Neha DaveMoneycontrol Research

In a historic meeting, US President Donald Trump and North Korean leader Kim Jong-un signed a joint agreement pledging nuclear disarmament by North Korea. The North Korean leader promised to complete denuclearisation of the Korean Peninsula in exchange for security guarantees by US. The current economic sanctions against North Korea continues. We look at the chain of events that culminated in this historic meet, followed by our assessment of its implications for global equity markets.

US – North Korea conflict

The tension between North Korea and the US go back a long way and can be traced to the Korean War in the 1950s. To put it simply, the root cause of the tension is North Korea’s pursuit of its nuclear program. Since coming to power in 2011, North Korea’s leader Kim Jong Un significantly increased the speed and scope of the development of the country’s nuclear weapons and the ballistic missiles to carry them. In response, US President Donald Trump vowed to halt North Korea’s development of nuclear weapons.

Nuclear escalations – a root cause

In 2017, North Korea stirred up geopolitical tensions with its missile tests and the effects were felt in stock markets worldwide. The situation intensified after it successfully launched an intercontinental ballistic missile (ICBM) on 4 July, followed by another on 28 July. The ICBM test was followed by aggressive rhetoric and posturing by both US and North Korea, which kept the global market investors edgy.

Economic sanctions

The US continued to put pressure on the North Korean regime, not just by threatening a military action, but also through economic sanctions. In fact, it could manage to get China, an ally and largest trading partner of North Korea, to vote in favor of a new round of sanctions on North Korea in UN Security Council on August 5. Russia too voted in favor of sanctions.

China angle

The US – North Korea standoff should be seen not just in isolation but also in terms of how they impact the geopolitically pivotal US-China relationship. China entered the Korean War on communist Korea’s side in 1950 and since then has remained its closest ally and trading partner. Unable to achieve progress by any other route, the US has tactfully put pressure on China by talking about trade sanctions. We think China could have influenced North Korea’s decision to come to the negotiating table.

Provocation to negotiation

Pushed to isolation and to prevent serious economic disruption from the international sanctions, Kim announced that North Korea would refrain from any further nuclear or missile tests in March this year and paved the way for today’s meeting with US.

Our assessment

Has North Korea’s ruler, Kim Jong-un, made a strategic decision to trade away his nuclear program, or has he just engaged in another round of deceptive diplomacy so that the economic sanctions are reversed? This is the key question that has arisen after today’s summit between Kim and US President Donald Trump in Singapore today.

Previous statements, in 1994 and 2005, contained similar promises but those agreements broke down over differences of interpretation and spats over verification. So, while the dialogue and friendly statements are heartening, the real impact will be measured by the progress made towards the difficult and complex goal of CVID: “complete, verifiable and irreversible denuclearisation” of the Korean peninsula.

Having said that, from a pragmatic view, the first Trump-Kim summit may not be able to resolve long standing major issues between the US and North Korea all at once. As per the statement, there would be further meetings between senior officials from both countries to continue the momentum of the summit.

While sceptics will be quick to term the summit as symbolic, we think this is a good start. Diplomatic talks are any day preferred to firing of nuclear missiles.

Investment implications

With today’s meeting between Trump and Kim Jong un, we anticipate a near-term easing of market risk sentiment as the risk of nuclear escalation between the two countries has abated. The South Korean and Japanese markets are most sensitive to North Korean risk and would benefit most from a today’s summit if implemented in true spirit.

But the most important takeaway from this summit is that economic objectives took precedence over politics. This summit could also now lead to de-escalation of US – China trade wars as China’s mediation in the run up to the summit could have played a very important role. We can expect moderation in US’s rhetoric against China now that its purpose is seemingly served.

In the long run, however, the market will focus on economic conditions and fundamentals while experts try to discern North Korea’s commitment to denuclearization.

Earnings, not geopolitical events, to drive equities

While still benefitting from a better outlook on global growth, global equity markets are witnessing higher levels of volatility. Concerns over how central banks unwind their low interest rate policies, rising bond yields and talks about protectionist policies have added to volatility. However, let’s focus on the fundamental picture, which is like a compass showing the right direction amidst political noise.

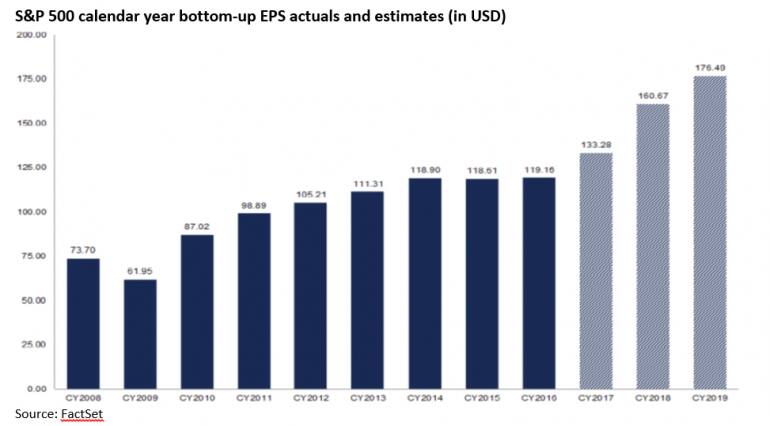

Earnings growth: First-quarter (Q1 2018) US earnings have grown at their fastest pace since 2011. With 99 percent of S&P 500 companies having reported Q1 earnings growth was robust at 24.6 percent year-on-year. US earnings are expected to continue to grow at double-digit levels through the remainder 2018, stimulated by tax cuts and the increase in public spending.

Valuations

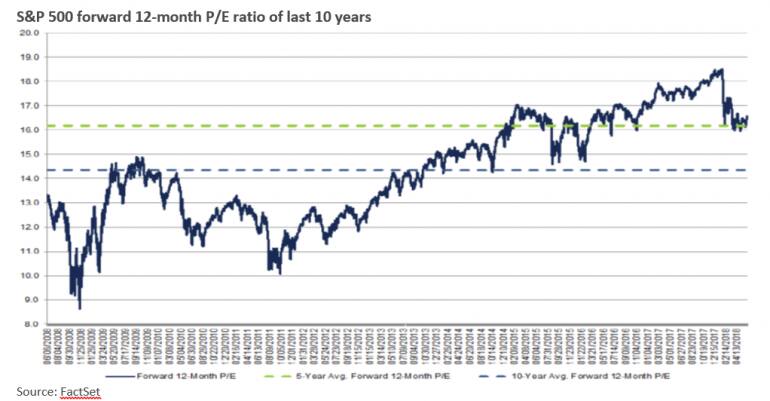

The forward 12-month P/E ratio for the S&P 500 is 17.3 which is above the 5-year historical average (16.2) and above the 10-year average (14.4). However, the higher valuation as compared to historic level is justified given that US economy is expanding and earnings are growing at very healthy pace of 18 percent plus.

Eurozone profit growth is positive if not stellar. Recent strength in the US dollar, the increase in US yields, and idiosyncratic risks in some countries have clouded the near-term picture for emerging markets. But the growth advantage enjoyed by emerging markets (EM) relative to developed economies should continue to support EM equities.

Despite this robust corporate profit growth, S&P 500 is up by only 4 percent and other major global indices are broadly flat to negative year-to-date. Geopolitical issues have grabbed headlines over the past few months. But we do believe markets will start looking through the noise and focus on robust corporate fundamentals.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.