Nitin Agrawal

Moneycontrol Research

Highlights:

- Weak volume growth coming in from OEMs, replacement market and in export market

- Business outlook for the company is weak for short-term, positive for long-term

- Operating margin continues to be under pressure

- Accumulate in staggered manner

--------------------------------------------------

Weakness in automobile sector was reflected in CEAT's disappointing set of numbers for Q3 FY19.

While the price hike taken by the company to pass on raw material price increase helped post growth in its topline, subdued volume growth coupled with higher operating expenses marred the financial performance.

We believe that the company is poised to gain from increase in market share in passenger vehicle (PV) and 2/3 Wheeler segments and capacity expansion in selected pockets. However, demand outlook continues to be weak in near term and hence we advise accumulating CEAT in a staggered manner for long-term.

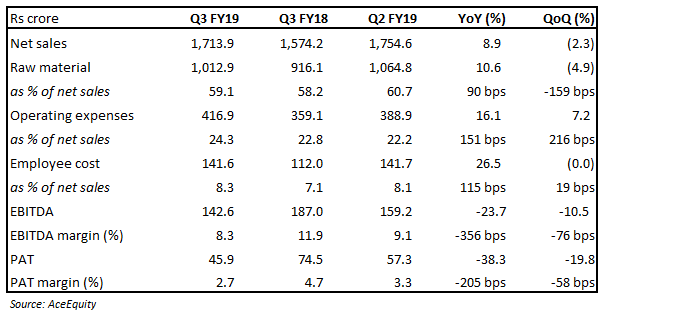

Quarter snapshot

Key highlights

CEAT posted a year-on-year (YoY) growth of 8.9 percent in its net revenue from operations driven, primarily, by the price hikes taken by the company to pass on raw material (RM) price increase. What troubled the company in the quarter was the weak demand coming in from original equipment manufacturers (OEM), and subdued demand in replacement segment. It also witnessed significant decline in export volumes. All these led the company to post a tepid volume growth of 2 percent.

Its EBITDA margin witnessed a decline of 23.7 percent (YoY) on the back of significant increase in operating expenses (higher ad expenses) and inventory buildup. This led to YoY EBITDA margin contraction of 356 bps.

Outlook

Subdued demand outlook

Automobile sector is reeling under multiple headwinds such as increasing cost of total ownership, insurance cost, weaker festive sales and liquidity crunch. The demand is expected to be sluggish in the near-term. However, long-term outlook continues to be very positive.

Raw material to put pressure – price hike helping

CEAT has started passing on the rise in RM prices and has taken multiple price hikes in Q3 FY19. However, increasing competitive intensity and weak demand have forced the company to roll back 1 percent of the price hike taken in November 2018. We expect RM inflation to continue, especially in an environment where volume is not picking up.

Areas to drive growth – passenger vehicle segment

The company caters to clients across all segments. However, its dependence on trucks and busses is much higher and in an effort to reduce dependence on that segment, the management has identified passenger vehicle (PV) and 2/3W segments as a focus areas to drive growth.

Capacity expansion

In light of multiple macro headwinds, the management has lowered the capital expenditure (CapEX) guidance for FY19. It is reduced to Rs1,000-1,200 crore as compared to Rs1,300-1,500 crore earlier.

CEAT has been facing supply constraints in 2W and hence it plans to incur capex to increase 2W capacity to 3 million units from 2 million units currently in next 1-1.5 years. Further, new plant in Nagpur is on track to put up capacity of 80,000 units for TBR (truck and bus radial) and expects it to commence from Q4 of this fiscal year.

Valuations – at attractive levels

Amid concerns over weak demand outlook and market volatility, the stock has corrected by 43 percent from its 52-week high. The correction has led to significant drop in the valuations of the company. CEAT is currently trading at 16.6 times and 12.5 times FY19 and FY20 projected earnings.

We have comfort on CEAT’s long-term strategy and business and valuation looks comforting. We advise investors to accumulate this business for long-term in a staggered manner.

For more research articles, visit our Moneycontrol Research page.

(Moneycontrol Research analysts do not hold positions in the companies discussed here)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.