Highlights:

- Disappointing set of April numbers by auto majors in all segments

- New axle load norms, tight liquidity and non-availability of finance weigh on CVs

- Lower-than-expected Rabi sowing dampened tractor sales

- Two-wheeler and passenger vehicle segments continue to disappoint

--------------------------------------------------

Indian automobile sector continues to perform poorly as is evident from April volume numbers reported by automobile majors. The subdued demand is on the back of multiple challenges due to increase in the total cost of ownership (on mandatory long-term insurance and implementation of safety regulations), higher cost of retail finance and moderate economic activity ahead of general elections.

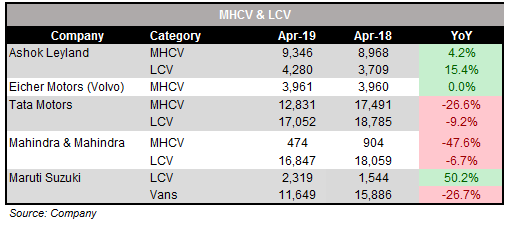

Commercial vehicle (CV) segment sales were muted for players in this space. The environment continues to be challenging for companies in this segment. Factors such as non-availability of retail finance, lagged impact of new axle load norms and slowdown in economic activity ahead of elections have impacted demand. Tractor segment also continues to remain weak on the back of higher base of last year and subdued farm sentiment.

Also read: India’s top 4 carmakers blame tight liquidity, Lok Sabha elections for April sales skid

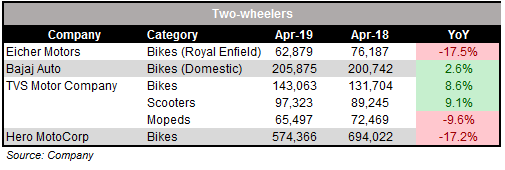

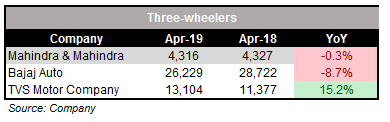

Three-wheeler (3W) sales were mixed on the back of very high base for last year. Two-wheeler (2W) volumes continues to be weak due to subdued consumer sentiment led by higher cost of ownership, high base of last year and adverse macro factors.

Commercial vehicle space continues to remain under pressure

Macro challenges led by liquidity problem, financing issues, rising interest rates, lagged impact of new axle load norms and slowdown in economic activity ahead of elections have dampened consumer demand for CVs. Managements expect demand to recover post-election.

Company-wise, Tata Motors registered a year-on-year (YoY) decline of 18 percent in CV volumes, led by 26.6 percent dip in the medium and heavy commercial vehicle (M&HCV) volumes.

Eicher Volvo also witnessed flat growth. Mahindra & Mahindra (M&M) saw a nine percent volume decline in April, primarily due to a significant dip in M&HCV segment volumes. Ashok Leyland, however, bucked the trend with a growth of seven percent driven by the light commercial vehicle (LCV) segment.

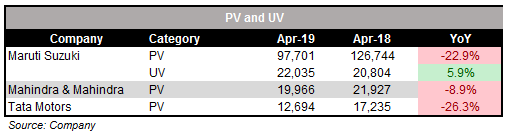

No sign of a recovery in the passenger car segment

The car segment continues to remain under tremendous pressure with no signs of a recovery. Negative sentiments in the space is due to increase in total cost of ownership led by rising interest rate and mandatory long-term insurance. Implementation of safety norms have led to increase in price, hurting sentiment. Hence, companies in the space have posted a decline in passenger vehicle volumes for April.

Segment leader, Maruti Suzuki posted a 19 percent dip in April volumes. The management expects demand to remain muted in H1, recover in H2 and grow by four-to-five percent in FY20.

Tata Motors’ PV segment witnessed a 26.3 percent YoY decline. The management is expecting strong months ahead as its new SUV Tata Harrier has been receiving good traction. M&M posted an 8.9 percent dip in its monthly volumes.

Two-wheeler segment: Inventory at an alarming level

The 2W segment has been the worst hit in the auto space, with inventory touching 45-50 days versus normal levels of 20 days. Hero MotoCorp, the leader in this space, saw a 17.2 percent decline. Eicher Motors, leader in premium bike segment, witnessed a 17.5 percent dip in its monthly sales numbers. Bajaj Auto saw a 2.6 percent volume growth on the back of aggressive pricing actions taken by the management in the entry-level segment, which helped it captured Hero’s market share. TVS Motor Company also bucked the trend and posted a growth of 4.2 percent in April.

Mixed showing by three-wheelers

The overall 3W market posted mixed numbers in April. TVS posted very strong growth (15.2 percent) and M&M saw flat growth. Bajaj Auto, the leader in this space, saw its volumes decline 8.7 percent due to a high base of last year.

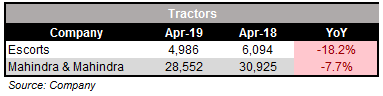

Lower Rabi season impacted tractor demand

The tractor segment is under pressure due to lower-than-expected Rabi sowing and subdued farm sentiment. Escorts and M&M posted a decline of 18.2 percent and 7.7 percent, respectively. M&M's management said expectation of a normal southwest monsoon will usher positive sentiment and boost tractor demand.

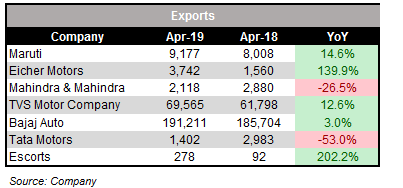

Positive sentiment on the export frontExports seem to be faring well as is evident from the monthly volume numbers. Barring M&M and Tata Motors, auto majors have posted strong export growth in April. Tata Motors’ management said the decline was due to new regulations and political uncertainty in Sri Lanka and slump in Middle East, affecting overall industry volumes in these markets.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.