Yesterday, Edelweiss Mutual Fund, India’s 13th largest fund house with assets of just under Rs 90,000 crore, launched the Edelweiss Nifty Midcap 150 Momentum 50 Index Fund (ENM50). This was one among three passive equity schemes of the fund house. ENM50 is also the 21st smart-beta fund to be launched by the Rs 40 trillion Indian mutual fund (MF) industry this year. The fund will invest in a basket of 50 stocks, drawn from the Nifty Midcap 150 index.

Overall, the Indian MF industry now has 35 smart-beta schemes with assets under management (AUM) of at least Rs 2,700 crore as on October 2022-end. The concept is relatively new in the Indian equity investment space, but garnering popular interest very fast. 21 of 35 smart-beta funds were launched in the last one year itself; the collective AUM of these 21 funds is around Rs 787 crore.

An ETF or exchange traded fund is a way of investing in a diversified portfolio of stocks that mirrors an underlying market capitalisation-based index like the Nifty 50 or Nifty 100. What you get are quality stocks in a diversified portfolio at a low cost because there is no active fund manager involved.

A smart-beta ETF goes a step further and filters stocks from an index to deliver attributes that suit you best. It’s often referred to as an active strategy within a passive structure. This can also be done through an index fund wrapper, where the fund invests in relevant ETFs instead of specific stocks.

Last year around this time, when there were about 13 such schemes already in existence, Moneycontrol had advised a wait-and-watch approach before investing in what was clearly becoming a fad. Has anything changed since? Let’s see.

Do you need smart beta?

Smart beta funds are best defined as portfolios which mirror an index, but remove stocks from it on the basis of filters like value, low volatility, and excess return or alpha, among others.

For example, an index like a Nifty 50 or Nifty Midcap includes stocks based on their market capitalisation. Nifty 50 has the top 50 stocks by market capitalisation. A smart beta index like the Nifty 50 Value 20 index has 20 of the 50 stocks.

Thirty stocks are filtered on the basis of return on capital employed (ROCE), dividend yield, low price to book (P/B) value, and low price to earnings (PE) multiple. In other words, the 20 most-liquid, value, blue-chip companies. Similarly, there are smart-beta indices based on other factors.

Also read | Smart Beta funds are high on quality stocks. Here are their top 10

According to Prableen Bajpai, an independent financial advisor and founder, FinFix Research and Analytics: “These funds offer variations within the passive funds universe. Fund selection risk is the biggest risk we take. If you are investing for the next 15-20 years, there is no certainty around who will manage your active fund investment, and that’s when passive strategies become attractive. Smart-beta strategies can be a part of your long-term portfolio allocation as long as there is no significant overlap in the underlying shares with other fund holdings.”

If you already have one or two large-cap funds, then adding a smart beta ETF, despite its differentiated stock selection, may not be useful as the universe of stocks it’s choosing from is limited and it’s likely that many of those already exist in your portfolio.

Among the various smart beta strategies, Bajpai prefers the Equal Weight index strategy when it comes to recommendations for her clients.

Strategies that suit your goals

Let’s assume you are a conservative investor. Is an actively-managed large-cap fund good enough? How about a passive fund, to be doubly sure? Vivek Rege, founder and CEO, VR Wealth Advisors, says that simply investing in frontline benchmark market indices may not achieve this. “In smart-beta indices, factors such as low volatility or quality are incorporated for the conservative investor,” he explains.

Advisors can guide investors towards the appropriate smart-beta strategy for their long-term growth portfolios. Plus, even where you have no means of accessing a good advisor or are unable to decide which fund manager will consistently deliver over your investment time frame, smart-beta funds can add the required filters to your long-term portfolio without having to manage the fund manager variable.

What you need to look out for

While the category name may suggest that you have a high probability of beating the index, smart-beta ETFs don’t always deliver above benchmark returns.

“When we witness a very polarised rise in the market index, a market capitalisation based index is likely to do better than an equal weight index. On the other hand, in times of broad based rallies, an equal weight index will do better.”

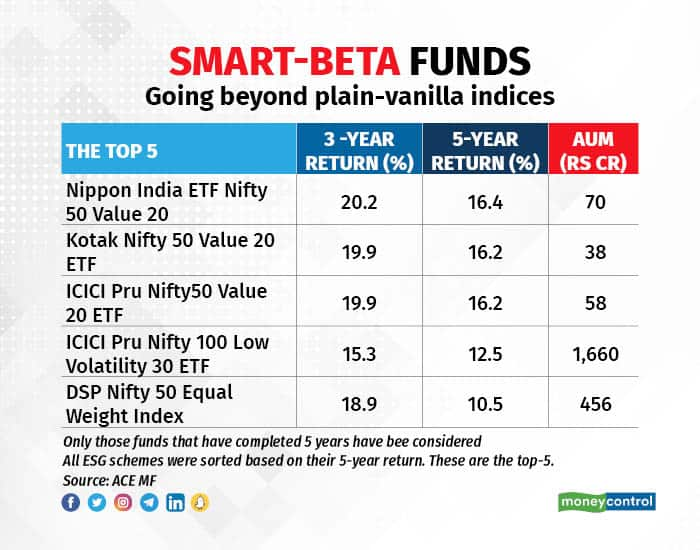

In the last 1-year period, the Nifty equal weight strategy has worked the best among smart-beta funds that have at least 1-year track record. But over the past 5-year time period, the Nifty 50 Value 20 strategy has worked the best.

Similarly, there can be market cycles where smart-beta strategies underperform the broader market capitalisation-based indices. For instance, passive strategies are fully invested regardless of market conditions. Any incremental funds coming in during market corrections have to be invested immediately. This means, investors participate in the downturn as well, when markets correct.

Active managers, on the other hand, can use their discretion in how much to invest while the market is correcting. Even though such asset allocation decisions by active fund managers are no guarantee of performance, it’s a tool in their hands, nevertheless.

The big question is: which smart-beta fund to choose? In simple words, one smart-beta fund can be as different from another as one thematic fund can be from another thematic fund. According to Rege, “There is no evergreen strategy even among smart-beta funds. It is one among many options which needs to be aligned with an investor’s risk profile, and expectations should be clearly spelt out. For example, let’s say an investor begins with a low volatility strategy when the market is in a downturn. When the cycle turns and the market bounces back, such a strategy will most probably underperform the broader market.”

Unless expectations are set right, one may not be able to stay with the strategy for the intended investment time horizon.

Advisors do not recommend using smart-beta funds to maximise returns. Use it more as a means to diversify your portfolio. Last, but not the least, go slow in adding smart-beta funds. Avoid investing in too many of these — like how investors went mad over thematic funds in the 2006-07 market rally.

Dhuraivel Gunasekaran contributed to this story

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.