Sachin Pal Moneycontrol Research

The cement sector ended FY18 on a strong note as majority of companies recorded decent volume growth in the last quarter. On the cost front, last fiscal turned out to be a challenging year as the industry faced multiple disruptions in the form of a ban on sand mining and petcoke and rising fuel prices. However, the worst seems to be over as some of these issues appear to have been resolved.

The industry is looking forward to improved capacity utilisation in coming years as demand environment, led by a pick-up in infrastructure and housing, is expected to remain buoyant. So, which are the midcap cement companies worthy of investment at this juncture?

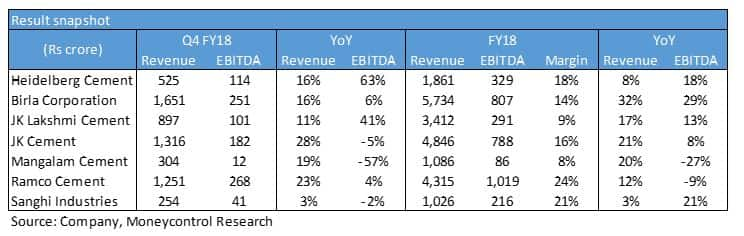

Result snapshot

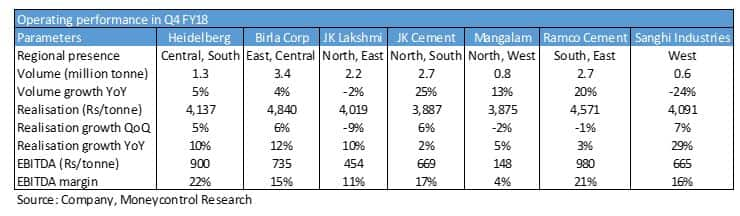

Heidelberg Cement reported a strong set of fourth quarter earnings, with year-on-year (YoY) sales growth of 16 percent and earnings before interest, tax, depreciation and amortisation (EBITDA) increase of 63 percent. Volumes grew 5 percent YoY owing to a strong demand in the central region. Operating leverage from higher capacity utilisation along with cost benefits from its waste heat recovery system plant and conveyor belt resulted in operating profit surging 63 percent YoY.

Birla Corporation, which mainly operates in the central region, posted a topline growth 16 percent, in line with that of its competitor Heidelberg Cement. EBITDA grew 6 percent YoY as profitability of its Chanderia plant was impacted by the petcoke ban and sand mining issues in the region.

JK Lakshmi Cement’s revenues increased 11 percent YoY to Rs 897 crore due to improvement in realisations as volumes remained flat during the quarter gone by. EBITDA increased 41 percent as it benefitted from a decline in inventory.

JK Cement reported a healthy topline growth of 28 percent on account of strong volume growth of over 20 percent across both north and south India. Its north-based plant is operating above 90 percent and its south-based plant is close to touching 80 percent utilisation. Despite the stellar topline growth, EBITDA declined 5 percent at Rs 182 crore owing to weak prices and cost pressure in the grey cement business.

Ramco Cements and Mangalam Cement had a strong topline growth of 23 percent and 19 percent YoY, respectively but profitability remained subdued on account of increasing cost pressures.

Sanghi Industries had a subdued Q4 as its result was impacted by a plant shutdown. Volumes declined 20 percent YoY due to a 15-day maintenance shutdown. However, realisation increased 7 percent quarter-on-quarter as prices remained firm in Gujarat: its core operating market. Operating margin stood at 16 percent (compared to full-year margin of 21 percent) due to a surge in expenses. The company had to source high-cost clinker from outside because of the kiln shutdown.

Central region in a sweet spot

Companies operating (Heidelberg Cement and Birla Corporation) in the central region (mainly Uttar Pradesh and Madhya Pradesh) appears to be in a sweet spot with higher volumes and improving realisations.

In the southern region, Andhra Pradesh and Telangana are seeing a robust pick-up in demand led by a strong pipeline of infrastructure projects. Despite high demand, prices in Andhra Pradesh/Telangana have remained stable due to heightened competitive intensity. Tamil Nadu faced subdued demand in FY18 but the same is expected to reverse as sand shortage issues are being addressed gradually.

UltraTech Cement’s ramp up of JP Associates’ cement capacity has increased supplies in the west and north and is giving stiff competition to players there. Clarity on National Company Law Tribunal’s Binani Cement takeover issue could add more supplies and enhance competitive intensity in the region.

Markets in the east as well as northeast are witnessing strong cement demand and are growing at a faster pace than the rest of India as the government has initiated a number of infrastructure projects as part of the North-East Industrial Development Scheme (NEIDS). This scheme has been designed to promote industrialisation in north eastern states.

Rising costs weigh on margins

The industry is facing a challenging operating environment as some key input costs have surged in the last 1 year. Rise in coal (up 8-10 percent YoY) and petcoke prices (up 20-25 percent YoY) have resulted in an increase in power and fuel costs. Increase in diesel prices (up 20-25 percent YoY) impacted freights costs. Fuel and freight costs constitute around 40 percent of total operating expenses and is excreting downward pressure on operating margins.

Business operations and profitability in mid-2017 was impacted by the sand mining ban. Uttar Pradesh, Madhya Pradesh, Tamil Nadu and Telangana were impacted by lack of sand availability due to the ban on illegal mining. This has now been resolved as the ban has been revoked.

Amid increasing competitive intensity and rising input costs, companies are increasingly focusing on cost controls (by looking for alternative fuels) and optimising cost structure.

Outlook and recommendation

With a pick-up in infrastructure development, overall demand is expected to remain firm. Government spending on infrastructure and affordable housing should propel industry growth to 7-8 percent in the current fiscal. We feel competitive pressure will continue to remain high in the northern and western region. However, companies with strong presence in the east, central and south India (specifically Andhra and Telangana) regions will gain from an improved demand environment.

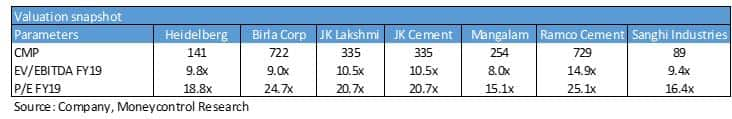

We prefer Heidelberg Cement and Sanghi Industries from the midcap cement pack. Heidelberg has strong positioning in the central market and a superior margin profile compared to other companies. Firm cement prices in the central region along with strong operating leverage (capacity utilisation is expected to touch 90 percent in FY19) is expected to aid Heidelberg’s earnings over the next 12-15 months.

Sanghi Industries merits attention of long-term investors due to: 1) the correction post-announcement of its Q4 result; and 2) Lowest production cost. The management has guided for volumes of 3.2-3.3 million tonne in FY19 (versus 2.4 MT in FY18) as it expects a sharp increase in volumes from its entry in the high-margin Mumbai market. The company is undergoing capacity expansion and remains on track to double its cement capacity by 4 MT by FY20.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.