycosis or Black Fungus into the ambit. Terms, conditions and the procedure for the making the withdrawal remain unchanged. The withdrawal will not attract any tax.

However, financial planners caution against making use of the facility simply because it’s available, without exploring alternatives. “A withdrawal from your EPF corpus to meet short-term needs would mean losing out on future compounding benefits. Look to take loans against fixed deposits and gold that is lying in your house unutilised. Your losses will be lower in such cases. EPF is a long-term retirement benefit that you need for your future security,” explains Mrin Agarwal, Founder-Director, Finsafe.

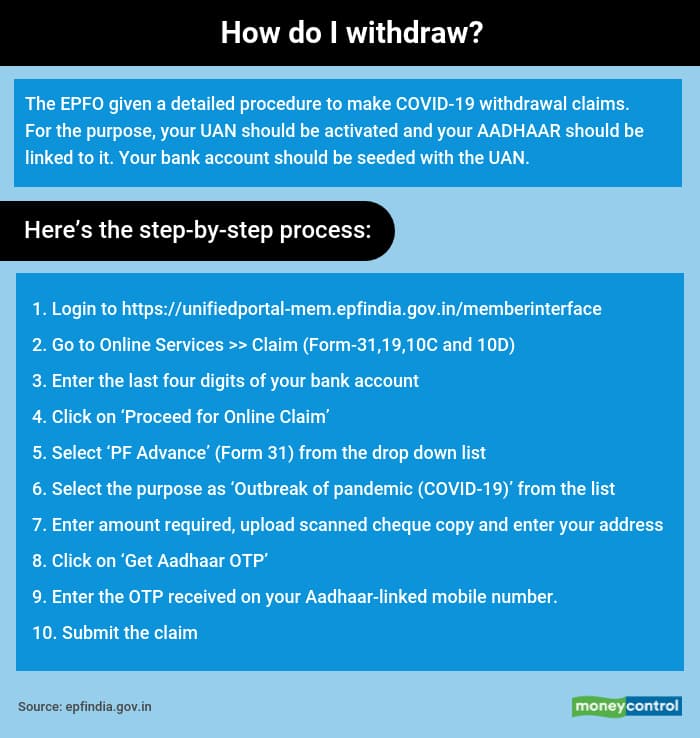

If you have exhausted all other options, however, here’s what you need to know about availing of this non-refundable COVID-19 ‘advance’:

Who can make withdrawals citing COVID-19 hardships?All employees who contribute to the EPF by way of mandatory deduction of 12 percent from their basic salaries every month can use this facility. According to the finance minister, this will benefit close to 4.8 crore employees registered with the EPFO.

What is the amount that can be withdrawn?You can withdraw up to 75 per cent of your EPF account balance or three months’ basic salary plus dearness allowance, or the amount that you actually need, whichever is lower.

Employers match employees’ PF contribution every month. Out of the employers’ contribution, 8.33 per cent is directed towards EPS (employees’ pension scheme). The EPF balance at any point in time is the sum of employers’ and employees’ EPF contributions plus the interest accrued over time. Put simply, your accumulated PF corpus.

For example, if your EPF balance on March 31, 2021 is Rs 10 lakh and your basic salary is Rs 50,000 per month, you will be able to withdraw only Rs 1.5 lakh. On the other hand, if your balance is Rs 2 lakh and basic monthly salary amounts to Rs 51,000, you can still withdraw only Rs 1.5 lakh. That is, lower of 75 percent of the Rs 2-lakh corpus and three months’ basic wages, which amounts to Rs 1.53 lakh in this case.

What constitutes basic wages?Typically, your basic salary and dearness allowance, if any, will constitute basic wages. To figure out the actual amount, you need to check your salary slip. “The salary component on which 12 per cent has been deducted as your PF contribution will constitute basic wages,” explains Parizad Sirwalla, Partner and Head, Global Mobility Services, Tax, KPMG. Typically, this will be the amount tagged as ‘basic pay.’

In 2019, a Supreme Court ruling required employers to include certain allowances that have been paid regularly and uniformly for that employee category in the ambit of basic salary. “Our understanding is that 'basic wages' definition may tend to vary as per the employer. Also, the verdict is relevant largely for relatively low-earners whose basic salary is less than Rs 15,000,” says Archit Gupta, CEO and Founder, ClearTax. For those in the middle and higher-income groups, the basic salary as specified by their organisation will be taken into account.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.