Select mutual funds, particularly, small and midcap schemes were the saviour for investors throughout 2017 even as the domestic equity market wiggled through uncertainty and multiple domestic as well as global headwinds.

A spate of outflow of portfolio money from foreign institutional investors and scars of demonetisation hurt domestic stocks through the year.

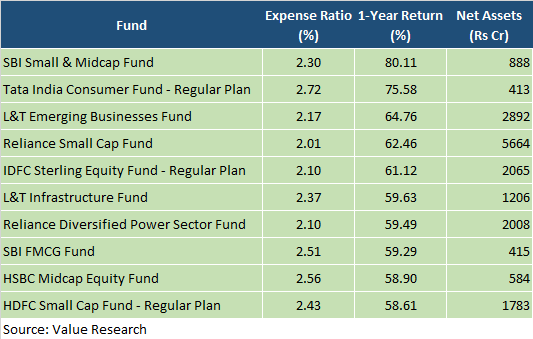

Among the best-performing funds, SBI Small & Midcap Cap Fund topped the chart, with a whopping 80 percent gains between January and December 2017 while the benchmark S&P BSE Small Cap Index delivered 59 percent return during this period.

“Overall (small cap) category has given upward of 50 percent. This (SBI Small & Midcap) Fund managed to contain its AUM (asset under management) as it had stopped accepting fresh investments,” Vidya Bala, Head of Mutual Fund Research at FundsIndia.

The scheme deploys in a diversified portfolio of equity and equity-related securities of small and midcap companies and is managed by R.Srinvisan.

Other small and midcap funds that featured among the top 10 wealth creators were HDFC Small Cap Fund, Reliance Small Cap Fund, HSBC Midcap Equity Fund and L&T Emerging Businesses Fund. They delivered average returns in the range of 58-64 percent.

With an expense ratio of 2.72 percent, Tata India Consumer Fund gave 76 percent average returns during the period under review. The top 5 holdings of this fund were Hindustan Unilever, Maruti Suzuki India, Future Retail, Zee Entertainment, and Raymond.

Most consumption stocks had rallied after the GST Council in its 23rd meeting made big changes to the tax framework, pruning the tax rates on over 200 consumer items.

Also Read: Mutual funds see more inflows: RBI report

Market experts said that consumption sector is expected to continue its robust performance in 2018 as well.

A report from Motilal Oswal Financial Services titled 'India Strategy' stated that, "The performance of consumer-oriented sectors indicates towards a revival in consumption. We expect this trend to strengthen in 2HFY18."

"We also expect initial teething issues related to GST to normalize and trade channels to revert to normalcy, especially wholesale and rural supply chains. Potential of consumption stimulus in the CY18 budget (the final budget before the general elections of 2019) could also provide a consumption catalyst."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.