Highlights

Karur Vysya Bank (KVB, CMP: Rs 247.7 Market Cap: Rs 19,924 crore, Rating: Overweight) has seen a steady improvement in its financial performance and has been a stellar performer in the past three years. The bank delivered a good set of earnings in FY25 - marginal compression in interest margin, business growth ahead of the system, traction in fees, cost control, and pristine asset quality. While the steep cut in system interest rates spell bad news for margins, especially with a large floating rate book, till liability costs adjust; we see valuation as a draw for long-term investors.

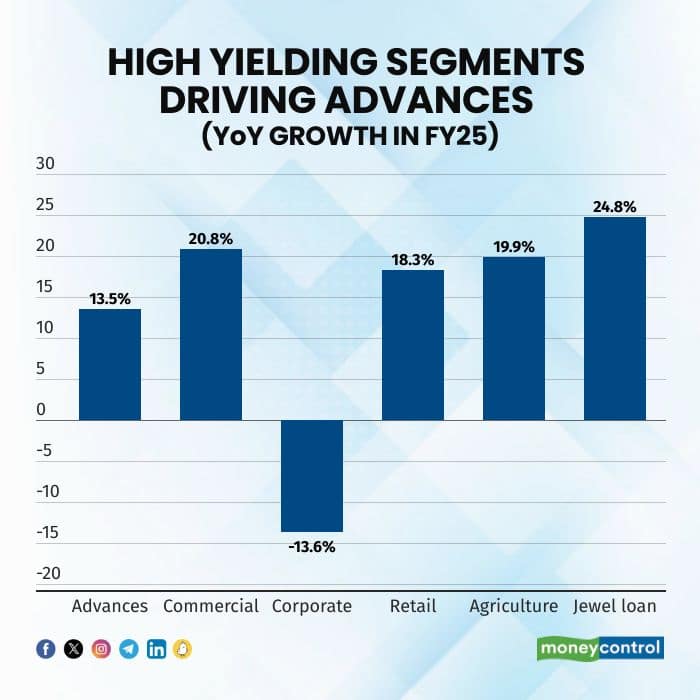

Improving composition of advances

KVB reported a loan growth of 13.5 percent in FY25 which was ahead of the system. More importantly, the growth was driven by relatively better-yielding segments such as commercial, retail, and agriculture. Gold loans, mostly a part of agriculture loans, also showed strong growth. The bank consciously stayed away from corporate loans because of the thin margin as it prioritised profitability over growth.

Source: Company

In FY26, the management is targeting to grow at least 200 basis points ahead of the industry, although the approach would be to grow commercial retail and agriculture and not push the accelerator on corporate till the cost of liability moderates.

Deposits remain a challenge

Overall growth in deposits has been ahead of the system at 14.5 percent YoY. However, term deposits were the sole driver with muted performance from low-cost CASA (current and savings account) and a decline in the share of CASA to 27.3 percent of total deposits from 30.4 percent in the year-ago quarter. Garnering deposits remain a challenge. With a focused strategy of deploying manpower as well as branch expansion, the bank is trying to address the same.

Source: Company

Nevertheless, with the sequential growth in deposits at 2.9 percent in Q4 being ahead of advances at 2 percent, the bank managed to marginally reduce its credit-to-deposit ratio by 70 basis points sequentially to 82.8 percent.

Interest margin stable but likely to decline

The bank saw 11 basis points improvement in yield on funds, thanks to the rise in yield on advances as well as investments. Thus, despite the 9 basis points sequential rise in the cost of funds, driven mainly by the cost of deposits, the bank saw a marginal sequential uptick in its interest margin in Q4.

Source: Company

However, the road ahead may be difficult as the bank has a large floating rate book — 52 percent linked to the EBLR (external benchmark) and 37 percent linked to the MCLR — that gets repriced down faster with a rate cut whereas liabilities reprice with a lag. The bank is thus guiding to an interest margin of 3.7-3.75 percent compared to 4.09 percent in FY25. We do expect pressure on NIM at least in the first three quarters of FY26.

However, with a pivot towards a high-yielding book and a negligible share of unsecured (2.2 percent of advances), the bank has headroom to grow the high-yielding piece that remains a key lever for margin gains in addition to the improving composition of deposits.

Asset quality strong

With negligible exposure to unsecured retail and micro-finance (only 37 basis points of loans), KVB continues to maintain pristine asset quality with a lower slippage at 57 basis points in FY25.

Source: Company

Thanks to the recovery as well as write-offs, gross NPA declined sequentially and gross and net NPA as a percentage of advances remained benign at 0.76 percent and 0.2 percent respectively with a provision cover of 74 percent. The credit cost for the full year was 71 basis points. The bank is creating a solid provision cushion with a Rs 25 crore prudential provision every quarter.

The SMA (Special Mention Accounts/overdue book) of 30-day plus of 30 basis points also indicates negligible NPA formation.

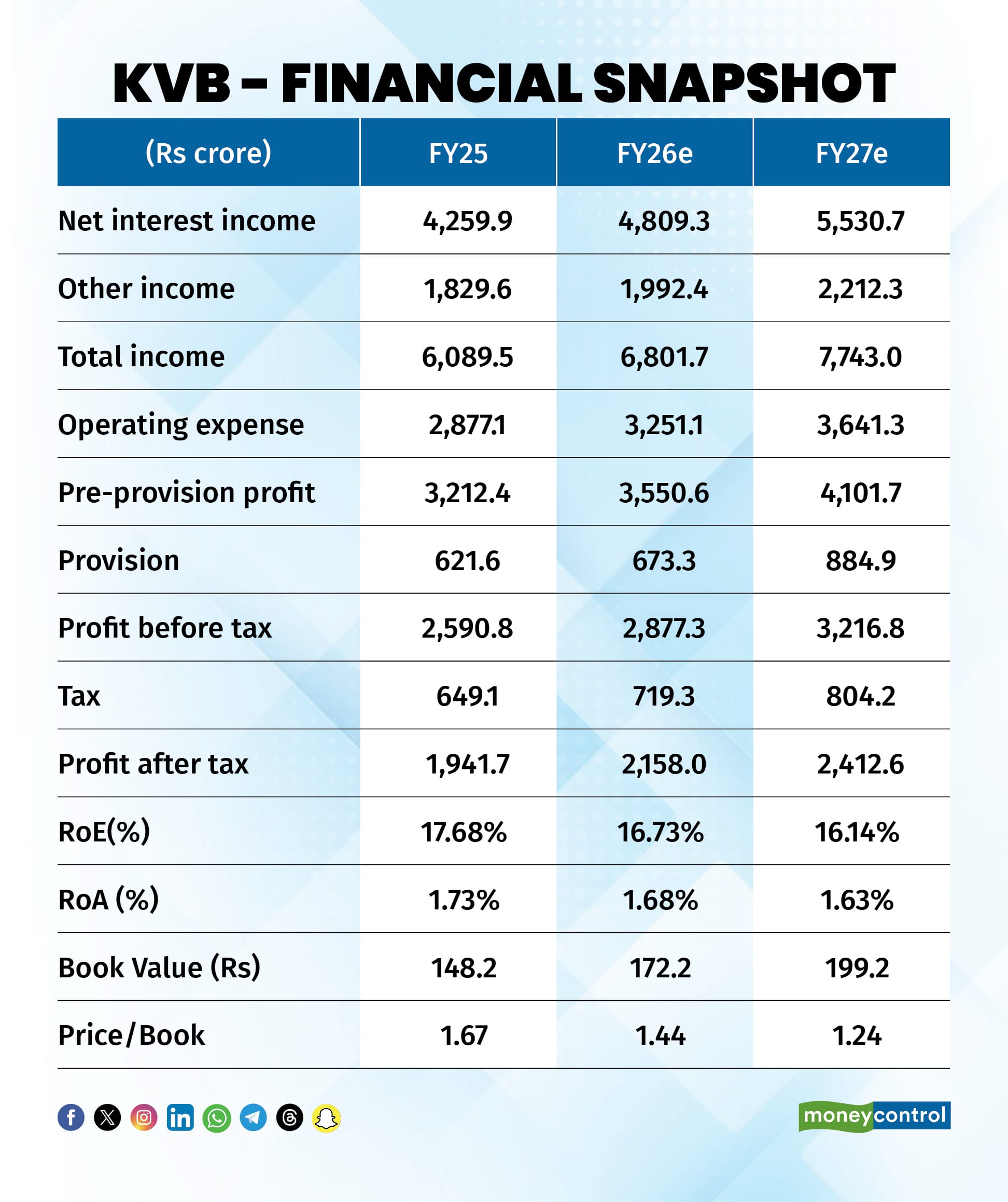

RoA decline on the cards?

The fall in interest margin will be a near-term drag and we feel credit cost has bottomed out. Despite spending on manpower and network to win market share in deposits and garner CASA, the YoY growth in operating expense has been well contained at 9 percent for the year with a cost-to-income ratio of 47.2 percent. We do not see much room for cost rationalisation. Non-interest income should be steady on fees as well as the rock-solid support from recovery in written-off accounts. Overall we see moderation in the return on assets (RoA). The bank is guiding to RoA of 1.55-1.65 percent.

Despite the decline in RoA and the moderation in earnings, we feel the steady execution and reasonable valuation make a case for long-term investment and accumulation on decline.

Source: Company, Moneycontrol Research

Key risks: A severe worsening of asset quality or slow growth due to the economic slowdown or inability to garner deposits

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.