The most relevant question in market participants’ mind before a budget presentation is how will bourses react and how investors should be positioned.

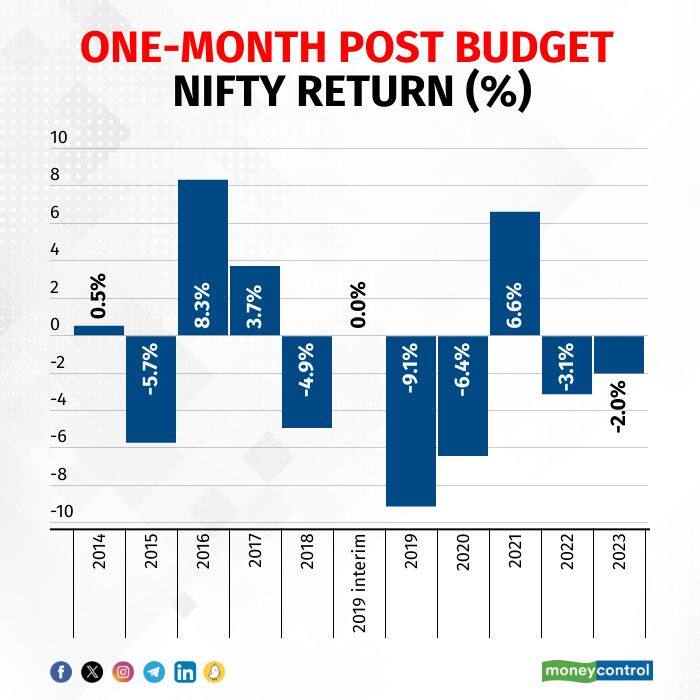

While prima facie it is a very fair question, our analysis of the past ten years’ budgets of the NDA government suggests that market movement after a month of the budget had not been significant, barring a few years. Hence, investors should not pay much heed to the budget day market movements.

India is now a multi-year growth opportunity and the reforms process is a steady exercise and not a one-off issue. Hence, investors usually get over the budget’s impact in a few trading sessions.

However, what matters for the markets in the medium to long term is the earnings trajectory. To that extent, any budgetary announcement that can lead to meaningful earnings revision will merit attention. Also, the valuation of the markets has a bearing on the post-budget movement.

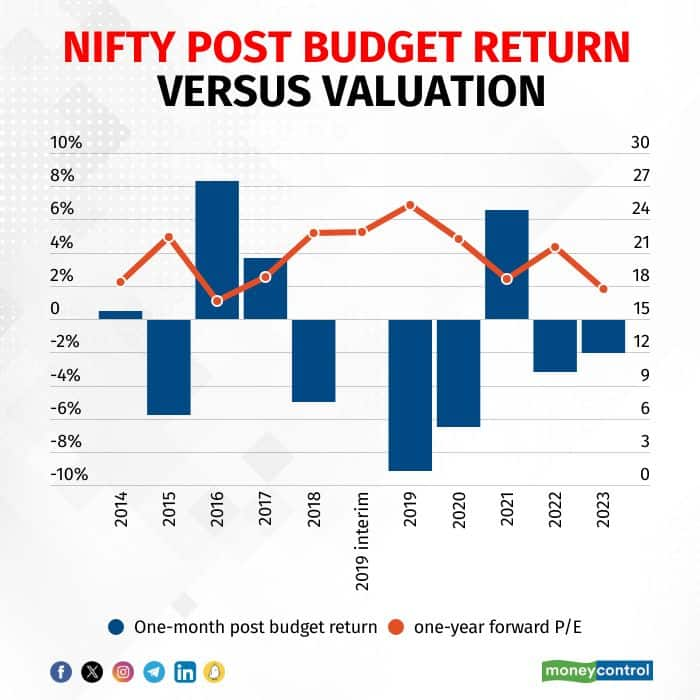

Source: Moneycontrol Research

Our analysis suggests that whenever the one-year forward Price Earnings of the Nifty is above 21x, markets have delivered a one-month negative return post the budget.

Seen in this context, the current valuation at 19.1x one-year is not only reasonable but at a discount to the ten-year average of 19.5x. Hence, going by historical trends, we do not foresee a negative one-month return.

We believe India’s current strengths — the transition to sustainable energy, the trillion-dollar manufacturing exports opportunity, its unique advantage to become a global service hub, the great infrastructure build-up along with the evergreen consumption opportunity — are mega trends for investors to ride on for many more years.

The earnings growth story in India is trending higher in a structural manner, supported by favourable demographics, improved labour productivity, and a multipolar world that will drive up services exports and FDI. The formalisation of the economy is getting reflected in the earnings growth of Corporate India. We have reasons to believe that beyond the earnings growth, there are several structural changes, including reduced reliance on volatile foreign flows, the coming of age of Indian retail investors, and a rising share of stable domestic liquidity, which will keep inflows into equities elevated for many more years.

Hence, any weakness in this market will be short-lived and bought into for the long term.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.