Arbitrage funds, which have made a strong comeback after the changes to the taxation of debt mutual funds, may continue to deliver decent returns, say experts.

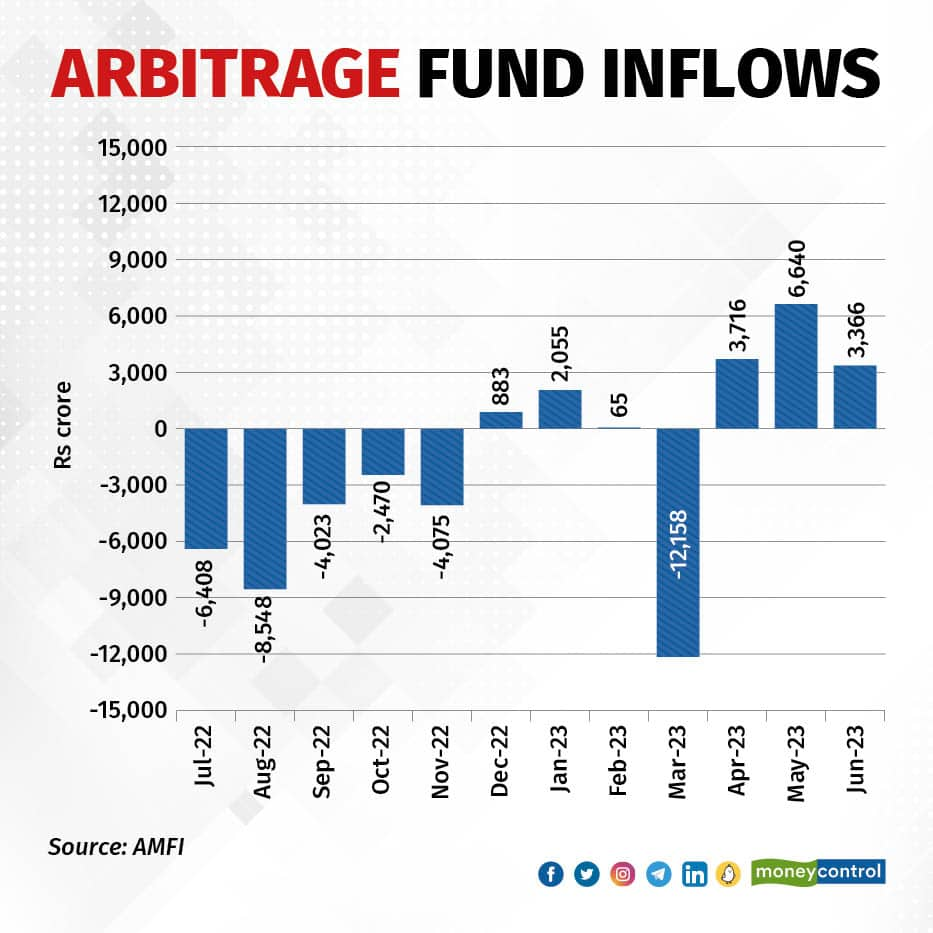

These funds have seen net outflows of Rs 34,678 crore from July 2022 till March 2023. However, since April 1, these schemes have received net inflows of Rs 13,722 crore.

Big tax push

Arbitrage funds allocate a minimum 65 percent to equity and equity-related instruments through spot-future arbitrage.

Put simply, these funds buy a stock in the cash market and simultaneously sell it in the futures market at a higher price to generate returns from the difference in the price of the security in the two markets.

Also read | Six changes in the financial landscape you need to keep an eye on this August

The government, in the Finance Act, 2023, decided that capital gains from debt funds and certain other categories of non-equity mutual funds (MFs) will be taxed at a higher rate. From April 1, gains from MFs with less than 35 percent of their assets in equities are now considered short-term capital gains and taxed at the income tax slab rate of the investor irrespective of the holding period.

This has benefitted arbitrage funds. “There continues to be a large tax arbitrage between debt funds and arbitrage funds, especially for investors who are in higher tax brackets. Arbitrage funds have seen a lot of inflow since the long-term capital gains (LTCG) tax benefit on debt funds was done away with from April 1, 2023,” said Vishal Dhawan, founder and CEO, Plan Ahead Wealth Advisors.

Can arbitrage funds continue to deliver?

On a three-month and 12-month basis, arbitrage funds have on average delivered returns of 1.60 percent and 6 percent, respectively, as per Value Research. Per Edelweiss Mutual Fund’s latest note, the arbitrage fund category experienced inflows to the tune of around Rs 12,000 crore, taking the overall category AUM (assets under management) to Rs 1 trillion.

In terms of market flows, the strong participation by foreign institutional investors (FIIs) supported the large-cap segment, while high-net worth individuals (HNIs) and retail investors drove the mid-caps and small-caps higher. In July alone, the FIIs injected a substantial $3.5 billion.

“Considering factors such as the market hitting all-time highs, strong participation from FIIs and HNIs, increased churn due to the five-week expiry, and sustained volatility in the earnings season, we expect arbitrage returns will be elevated,” Edelweiss MF said.

ICICI Prudential Mutual Fund believes arbitrage spreads in the coming months would be dependent on inflows (higher demand of arbitrage funds will suppress the spread, and vice versa), short-term rates movement (spreads typically move in line with rates), and market direction (a bullish market would result in a higher spread, and vice versa).

“We believe this to be a good time to park funds for three months and above,” said Chintan Haria, Head Investment Strategy, ICICI Prudential Mutual Fund.

JM Financial Mutual Fund says that, “Markets could be volatile in 2023 due to global macro uncertainty. The volatility could help churn the arbitrage portfolio and generate reasonable returns.”

What should investors do?

For the August Options series, market participants will closely observe policy announcements from the central banks of India, the Euro zone, Japan, the UK, and China, where guidance on inflation and economic growth will be of significance.

Keep in mind that when a lot of money starts flowing into arbitrage funds, spreads can compress, resulting in lower yields.

Also read | Midcap darlings of conservative hybrid funds for long term growth

Therefore, a key question for arbitrage strategy is at corpus size will returns get negatively impacted.

Per a note from Invesco Mutual Fund, the arbitrage corpus a market can absorb depends on demand in the futures and options market.

“In the current scenario, the participants seem to be very bullish and hence, the arbitrage spreads have not been dented in a big way in spite of the steep rise in the corpus. In short, we believe that the arbitrage category can absorb more funds. The buoyancy in the spreads indicates that the bullish undertone could continue in the markets,” the fund house said.

Wealth advisors believe arbitrage funds to be a good choice for cautious investors who want to benefit from a volatile market without taking on too much risk.

“With respect to the future direction, we believe that arbitrage funds are good options to consider when investors have at least a three to six-month investment horizon,” said Dhawan.

Investors must not use arbitrage funds (instead of a liquid or overnight fund) if they're looking to park money only for a few days or weeks.

This is because, one, there is an exit load that could come into play, and second, arbitrage returns tend to normalise over three to six months. On a month-on-month basis, they can be volatile.

Therefore, in order to overcome that volatility, it's a good idea to have a three-six month horizon when investing in arbitrage funds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.