Neha Dave

Moneycontrol Research

Highlights:

-Over-the-top (OTT) content consumption is on the rise, but India is unlikely to go US way

-Despite being convenient, global OTTs are relatively costlier with not much regional content

-That said, redistribution of TV industry profits is inevitable

-TV broadcasters have launched their own OTT platforms but facing global disruption will require a lot of capital

-A wave of collaboration and consolidation will redefine the media ecosystem ---------------------------------------------------------

India is the second largest smartphone market in the world and, by 2020, it is expected to become the second largest video viewing market. What does this imply? With increasingly data being consumed on 4x5 inch screens, the Indian media and entertainment (M&E) sector is set for a major overhaul.

A need for escapism, knowledge and social acceptance backs India’s vibrant M&E sector. With more than 800 television channels, 100 million cable TV households, 70,000 newspapers and 1,000 movies produced annually, the Indian M&E sector has so far managed to buck the global trend and is growing at a healthy rate. The data points, however, can make one believe that the sector is thriving. That’s not the case. In fact, the M&E sector is on the brink of disruption.

The media consumption habit of Indians is undergoing a huge shift, though it is hard to recognize some of the rapid and enormous changes around us. For instance, footfalls in theatres are stagnating and print advertising revenue is at a decadal low, while internet-based video streaming platforms are exploding in ubiquity.

What’s behind these changes? An overwhelming digital tsunami. India’s M&E sector is at a digital tipping point. For instance, the online video viewing audience in India is projected to reach 550 million by FY23 compared to 225 million in FY18, according to KPMG. The explosive growth seen in digital access and consumption has been aided by the rapid proliferation of smartphones. It accelerated further with falling data cost fueled by Reliance Jio’s entry.

So how exactly will the growing popularity of over the top (OTT) platforms reshape the Television (TV) industry, the largest segment of Indian’s M&E sector? Let’s take a closer look.

Will India go the US way in cord cutting?

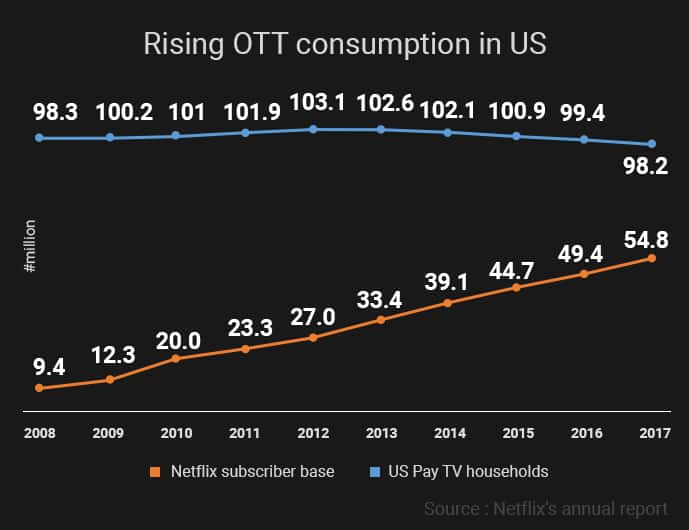

A large number of people in the US consume video content directly on the internet through OTT platforms, such as Netflix and Amazon Prime, and have cut off their cable connections. For instance, Netflix’s subscriber base has reached 55 percent of all pay-TV homes subscribers in the US. The behaviour, popularly known as cord cutting in the US, has been driven by favourable price differential between the subscription fees of pay TV and OTT services, aside from the availability of supporting network infrastructure and varied and rich content provided by OTT.

However, we may not witness the same trend of cord cutting in India in the near term despite the increasing popularity of Netflix and Amazon Prime. This is because the subscription based video on demand (SVOD) services costs more than cable charges.

But the threat posed by global OTTs shouldn’t be underestimated. A former CEO of Blockbuster- a DVD renting company in the US, had said in 2008 that “Netflix isn’t even on the radar screen in terms of competition.” By 2010, Blockbuster had gone bankrupt.

What’s holding customers back from switching to OTT?

To build a large and sticky base of users who are willing to spend their time away from their TVs, OTT players need to succeed in providing 3 Cs – cost, content and convenience.

OTTs are convenient. But the other two Cs- cost and content (regional) are key impediments holding back the customers from fully switch to OTT.

Cost is the first obstacle for OTTs. Netflix charged $8-12 in the US market when the average pay TV prices were between $40-100 a month. Hence, users in the US saw a lot of value and Netflix benefited by this price arbitrage. But in India, that’s not the case. Pay TV (cable TV) charges in India are $2-5 per month.

That said, the new tariff guidelines announced by TRAI (where users can now pay per channel) is likely to increase the monthly bill for most subscribers of TV channels, as per CRISIL. In effect, it will hasten the adoption of OTT platforms.

The most important value proposition to attract customers is the content. Netflix seems to have already made a mark among millennials in India. Youngsters don’t want to negotiate for the remote anymore. But the global king of disruption knows that urban India is distinct from rural India.

Globally, Netflix is using its war chest of capital to buy, create and license content at an unprecedented scale. It spent a mammoth $6 billion in 2017 and more than $8 billion on content last year. We believe that in India, too, it will focus on building a library of content with mass and regional appeal. And once it has a bulk of regional content, Netflix will bring down subscription prices and cost for customers. And if that happens, it will be beginning of the end for TV broadcasters.

So, where do TV broadcasters go from here?

As explained above, we don’t see OTT players replacing TV broadcasters in the near term because of the cost factor. As of now, Saas – bahu sagas will co-exist with Sacred Games.

Having said that, the disruption caused by OTT players is for real with the potential threat coming from incremental subscribers. For affluent customers, the second TV connection is moving to OTT platforms. Naturally, this would have business repercussions for TV broadcasters who will start losing advertising revenue over the next few years.

Reacting to this “new wave” of digital growth, TV broadcasters have launched their own OTT platforms. However, given the intensity and quality of competition from global OTTs like Amazon Prime and Netflix, scaling up may not be easy. It will require a lot of capital and we may see a wave of collaboration and consolidation in the space.

It is impossible to predict the new ecosystem in the media sector. However, there is one prediction we can make with a high degree of confidence: broadcasters will grow, but the growth will be slow. India’s digital revolution is forcing the rearranging of the media industry chessboard.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.