The market for smart-beta funds has been steadily rising. Today, there are 17 smart-beta schemes with a total size of Rs 2,444 crore, up from just eight schemes with a size of Rs 213 crore in 2018.

Smart-beta funds have been around for longer than five years. But as markets scale new highs and funds cannot roll out more than one scheme per category, many more such funds may be in the pipeline. How different are they from index and exchange-traded funds (ETFs)? Should you invest in them?

What are smart-beta funds?Index funds and ETFs benchmark themselves to indices. There are 34 schemes (ETFs and index funds) that track the Nifty 50 and 14 schemes that follow the Sensex.

The challenge is to outperform these indices and yet avoid fund manager’s risk.

A smart-beta fund seeks to achieve this. The fund management team or data scientists frame rules on which companies get shortlisted. A stock market index is made around these rules based on companies that get regularly filtered. Then the smart-beta fund invests in them. As with an index fund it invests in all the stocks and in the same proportion.

There could be just one factor based on which the index and the underlying companies are filtered, or there could multiple factors. For example, Nifty Alpha Quality Low Volatility 30 index is designed to reflect the performance of a portfolio of stocks selected based on a combination of Alpha, Quality and Low-Volatility. Or, it could be a ‘momentum’ factor – a stock with the tendency to rise during raging markets is expected to continue in that mode and vice versa.

There is no fund manager intervention here. Factors, once decided, are not expected to change. It’s just an algorithm that runs and maintains the index. All the smart-beta fund has to do is to mimic that index.

In many ways, smart beta funds are an extension of pure passive funds.

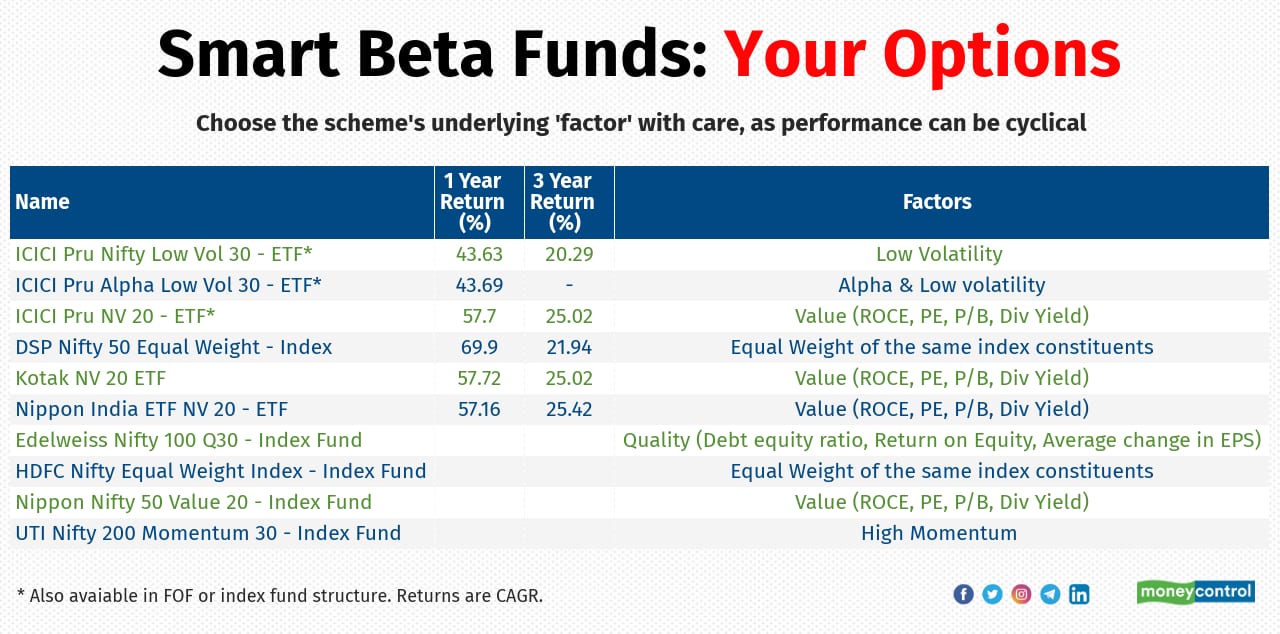

How do you get access?Choosing a smart-beta fund is not that easy. There are around 20 factor indices from the NSE stable. These are known as Strategy Indices. One index (with a set of factors) can be vastly different from the other.

A team of data scientists works to prepare factors and indices, and back-tests them to ensure they work in various market conditions. Due to their involvement, the expense ratios of such funds are higher than pure index schemes and ETFs.

Does your portfolio need a smart-beta fund?The term smart beta suggests that somehow these schemes are better than regular, plain vanilla index funds and ETFs. There is no evidence to support that observation.

It is difficult to ascertain in advance as to which factor may be more impactful in a particular market cycle. Long-term performance and consistency data is not available, as these schemes don’t yet have a history which is long enough. Theoretically, multi-factor based smart beta funds are meant to dilute the cyclicality of single-factor funds.

For a first-time investor in equity funds, these are avoidable. You should ideally start with simple index funds to gain experience in market-linked investing. Those with experience in investing in mutual funds regularly, may invest selectively in smart-beta funds for the satellite portion of their portfolio.

Ensure that you understand the underlying factor filter being applied. Do not just go by past returns.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.