Krishna Karwa

Moneycontrol Research

Highlights:

- D-Mart’s valuations are stretched

- Revenue growth should remain steady

- Margins may moderate going forward

--------------------------------------------------

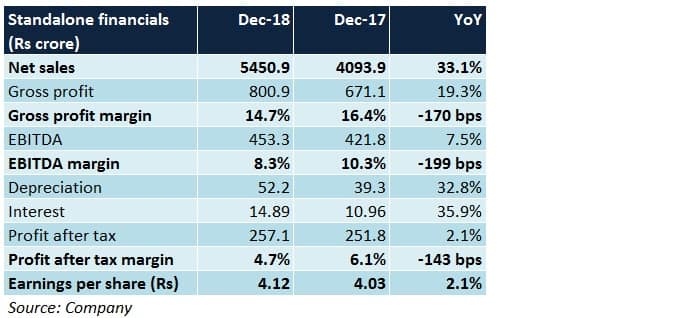

Avenue Supermarts, one of India’s leading supermarket chains which operates under the D-Mart brand, reported a weak set of Q3 earnings despite robust sales growth. The stock’s heady valuations restrict its re-rating prospects.

D-Mart operates 164 retail stores with an area of 5.3 million square feet in regions except eastern and north-eastern India. Its product portfolio spans food, grocery, home and personal care, bed and bath linen, luggage, footwear, apparel, kitchenware and toys.

Q3 analysis

Positives

- Topline growth was healthy because of store additions and higher volumes

Negatives

- Reduced average selling prices led to a dip in gross margin

- Hiring of new employees and longer working hours in the festive season impacted operating margin

- Investments in infrastructure led to higher depreciation and interest costs, resulting in a contraction in net profit margin

Observations

Revenue drivers

- Around 25-30 stores will be opened each year. At some locations, properties may be considered for lease

- ‘Everday low cost – everyday low price’ strategy will help achieve economies of scale and facilitate market share gains

- D-Mart Ready, the company’s online retail arm, will cater to geographies other than Mumbai

Margin drivers

- Brick-and-mortar network expansion will be cluster-based to save on distribution costs

- Product mix will gradually change from food to non-food items

- Rs 81 crore of long term debt is yet to be repaid from proceeds of its public offer

Risks- Heavy capex in offline stores entails long gestation periods (typically 3-4 years) and increased overheads

- Since most outlets are already mature, achieving a noticeable increase in same-store sales can be difficult

- High margins in the perishable food category, as seen in the past, won’t be sustainable in the long term

- Competition from retail giants (Big Bazaar, Reliance Retail) will persist

Outlook

After a weak Q3 performance, there was 11 percent drop in the stock's price on January 14. Notwithstanding this fact, it continues to trade at elevated levels (72 times FY20 estimated earnings). Therefore, buying on dips is advisable. As per SEBI guidelines, reduction of promoter stake to 75 percent in three years (ie. by April 2020 from 81.2 percent as on December 31, 2018) post its IPO also remains an overhang.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!