Anubhav Sahu

Moneycontrol research

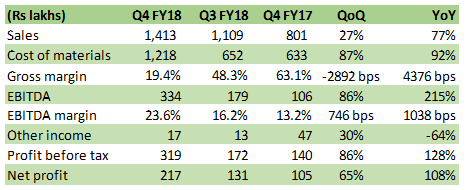

Alufluoride reported another strong set of numbers for the March quarter, underpinned by higher sales volumes and better prices. Gross margins were crimped by higher raw material costs, but net margins—as a measure of earnings before interest, taxes, depreciation and amortization—were helped by higher product prices.

The management expects gross margins to improve once the benefits of the long term contracts with raw material suppliers starts kicking in. The company is currently operating at full capacity and the pace at which it will be able to expand capacity by FY20 holds the key to re-rating.

Q4 update: Sequential surge in sales

Source: Company

The company faced margin pressure during the March quarter due to difficulty in sourcing raw material, silicic acid from adjacent fertilizer complex. To meet its commitments to customers, the company was forced to source expensive silicic acid from other places.

The margin pressure was partly offset by lower power & fuel costs due to the captive power plant becoming operational.

Pricing trend positive

Prices of Aluminum fluoride have stayed elevated due to strong end market demand as well as the increase in fluorspar prices. It is a win-win for Alufluoride as the company benefits from higher Aluminium fluoride prices globally, but at the same time is not impacted by higher fluorspar prices as it does not produce through the fluorspar method.

In the recently concluded annual contract cycle, pricing for Aluminum fluoride has been settled at approximately Rs. 70 per kg.

Raw material availability and calibrated expansion plan

Earlier this year, company had signed a 20 year agreement for the supply of raw materials from Coromandel (4000 tons) and IFFCO (7000 tons), with additional sourcing of 3000 tons expected from Paradeep Phosphates, which also takes into account incremental raw material requirement for capacity expansion.

Coromandel plans to expand its phosphoric acid production capacity, and it is expected to become operational by the first quarter of financial year 2019-20. This fits well with Alufluoride’s capacity expansion plan and so supply of raw material from the Coromandel would be available then.

Managing director of Alufluoride, Venkat Akkineni told Moneycontrol the capacity expansion by 4500 tons (Current 7,500 tons) is on track and would be operational by end of the Q1 FY20.

Improving growth outlook at reasonable valuation

Based on the latest quarterly update and inputs from the management, we have revised our financial projections for the company. These take into account estimates for new contract cycle and emerging pricing scenario. The company’s current capacity is fully utilised and the management expects to sell about 8000 tons in FY19 before benefitting from capacity expansion in early FY20.

Further, our conservative estimate of about 50 percent capacity utilisation for the new capacity in from the second quarter of FY20 should contribute to a topline growth of 36 percent compounded annually between FY18 and FY20.

We expect EBITDA margins to improve by around 230 basis points by FY20 due to operational efficiency and installation of captive solar power plants. At the end of the first quarter quarter of FY20, three solar plants with capacity of 2.6 MW would be functional and supply about 90 percent of the electricity requirement (including new capacity).

Source: Company, Moneycontrol Research

Considering these factors, the stock is currently trading at 9.9 times/5.5 times estimated earnings for FY19 & FY20 respectively and at an enterprise value of 4 times estimated EBITDA for FY20. This is at a discount to the current valuation multiples for the non-ferrous sector. The stock is currently trading 30 percent below its 52-week high and closer to 200-day moving average.

Additionally, the company’s multi-year tie up with the raw material suppliers and the calibrated expansion plan provides visibility on operational efficacy. Overall, we remain positive on the stock given the buoyancy in aluminum end market, capacity expansion plan, and reasonable valuations.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.