The financial year 2024 was a spectacular year for mutual funds as their assets under management (AUM) increased by Rs 14 lakh crore to Rs 53.4 lakh crore, showing a yearly growth of 35 per cent, the government's Economic Survey, tabled in Parliament by Finance Minister Nirmala Sitharaman on July 22, said.

The rise was boosted by the mark-to-market (MTM) gains and expansion of the industry.

According to the Economic Survey, a rise in retail participation was more substantial and steadier through the indirect channel via mutual funds.

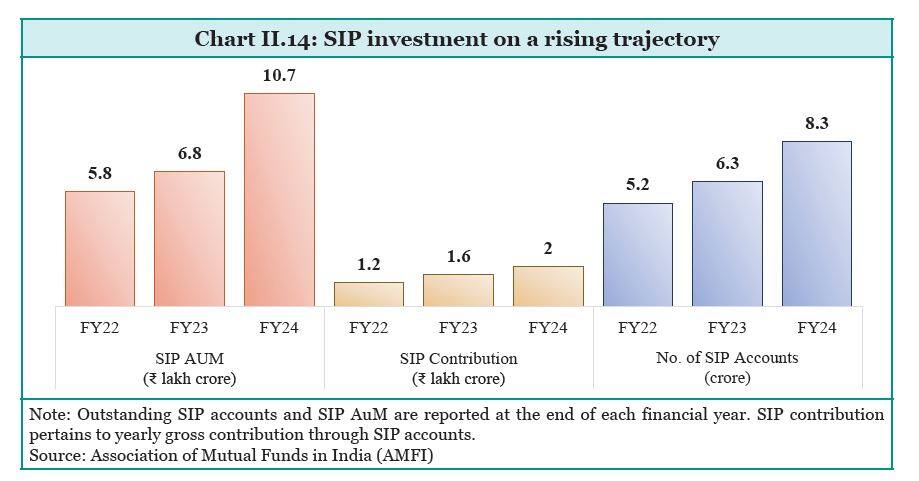

Also read | Economic Survey 2024 Live UpdatesFurther, the Survey highlighted that the mutual fund segment presently has about 8.4 crore systematic investment plan (SIP) accounts through which investors regularly invest in schemes.

“Annual net SIP flows have doubled in the last three years, from Rs 0.96 lakh crore in FY21 to Rs 2 lakh crore in FY24. Total SIP AUM is approximately 35 percent of the AUM of the MF industry for equity-oriented schemes. This has pushed up ownership of MFs in Indian equities to 9.2 percent as of December 31, 2023, compared to 7.7 percent as of December 31, 2021,” the Survey said.

The investment via SIPs rose to Rs 21,262 crore in June against Rs 20,904 crore in May. Monthly investments via SIPs had topped the Rs 20,000-crore landmark for the first time in April 2024.

Moreover, the total number of folios increased from 14.6 crore at the end of FY23 to 17.8 crore at the end of FY24.

The Economic Survey, meanwhile, highlighted that barring income or debt-oriented schemes, all categories of mutual fund schemes witnessed net inflows during the last financial year.

In a big blow to mutual fund investors, the government in Finance Act 2023 had decided that capital gains from debt funds and certain other categories of non-equity mutual funds would be taxed at a higher rate. Experts say that that impacted the appeal of debt funds to an extent and wish for a roll-back.

According to the amendments to the Finance Bill on March 24, 2023, gains from funds with less than 35 percent of their assets in equities do not offer long-term capital gains tax and indexation benefits. Irrespective of when you sell these units, they are added to your income and taxed at your income-tax rates.

Meanwhile, the Economic Survey highlighted that inflows into growth or equity-oriented and hybrid schemes accounted for more than 90 percent of net inflows into mutual funds. Among the passive schemes, exchange-traded funds (ETFs) (other than gold exchange-traded funds) witnessed a 37 percent rise in net assets in FY24.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.