A year after the tax exemption on maturity proceeds of Unit-Linked Insurance Plans (Ulips) on annual premiums of over Rs 2.5 lakh was removed in Budget 2021, the Central Board of Direct Taxes (CBDT) issued detailed rules on how taxes would be calculated.

Maturity proceeds received under such high-value Ulips purchased after February 1, 2021, will not be tax-free under section 10(10D), as was the case earlier. If there are multiple Ulips, the aggregate premium paid will be taken into account.

Under the Income Tax Act, 1961, section 10(10D) allows this tax break on maturity proceeds provided the death benefit is at least 10 times the annual premium. The renewal premiums paid on Ulips bought before February 1, 2021, will continue to be tax-exempt.

Similarly, dependents will not have to pay any tax on any claim amount received after policyholder’s death. “The purpose of the circular is to make certain things clear. For one, in the case of multiple Ulips, the aggregate premiums paid during the year will be factored in, so you cannot bypass the limit by buying several policies with annual premium of under Rs 2.5 lakh. But, if you have multiple policies, the option most beneficial to you will be considered while computing this limit,” says Melvin Joseph, Founder, Finvin Financial Planners.

Also read: How Ulip taxation has brought in a level-playing field with other investments

The CBDT recently framed rules on determining taxability of Ulip proceeds in various scenarios. “There were still challenges pertaining to the methodology to be followed for the purpose of taxing such Ulip proceeds. In the recent circular, the tax department has provided several illustrations to clarify the taxability of Ulips,” says Suresh Surana, Founder, RSM India, a tax consultancy firm.

Here are three key situations you need to understand Ulip proceeds’ taxability.

Scenario #1: Two Ulips purchased on April 1, 2021. Policy A with an annual premium of Rs 2 lakh and Policy B with Rs 3 lakh.

Taxability: Maturity proceeds under Policy A will not attract any tax, but Policy B’s proceeds will.

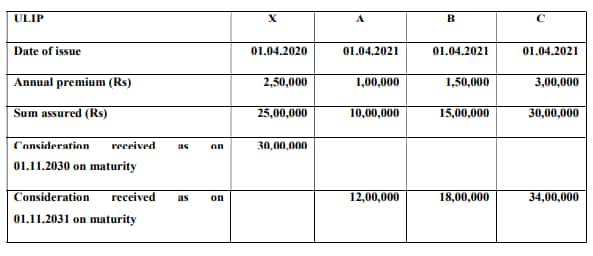

Scenario #2: Policyholder owns one Ulip purchased before February 1, 2021 and has purchased three more with different premium amounts later.

Taxability: Maturity proceeds under Policy A will not attract any tax, but Policy B’s proceeds will.

Scenario #3: Policyholder owns one Ulip purchased before February 1, 2021 and has purchased three more with different premium amounts later.

Taxability: In this case, proceeds received under Ulip X will not attract any tax. Since the policyholder will pay renewal premiums on this policy in year 2022 as well, that amount will be considered to calculate the aggregate premium. So, maturity proceeds received under Ulip X and Ulip B – with total premium under these policies amounting to Rs 2.5 lakh in 2022 – will be eligible for tax benefits under section 10(10D). Now, Ulip C is certainly not eligible for the tax exemption as the annual premium is more than Rs 2.5 lakh.

Between Ulips B and A, the former has been considered as it’s this combination (X + B) that can help the policyholder maximise the tax relief on offer – maturity amount under B is higher than what has been received under Ulip A. “Here, instead of Ulip B, we could have taken ULIP A as the aggregate of annual premium payable for Ulips X and A is also less than Rs 2.5 lakh during the term of these ULIPs. However, since including Ulip B instead of Ulip A is more beneficial to the assessee, Ulip B has been considered for the exemption,” the CBDT explained in its circular. This is an important clarification, say tax experts. “There was a lot of confusion with respect to the limit of Rs 2.5 lakh and taxability of such Ulips’ maturity proceeds. So now, it is clear that in the case of multiple Ulips, taxpayers can choose the Ulip with higher maturity proceeds to claim the exemption,” Abhishek Soni, Co-founder and CEO, Tax2win.in.

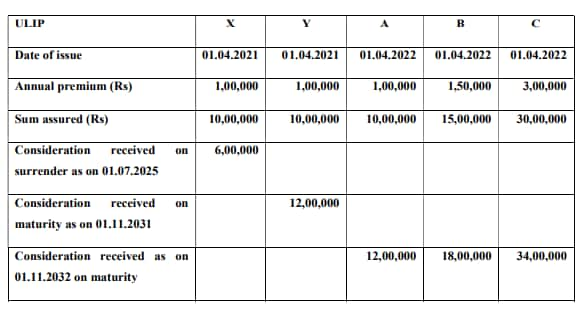

Scenario #4: Multiple policies bought after the Budget 2021 announcement, but one terminated – or surrendered – before maturity.

Taxability: The surrender amount of Rs 6 lakh received under Ulip X will be entitled to the tax exemption, as will be maturity proceeds received under Ulip Y. Since aggregate premium of all these policies put together exceeds Rs 2.5 lakh, Ulips A, B and C will not get the tax break. While Ulip X did get terminated in year 2025, the fact is that aggregate annual premiums beyond the Rs 2.5-lakh limit were being paid simultaneously under all policies from April 1, 2022 to July 1, 2025. And as per the Budget announcement, the exemption is not available if aggregate premiums breach the Rs 2.5-lakh mark in any of the previous years. “In case of multiple Ulips, the aggregate of the premium payable for all the policies which are claimed to be exempt under clause (10D) shall not exceed Rs 2,50,000 for any previous year during the term of any of the policies,” the I-T circular notes.

Source for examples: www.incometaxindia.gov.in

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.