Highlights:

- Equity inflows muted

- SIP flows continue to hold up- Liquid MF outflows a quarter-end phenomenon

--------------------------------------------------

Association of Mutual Funds in India (AMFI) released data for September 2019. Here are the key takeaways.

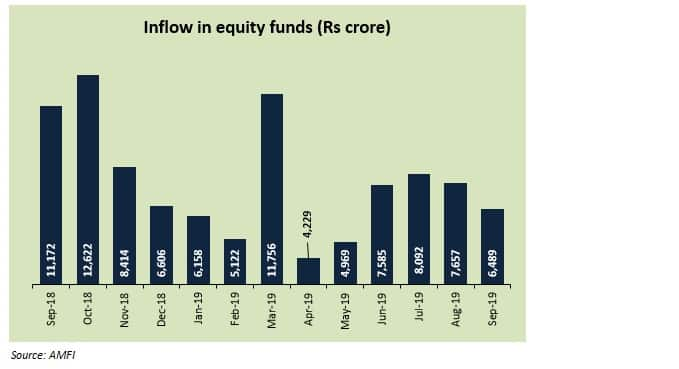

Equity funds

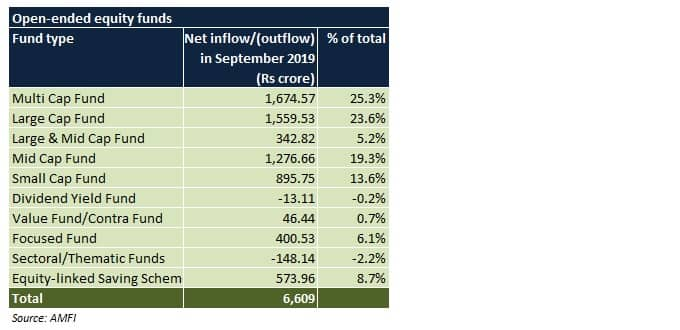

In September 2019, net inflows stood at Rs 6,489 crore, registering a decline of 15.26 percent month-on-month. While the open-ended schemes witnessed robust net inflows of Rs 6,609 crore, in case of the close-ended ones, the net outflow was Rs 120 crore.

A breakdown of the open-ended funds data suggests that nearly 50 percent of the total net flows were attributable to the multi cap and large cap funds alone. Given the tepid market sentiments, investors, unsurprisingly, preferred blue chip names to limit their risk exposure. Furthermore, mid caps also seem to have attracted investors’ interest due to price corrections in some cases (prior to the tax cut announcement) and earnings growth prospects in some other instances (post- announcement).

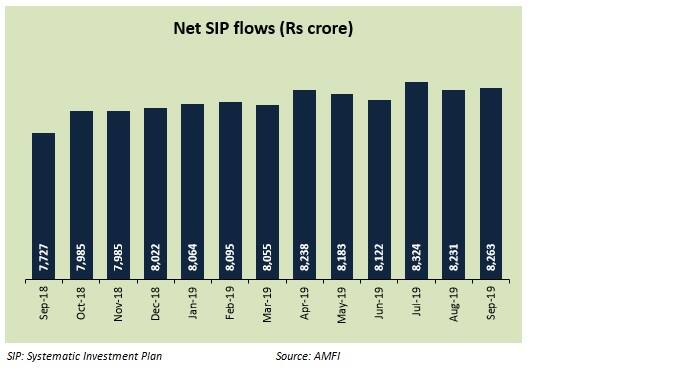

SIP flows

In September 2019, SIP flows increased by 6.9 percent year-on-year and were flattish from a month-on-month perspective.

In spite of market volatility and heavy selling by FIIs (foreign institutional investors), DIIs (domestic institutional investors) have been able to keep the markets going primarily on the back of consistent SIP investments by the retail investors.

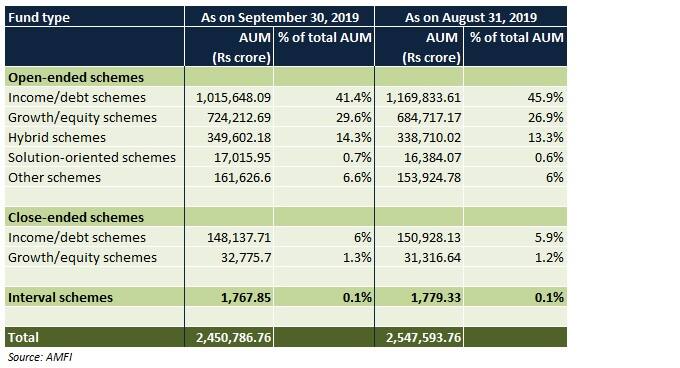

Assets under management (AUM)

As on September 30, 2019, total AUM stood at Rs 24.5 lakh crore, as against Rs 25.4 lakh crore as on August 2019-end. The segment-wise breakdown is as under.

The month-on-month shift (August to September) from income/debt schemes to growth/equity schemes has been pretty noticeable.

Liquid funds

In September 2019, there was a net outflow of Rs 14,40,731.25 crore vis-à-vis a net inflow of Rs 79,428.2 crore in August 2019. Since advance tax payments fall due by September-end, investors (mainly the corporates) resorted to selling of such funds.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.