Highlights

While most stocks in the sector are trading sideways as investors assess the long-term impact, Sirca Paints (CMP: Rs 419; Market Cap: Rs 2,295 crore; Rating: Overweight), a leading player in the paints and wood coatings space, has emerged as a notable out-performer.

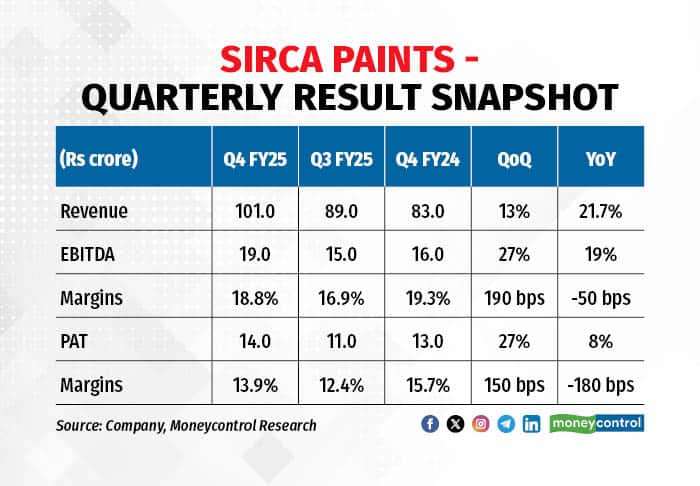

The company posted an impressive 22 percent year-on-year (YoY) revenue growth in Q4FY25, marking a strong recovery, after several quarters of muted performance and margin pressure.

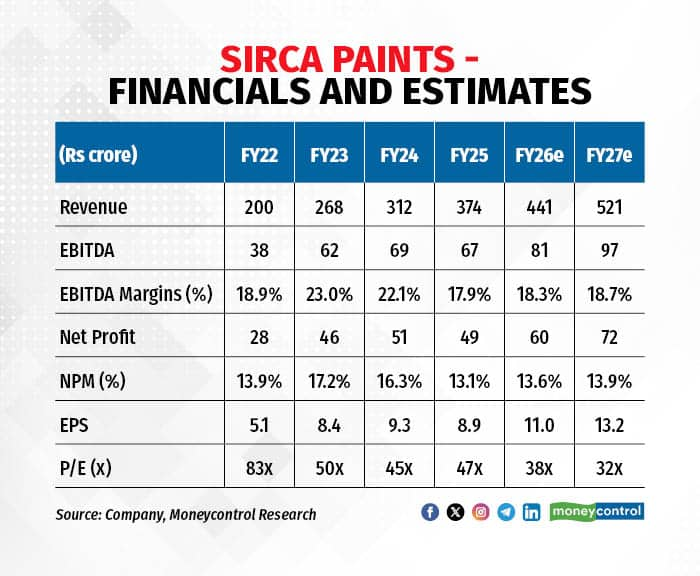

This turnaround has propelled the stock over 61 percent since our March 2025 recommendation to accumulate. But with competitive intensity rising and margin headwinds still a concern, the key question is: is the rally sustainable?

Portfolio expansion, strategic partnership

Sirca continues to diversify its product portfolio across the entry-level, economy, and luxury segments. Its partnership with Italy’s OIKOS S.P.A. has been a key growth driver, bringing in high-value, eco-friendly products with A+ air quality standards.

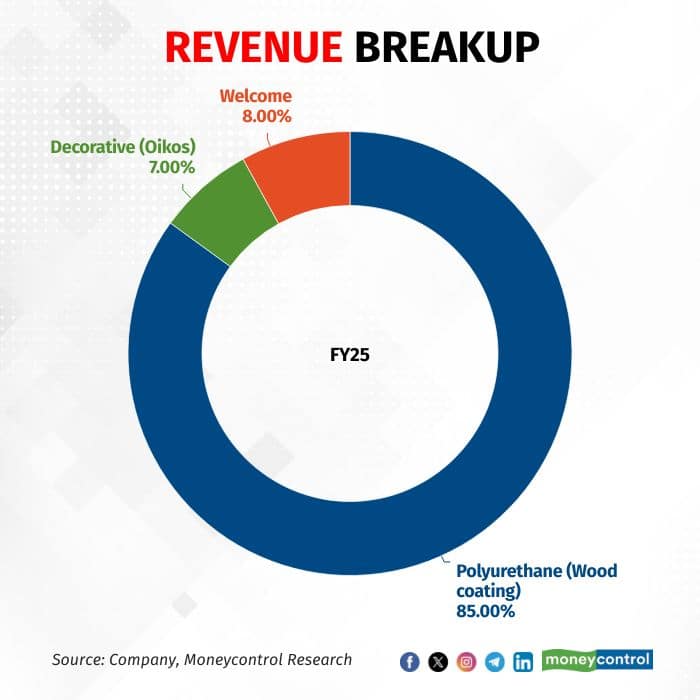

While the high-margin decorative and luxury segments—especially OIKOS offerings—are gaining traction, the economy decorative segment is witnessing increased competition. In FY25, decorative paints, including OIKOS, contributed 7 percent to the company’s revenue.

To strengthen brand visibility and customer engagement, Sirca is investing 4–5 percent of its revenue in marketing and promotions. The company is also preparing to launch ultra-premium wall paints in collaboration with OIKOS, targeting the luxury home décor segment. Additionally, Sirca is expanding its presence in emerging markets like Madhya Pradesh, Chhattisgarh, the North-East, and South India, supporting its pan-India growth ambition.

Dealer expansion on track

Dealer expansion on track

Sirca generates nearly 70 percent of its revenue from northern India. To build a stronger pan-India presence and reduce regional dependency, the company is actively expanding its dealer network across other parts of the country. As of FY25, Sirca’s dealer and distributor network has grown to over 4,000, which also includes the dealer network of its recently acquired Welcome brand. This expansion is aimed at driving growth and strengthening its position in new and under-penetrated markets.

Expands capacity, eyes global export growth

Sirca has expanded its Sonipat manufacturing unit’s capacity from 12,000 tonnes to 16,000 tonnes. The current capacity utilisation stands at 55-60 percent, and it is expected to reach 70-75 percent over the next 1-2 years, with a single-shift operation.

Exports present a significant opportunity for Sirca, with the company targeting 20 million euros in exports to Russia, the UAE, Saudi Arabia, and Estonia for economical PU products, pending final approval from Sirca Italy for product quality checks. The current facility is well-equipped to handle export demand.

Sirca plans to set up a manufacturing facility in Dahej with an estimated investment of Rs 20–25 crore, which will add an additional capacity of 16,000 tonnes. The company is also exploring inorganic growth opportunities, including potential expansion into the metal coatings segment. To support its upcoming capital expenditure plans, Sirca is raising Rs 76 crore through a preferential issue.

Welcome brand to drive growth

The acquisition of the Welcome brand is progressing well and is strengthening Sirca’s presence in the value segment. The addition of products like sanding sealers, lacquers, enamels, and melamine expands its portfolio to tap industrial demand. Despite weak consumer sentiment, Sirca has generated Rs 35 crore in revenue from the Welcome brand in 9MFY25.

Outlook & valuations

Sirca Paints has continued to show strong revenue growth, but margins have come under pressure in recent quarters due to higher dealer incentives. Going forward, we expect margins to stabilise with a better product mix and increasing contribution from the Welcome brand. The stock has seen a strong rally in the past four months and is now close to its all-time high of Rs 430. Despite rising competition, we believe Sirca can still grow at 15–20 percent annually. While the recent rally may be factoring in short-term optimism, the long-term growth story remains strong. At 32x FY27 estimated earnings, we remain positive on the company’s future.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.