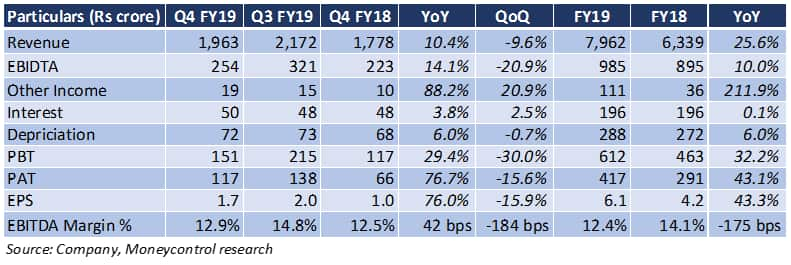

Gujarat Gas (GG) reported a decent set of Q4 FY19 earnings with some strength in net margin on the back of lower tax expenses. However, barring CNG, volumes across segments continued to remain under pressure.

Key positives

- On a year-on-year basis, Q4 remained a healthy quarter with an uptick in revenue and profit

- Improvement in net margin was chiefly driven by lower incidence of tax. Accrued income tax refund and write-back of excess tax provisions led to improvement in net margin

- The compressed natural gas (CNG) segment saw a healthy six percent year-on-year volume growth

- The company installed 63 new CNG stations in FY19, which will help in maintaining the growth momentum in CNG offtake

- Post orders from National Green Tribunal (NGT) for closing down of ceramic units running on coal gasifiers in Morbi, demand has switched over to natural gas, resulting in better volumes since February

- Despite downward price revisions of around Rs 3.75 per standard cubic metre (scm), the company was able to clock healthy EBITDA per unit of Rs 4.3 per scm due to weak spot liquefied natural gas (LNG) prices

Key negatives

- Weak economic environment led to a nine percent YoY lower offtake in the industrial segment (Morbi)

- Domestic PNG volumes also saw a 10 percent annual fall in volumes

- The quarter saw an uptick in employee expenses

OutlookEven though volumes remained slightly under pressure, the latest NGT ruling favours the company. There has been an uptick in volumes post the ruling in February and see this trend continuing.

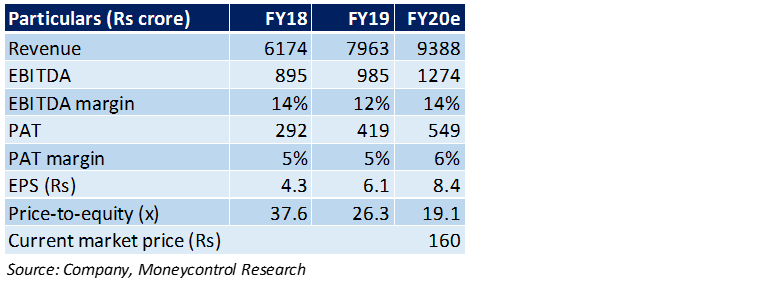

We expect the strong performance to continue with rising demand and deeper penetration in existing geographies. Allocation of new gas networks in the 10th round of city gas distribution (CGD) bidding would be an additional growth driver.

At the current market price, the stock is trading at an estimated FY20 price-to-earnings of 19.5 times. We are positive on the counter given expectations of uptick in volumes, pricing flexibility post elections and weak spot LNG prices. We would recommend investors buy the stock on dips.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!