Sachin Pal

Moneycontrol Research

The cement sector started FY19 on a strong note as majority of companies recorded healthy volume growth in the first quarter. On the cost front, companies are showing minor improvement on a quarter-on-quarter (QoQ) basis as rising input pressures appear to have stabilised.

FY18 had turned out to be a challenging year as the industry faced multiple disruptions like sand mining and petcoke ban and rising fuel prices. However, the worst seems to be over as some of these issues appear to have been resolved. The industry is looking ahead to improved capacity utilisation in coming years as demand environment (led by pick-up in infrastructure and housing) is expected to remain buoyant. We have analysed the performance of Star Cement, Heidelberg Cement and Shree Cement to check which ones are worthy of investment at this juncture.

Q1 FY19 results snapshotStar Cement, the largest producer in the northeast, reported strong topline growth for the June quarter. Volume growth of 14 percent year-on-year (YoY) and improved realisations drove the double digit growth in topline.

Volumes stood at 0.81 million tonne (MT) compared to 0.71 MT YoY. This was driven by strong demand in the northeast. Realisations dipped 3 percent on a quarter-on-quarter (QoQ) basis on account of higher clinker sales (jumped more than 90 percent YoY).

Operating profit margin declined over previous quarters on account of rising cost pressures. Expenses came in higher due to multiple factors. Freight expenses jumped as related subsidies of around Rs 300/tonne expired in January. Rising petcoke and coal prices resulted in increased fuel expenses. Besides these, the company also incurred advertisement expenses of Rs 100/t, which dragged operating margin lower.

Clinker utilisation reached near full capacity and has been displaying this trend for the last two quarters. To meet additional demand, Star Cement is planning to expand clinker capacity from 2.6 MT to 3 MT by investing around Rs 15 crore.

The management plans to set up a 1.5-2 MT grinding unit in Siliguri (West Bengal) at a cost of Rs 200-250 crore. This capacity is expected to turn operational by the second half of FY20.

It expects volume growth momentum to continue as a number of infrastructure projects have been announced in the region in recent months. The management also expects earnings before interest, tax, depreciation and amortisation (EBITDA) per tonne to improve Rs 1,800-1,850 from Rs 1,600 witnessed during the quarter gone by.

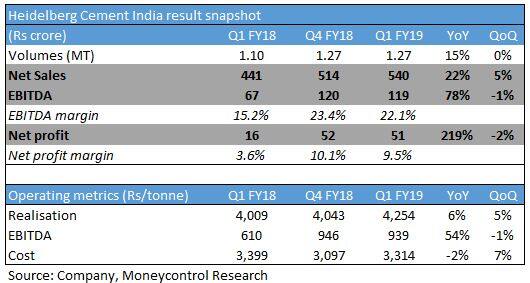

Heidelberg Cement reported a strong Q1 FY19 with sales and EBITDA growth of 22 percent and 78 percent YoY, respectively. It recorded volume growth of 15 percent owing to a strong demand in the central region.

Players in the central region (comprising Madhya Pradesh and Uttar Pradesh) continue to have strong pricing power. The company reported 5 percent QoQ improvement in realisations. Amid strong demand from rural markets in MP and UP, the company hiked cement prices by Rs 15-20 per bag in June.

Operating leverage from higher capacity utilisation, cost benefits from its Waste Heat Recovery System plant and conveyor belt offset the increased cost pressures and resulted in the sharp jump in operating profit to Rs 119 crore in Q1.

EBITDA per tonne stood at Rs 939 compared to Rs 610 in the same period last year as the company benefitted from premiumisation as well as strict cost control measures.

Capacity utilisation during Q1 was more than 90 percent. Going forward, the company plans to incur small capex to debottleneck its existing capacity.

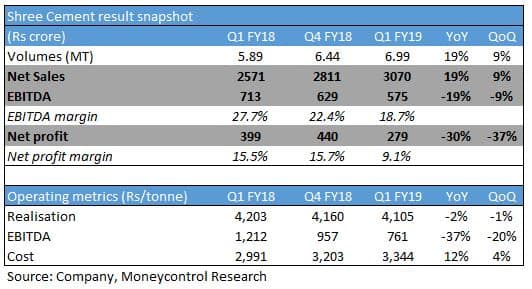

Shree Cement reported a healthy topline growth of 19 percent in the quarter gone by on the back of over 18 percent volume growth accruing from demand in its key operating markets. The company reported 12 percent and over 35 percent volume growth in northern and eastern markets, respectively.

Despite the strong topline growth, EBITDA declined 19 percent YoY to Rs 575 crore owing to increased cost pressures and forex losses. On a segment basis, operational performance was particularly weak in the cement segment, which dropped to Rs 532 crore (versus Rs 715 crore in Q4 FY18 and Rs 616 crore in Q1 FY18). This was partly offset by power segment, which reported a strong jump in EBITDA to Rs 42 crore in Q1 (versus Rs 13.5 crore in Q4 FY18 and Rs 1.4 crore loss in Q1 FY18).

Additionally, EBITDA was also impacted by a mark-to-mark forex loss of around Rs 70 crore on account of external commercial borrowing (ECB) drawn to fund the acquisition of UAE-based Union Cement Company (UCC). Earlier this year, it acquired the 3 MT clinker unit of UCC for an enterprise value of around $305 million.

During Q1, it completed the acquisition of UCC and also commissioned a 3 MT cement plant unit at Gulbarga (Karnataka).

The management expects slight improvement in Q2 operating margin as exit prices in northern and eastern regions were higher than the Q1 average.

Outlook and recommendation

With a pick-up in infrastructure development activities, overall demand is expected to remain firm. Government spending on infrastructure, along with affordable housing schemes, should propel cement industry growth to 7-8 percent in the current fiscal.

We prefer Heidelberg Cement and Star Cement from the above mentioned names. Heidelberg Cement has a strong positioning in the central market and a superior margin profile compared to its similar sized peers. Firm cement prices in the central region along with strong operating leverage is expected to aid Heidelberg Cement’s earnings over the next 12-15 months. The stock has seen a strong rally after its Q1 result and is now trading at a FY19 enterprise value/EBITDA multiple of 10 times. We therefore advise investors to accumulate this stock on dips.

Despite the lacklustre quarterly performance, Star Cement stands to benefit from its strong presence in the northeast and industrial development in this region. While the demand picture looks robust, the company is facing a challenging cost environment with rising input costs and expiry of freight subsidy. Star Cement with its unique geographical positioning is well positioned to overcome near term cost pressures. The company is trading at a FY20e EV/EBITDA multiple of nearly 9 times and remains our top pick from the midcap cement sector from a long term perspective.

Also read: Prefer Heidelberg, Sanghi Industries from midcap cement pack

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!