Money manager Franklin Templeton (India) has announced the launch of its first fixed-income fund since it wound up six of its debt funds in April 2020.

Franklin India Ultra Short Duration Fund (FIUSDF) will invest in debt and money market instruments such as non-convertible debentures (NCDs), bonds, certificates of deposits, commercial papers, treasury bills and government securities such that the Macaulay duration of the portfolio is between three and six months.

“The fund aims to offer returns commensurate with moderate credit risk for both institutional and individual investors,” Franklin Templeton–India president Avinash Satwalekar said on August 16.

The New Fund Offer (NFO) will open on August 19 and close August 28. Units will be available at Rs 10 apiece.

The scheme will look to offer the benefits of lower volatility, reduced interest rate risk, and moderate credit risk, making it a good choice for short-term savings. The fund is ideal for investors with a one-six-month investment horizon.

FIUSDF will be managed by Rahul Goswami, Chief Investment Officer & Managing Director, India Fixed Income and Pallab Roy, Portfolio Manager, India Fixed Income at Franklin Templeton (India).

Commenting on the fund launch and its investment strategy, Goswami, said, “FIUSDF is designed keeping in mind a diversified short-duration portfolio aiming for low-interest rate risk and low to moderate credit risk.”

In the current macro-economic scenario and the expectation of the yield curve steepening on the back of high liquidity environment, the fund aims to be well-positioned to deliver a combination of income and capital growth for conservative fixed income investors, he said.

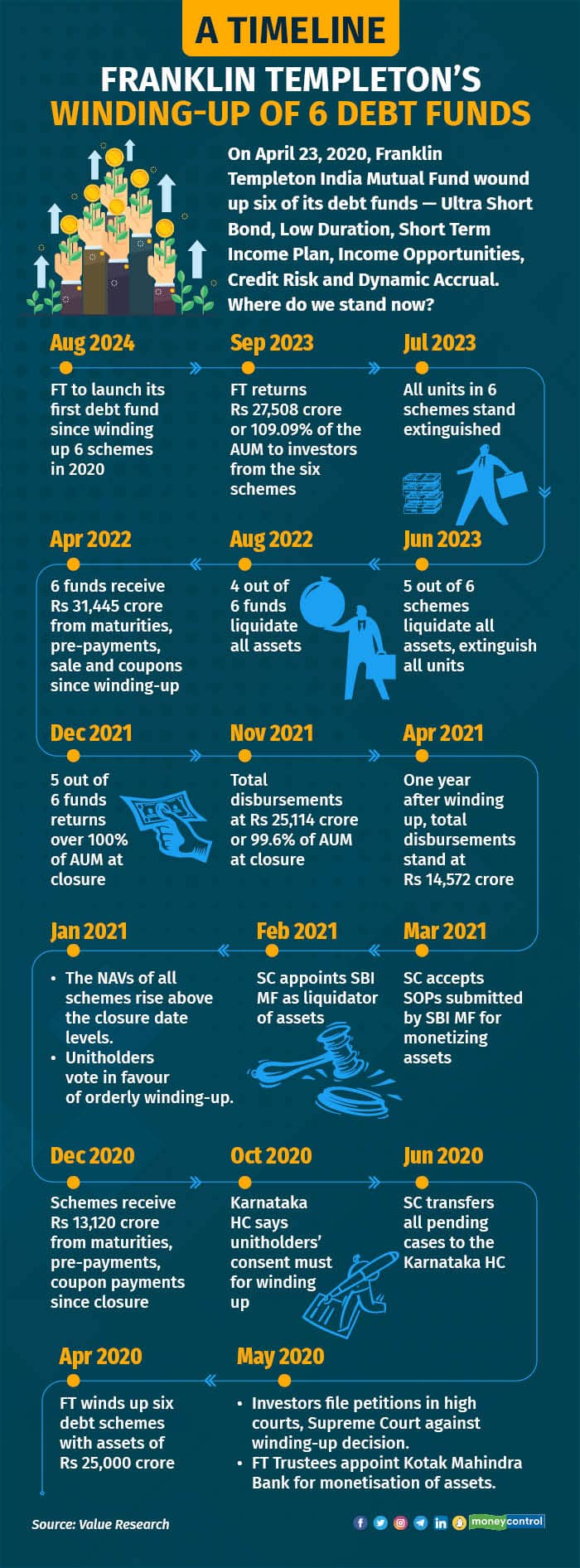

On April 23, 2020, Franklin Templeton India Mutual Fund shocked investors when it announced the winding up of six debt funds — Franklin India Ultra Short Bond Fund (FIUBF), Franklin India Low Duration Fund (FILDF), Franklin India Short Term Income Plan (FISTIP), Franklin India Income Opportunities Fund (FIIOF), Franklin India Credit Risk Fund (FICRF) and Franklin India Dynamic Accrual Fund (FIDAF).

Also read | Turning 30 and still going strong: How Franklin Templeton built wealth in its two oldest schemes

Franklin Templeton has returned Rs 27,508.14 crore amounting to 109.09 percent of the assets under management (AUM) to investors from the six schemes that were closed due to a surge in redemptions during a liquidity crisis in the debt market, triggered by the COVID-19 pandemic.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.