Mutual funds purchased shares worth over Rs 8,100 crore in Kotak Mahindra Bank in April following a significant sell-off triggered by the Reserve Bank of India's ban on new customer onboarding by the bank via online and mobile banking, along with the suspension of new credit card issuance.

During the month, these funds acquired around 4.62 crore shares of the bank, following the purchase of over 96 lakh shares in the December quarter. This marked the ninth consecutive month of mutual fund buying activity in Kotak Mahindra Bank.

On April 29th, the RBI's ban on Kotak Mahindra Bank acquiring new customers led to the stock plummeting over 11%, wiping out over Rs 40,000 crore in market capitalisation in a single day. The stock experienced a 9 percent decline in April alone; year-to-date in 2024, it has dropped over 15 percent. In contrast, in 2023, it saw gained 4.4 percent.

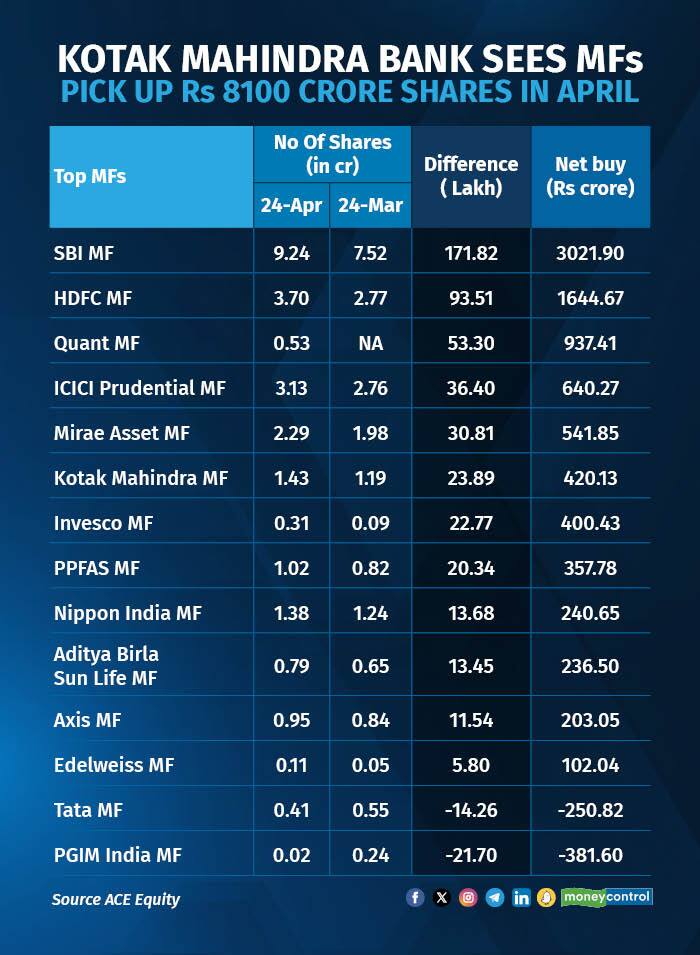

In April 2024, 39 mutual funds collectively held around 30.24 crore shares of Kotak Mahindra Bank, up from 25.63 crore in March. The value of these shares rose to Rs 53,186 crore from Rs 41,663 crore. Among these funds, 29 increased their holdings, 9 reduced their stakes, and one, NJ Mutual Fund, maintained its holding at Rs 24.5 crore.

SBI Mutual Fund emerged as the largest holder with 9.24 crore Kotak Mahindra Bank shares worth Rs 15,000 crore in April, up from 7.52 crore shares valued at Rs 13,420 crore in March. HDFC Mutual Fund followed with 3.71 crore shares valued at Rs 6,011 crore, up from 2.77 crore shares worth Rs 4,939 crore. ICICI Prudential MF held over 3.13 crore shares valued at Rs 5,082 crore, up from 2.77 crore shares worth Rs 4,936 crore. Among the sellers, PGIM India MF and Tata MF divested around Rs 381 crore and Rs 250 crore worth of shares in the lender, respectively.

After the stock cracked in late April following the RBI action, several brokerages maintained ratings and targets for Kotak Mahindra Bank despite RBI restrictions, anticipating a limited impact.

The RBI banned new customer onboarding and credit card issuance by Kotak Mahindra Bank due to IT issues, mandating an external audit. Brokerage Emkay downgraded Kotak Bank, lowering its target price by 10 percent. Morgan Stanley expects temporary stock price effects but a limited earnings impact.

Kotak Bank's credit card business accounts for 4 percent of loans, with growth hindered by restrictions. Analysts monitor tech spending and branch expansion. Macquarie highlighted the strictness of the RBI's order compared to others, suggesting a potential medium-term devaluation. HSBC predicts a 2-5 percent EPS decrease and a 5-6 percent RoA loss in the credit card business, offset by growth in other portfolios. EPS estimates have been revised downwards for FY25-27.

Apart from Kotak Mahindra Bank, the top picks for mutual funds included Vodafone Idea (Rs 3244 crore), Axis Bank (Rs3112 crore), Reliance Industries Ltd (Rs2597 crore), Infosys (Rs 2109 crore), HUL (Rs 1950 crore) and HDFC Bank (Rs1716 crore).

State Bank of India led in selling, with mutual funds withdrawing Rs 1,666.94 crore, followed by Bajaj Finance, which divested around Rs 1,166 crore, and L&T, which offloaded around Rs 979 crore. Other stocks that witnessed selling include Mahindra & Mahindra (Rs 848 crore), Divi's Lab (Rs 810 crore), Interglobe Aviation (Rs 804 crore), ICICI Bank (Rs 622 crore), and Nestle India (Rs 566 crore).

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.